Understanding the Benefits of E-Invoicing Under GST

Published on: Fri Mar 03 2023

What is e-invoicing under GST?

E-invoicing under GST is a system for generating and transmitting invoices electronically in compliance with the GST laws in India. It is a mandatory system for certain businesses and is aimed at reducing tax evasion and improving compliance with GST regulations. Under e-invoice, businesses must generate invoices in a specific format and transmit them to the GST network for validation before they can be sent to customers. This helps to ensure the accuracy and integrity of invoice information and simplifies the GST compliance process for businesses.

Real-time transfers of all invoice data are made from this site to the portals for GST and e-way bills. As a result, since the data is sent directly from the IRP to the GST portal, it eliminates the need for manual data entry when filing GSTR-1 returns and creating part-A of the e-way bills.

Read Our Detailed Article on Goods & Services Tax(GST)

Who must generate the e-invoice and its Applicability?

E-invoicing under GST is currently mandatory for certain taxpayers based on their turnover.

As per the recent gazette notification, E-invoice is mandatory for businesses whose turnover exceeds Rs. 100 crores from January 1, 2020, and for businesses whose turnover exceeds Rs. 50 crores from April 1, 2020.

It will be mandatory for all taxpayers from October 1, 2020.

Additionally, all taxpayers who are required to file their GST returns every month will also be required to generate e-invoices.

Who need not comply with E-Invoice?

The foregoing exemptions from creating e-invoices are for the entity as a whole and are not limited by the kind of supply being made by the said entity, according to Circular No. 186/18/2022-GST.

Systems before & after e-invoicing

Before the implementation of GST e-invoice, businesses in India were required to generate and file invoices manually or through their own computer systems. They also had to file separate returns for each state in which they operated, which was a time-consuming and complex process.

After the implementation of GST e-invoice, businesses are required to generate invoices electronically and send them to the government’s e-invoice portal for validation. Once the invoice is validated, a unique invoice reference number (IRN) is generated and returned to the business. The business can then use this IRN to file its GST returns. This system is intended to make the invoicing and return filing process more efficient and reduce the potential for errors.

Process of getting an e-invoice

The process of getting a GST e-invoice involves the following steps:

- Generating the invoice: The invoice must be generated in a standard format, which includes details such as the GSTIN (Goods and Services Tax Identification Number) of the buyer and seller, the HSN (Harmonized System of Nomenclature) code, and the value of the goods or services sold.

- Validating the invoice: The invoice must be validated by the GSTN (GST Network) to ensure that all the details are accurate and complete. This can be done through an API (Application Programming Interface) or a web portal provided by the GSTN.

- Registering the invoice: Once the invoice is validated, it must be registered with the GSTN. This will create a unique IRN (Invoice Reference Number) for the invoice, which will be used for tracking and monitoring purposes.

- Making the invoice available: The invoice will be made available to both the buyer and seller, as well as to GST authorities for monitoring and compliance purposes. The invoice can be accessed through the GSTN portal or through the API.

- Record Keeping: The invoice must be kept for a period of not less than 5 years from the date of its issue.

It’s important to note that the invoice generation and validation process is to be done by the supplier or the seller, however, the recipient can also validate the invoice through the GSTN portal.

Benefits of e-Invoicing to businesses

E-Invoicing under GST (Goods and Services Tax) has several benefits for businesses:

- Reduced compliance burden: e-Invoicing eliminates the need for businesses to manually generate and submit invoices, reducing the administrative burden.

- Improved accuracy and efficiency: e-Invoicing systems are designed to automatically capture and validate invoice data, reducing errors and increasing efficiency.

- Real-time tracking: e-Invoicing allows businesses to track invoices in real time, reducing the risk of fraud and ensuring timely payment.

- Better visibility: e-Invoicing enables businesses to have better visibility into their financial performance and compliance status.

- Reduced costs: e-Invoicing can help businesses to reduce costs associated with printing, mailing, and storing paper invoices.

- Better compliance: e-Invoicing ensures that businesses meet all compliance requirements, including timely submission of invoices and accurate record-keeping.

- Better reconciliation of input tax credit (ITC) with the GST portal.

- Better integration with accounting and ERP software.

How can e-invoicing curb tax evasion?

GST e-invoicing can curb tax evasion in several ways:

- Real-time tracking: GST e-invoicing allows businesses to track invoices in real time, providing the government with a comprehensive view of transactions and enabling them to detect any discrepancies or irregularities.

- Automated data validation: GST e-invoicing systems automatically capture and validate invoice data, reducing the risk of errors and making it difficult for businesses to evade taxes by providing inaccurate or false information.

- Improved compliance: GST e-invoicing ensures that businesses meet all compliance requirements, including timely submission of invoices and accurate record-keeping, making it harder for businesses to evade taxes by failing to report transactions or providing false information.

- Better GST credit reconciliation: GST e-invoicing enables businesses to reconcile their GST credits and claim the same in a timely manner, reducing the chances of fraud and tax evasion.

- Better fraud detection: GST e-invoicing has the capability to detect fraudulent activities and prevent them, thus reducing the risk of tax evasion.

- Better analytics: GST e-invoicing also provides analytical tools to the government to track and monitor the invoicing process, helping them to identify areas of improvement and optimize their operations.

- Improved transparency: GST e-invoicing increases transparency in the invoicing process, making it difficult for businesses to evade taxes by hiding transactions or providing false information.

- Better integration with other government systems: GST e-invoicing can be integrated with other government systems like import-export, e-waybill, and others, making it difficult for businesses to evade taxes by providing false information in different systems.

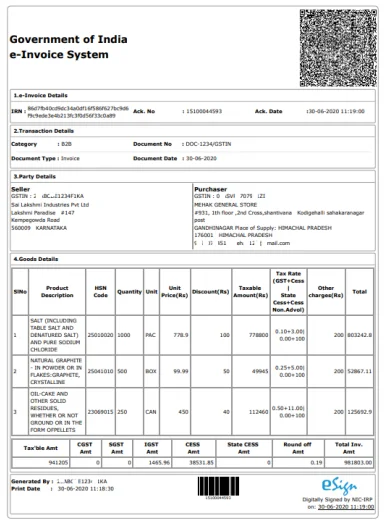

What are the mandatory fields of an e-invoice?

Basic information, supplier information, receiver information, invoice item details, and document total are the five required parts. The item descriptions and the document total are the two required annexures.

Format of sample e-invoice

How does Clear e-Invoicing help?

Clear GST e-Invoicing is a system for generating and transmitting invoices electronically under the Indian GST (Goods and Services Tax) system. It helps businesses in the following ways:

- Streamlines invoice generation: Clear GST e-Invoicing automatically generates invoices based on the business’s sales data, reducing the need for manual data entry.

- Improves data accuracy: The system automatically captures and validates invoice data, reducing errors and increasing efficiency.

- Facilitates real-time tracking: Clear GST e-Invoicing allows businesses to track invoices in real-time, reducing the risk of fraud and ensuring timely payment.

- Enhances compliance: Clear GST e-Invoicing ensures that businesses meet all compliance requirements, including timely submission of invoices and accurate record-keeping.

- Improves GST credit reconciliation: Clear GST e-Invoicing enables businesses to reconcile their GST credits and claim the same in a timely manner.

- Better integration with accounting and ERP software: Clear GST e-Invoicing facilitates better integration with accounting and ERP software, making the process more efficient.

- Better analytics: Clear GST e-Invoicing also provides analytical tools to businesses to track and monitor their invoicing process, helping them to identify areas of improvement and optimize their operations.

- Better fraud detection: Clear GST e-Invoicing has the capability to detect fraudulent activities and prevent them, thus reducing the risk of fraud.

FAQs

- To whom will e-invoicing apply

GST e-invoicing applies to businesses registered under GST in India, whose aggregate turnover exceeds a certain threshold or dealing in specified goods or services as notified by the government. From October 2022, it will apply to those having a turnover from Rs.10 crore to 20 crores.

- Can an e-invoice be canceled partially/fully?

E-invoicing cannot be canceled partly. But it can be canceled wholly.

On cancellation, it must be notified to the IRN within 24 hours.

- Will the bulk upload of invoices for the generation of IRN is possible?

Yes, it is possible to bulk upload invoices for the generation of an Invoice Reference Number (IRN). Many invoicing and accounting software programs have the capability to bulk upload invoices and generate an IRN for each one. Additionally, some governments provide a portal for businesses to bulk upload invoices and generate IRNs. However, the specific process for bulk uploading invoices and generating IRNs will depend on the invoicing software or portal being used.

- Will there be a facility for e-invoice generation on the common GST portal?

No, the distinct ERP programs now used by firms will continue to be used to create invoices.

- What are the types of documents that are to be reported to the IRP?

The types of documents that are typically reported to an IRP include invoices, credit and debit notes, and other types of financial documents that are used to record transactions for goods and services.

Are you Looking for GST Refund Service? Mygstrefund.com offers GST refunds on business, exports, and many more if your GST application is rejected. Get in touch with us today.

Related Posts