India's First AI-Powered CFO Dashboard

India's leading cloud-based CFO Dashboard—Centralize your GST data, gain actionable insights, reduce risk, and protect your business.

Trusted by leading Companies

Why Businesses & CFO’s used It?

Save 80% Data Review Time

Reduce manual effort and review data faster with automated validation and intelligent checks.

Real-Time Alerts & Notices

Reduce manual effort and review data faster with automated validation and intelligent checks.

Confident, Data-Driven Decisions

Make informed financial decisions with accurate, real-time insights you can trust.

See how CFOs save 80% review time and make confident, data-driven decisions.

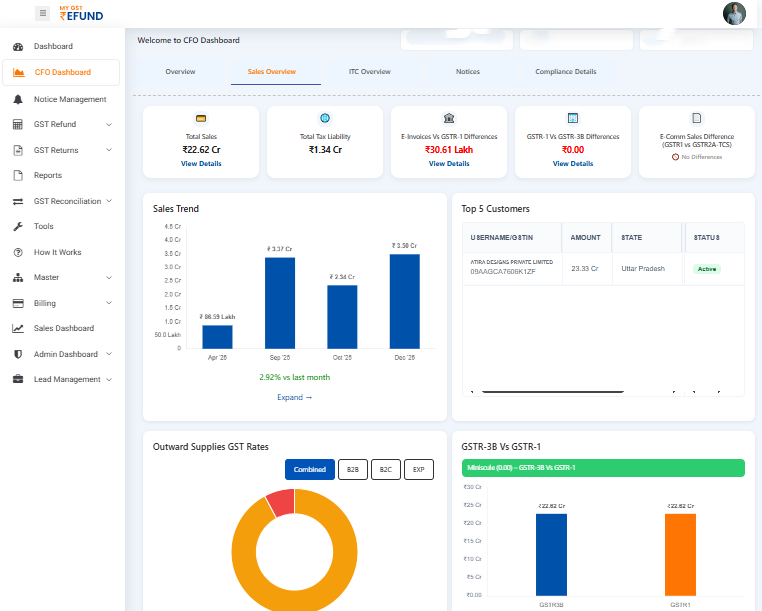

Single Dashboard for All Your GST Data

Centralized view of all GST-related information for better compliance and business decisions

Sales Overview

Monitor your business performance with real-time sales analytics and GST insights.

Get Started in 3 Simple Steps

Start optimizing your GST compliance and financial tracking in minutes

Step 1 - Sign Up

Create your account quickly and securely with email verification

Step 2 - Connect Your GSTIN

Link your GSTIN(s) to view all GST data including GSTR-1, GSTR-3B, GSTR-2B, and financial information

Step 3 - Visualize Your Dashboard

Track liabilities, ITC, supplier compliance, and key metrics in one interactive dashboard

Built for Every Finance Role

Business Owners

Complete financial & GST real-time visibility to make confident, data-driven decisions.

Tax Professionals

Automated compliance monitoring, GST tracking, and actionable alerts in one place.

CFOs & Finance Leaders

CFO-level GST insights, financial control, and strategic performance visibility.

What Our Clients Say About Us?

Take Control of Your GST Compliance Today

Centralize your GST data, gain actionable insights, and prevent future losses with smarter decision-making.

Frequently Asked Questions

A centralized dashboard that helps CFOs, accountants, and tax professionals monitor GST compliance, spot risks, and make informed decisions.