GST Refund in case of Inverted Duty Structure

Published on: Thu Sep 22 2022

What is an Inverted Duty Structure?

An inverted Duty Structure is a scenario where the tax rate on inputs used is higher than the tax rate on outward supplies. In simple terms, GST paid on inputs purchased is more than GST payable on outward sales. This results in the accumulation of Input Tax Credit in the electronic credit ledger of the registered person.

Under GST Law, a registered person may claim the refund of an unutilized ITC subject to the fulfillment of certain conditions, which we will discuss in this article.

Scenarios where Inverted Duty Structure is applied

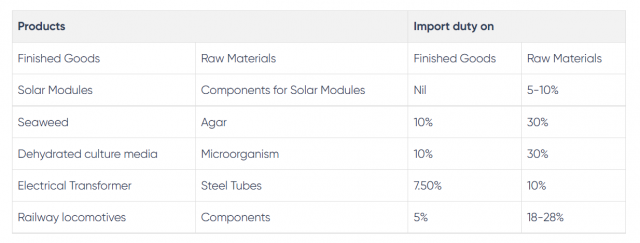

To explain this situation, here are some of the scenarios where the tax paid on inputs is higher than the tax paid on outward supplies:

Hereabove, it can be seen that the raw materials are imported from overseas and such inputs are used in the production/manufacturing of finished goods. The duty on raw materials is higher than the finished goods which fall under the Inverted Duty Structure.

Documents required for GST Refund in case of Inverted Duty Structure

Application filed for refund has to be accompanied by documentary or other evidence in order to establish that the amount of tax and interest, if any, paid on such tax or any other amount paid in relation to which refund is claimed was collected from, or paid by, him and incidence of such tax and interest had not been passed on to any other person.

Below is the list of required documents:

- Declaration under the second and third proviso to section 54(3)

- Declaration under section 54(3)(ii) (not used for Nil or exempt supply)

- Undertaking in relation to section 16(2) (c) and section 42

- Statement 1 under rule 89(5)

- Statement 1A under rule 89(2)(h)

- Self-declaration under rule 89(2)(I), if the amount claimed, does not exceed two lakh rupees, certification under rule 89(2)(m) otherwise

- Copy of GSTR-2A of the relevant period

- Statement of invoices (Annexures-B)

- Self-certified copies of invoices entered in Annexures-B whose details are not found in GSTR-2A or 2B of the relevant period

Time limit to claim GST refund in case of Inverted Duty Structure

As per the provisions of Section 54 of the CGST Act, any person may make an application to claim a refund of the input tax credit before the expiry of two years from the date of the relevant period.

Further, CBIC vide Notification No. 13/2022-Central Tax dated 5 July 2022 has excluded the period from 1 March 2020 to 28 February 2022 for the computation of the period of limitation for filing refund applications under section 54 or 55 of the Act. With this notification, two years period shall not be included within the stipulated period.

Calculation of GST refund in case of inverted duty structure

The taxpayer may calculate the GST refund in case of an inverted duty structure in the following manner:

Maximum Refund Amount = {(Turnover of inverted rated supply of goods and services) x Net ITC / Adjusted Total Turnover} – {(Output tax on inverted rated supply) x ITC on goods / ITC on goods and services}

For instance,

Turnover of inverted duty structure = 500

Total Turnover = 1500

ITC on input = 60

ITC on input services = 40

Output tax on inverted rated supply = 25

Refund amount = {(500*60)/1500} – {(25*60)/100} = 5

Do you want to check your GST refund calculation? Click here to calculate

The process to file GST Refund for Inverted Duty Structure

In order to file a GST Refund in case of an Inverted Duty Structure, a taxpayer needs to follow the below steps:

Step 1 – File RFD-01 along with the documentary and supporting evidence

Step 2 – After the application is filled by the taxpayer, the details and the acknowledgment will be auto-generated in Form RFD-02. The same will be forwarded via an email and an SMS for future references to the applicant.

Step 3 – All the documents are filed with the department

Step 4 – In case of any faults, shortcomings, or shortages in the GST refund application then the applicant is required to file Form RFD-03 which will be sent to them for correcting their application.

Step 5 – When the tax is claimed for exports of goods or services then the authorized officer is subjected to issue a provisional refund order. This order needs to be filed in Form RFD-04 for 90% of the refund claim.

Step 6 – When the taxpayer gets a green signal from the authorized officer after all the documents are checked and they are abiding by the law, then the officer passes a final order.

Step 7 – Form RFD-06 is passed when the refund is granted to the taxpayer.

In cases the refund application is not accepted, RFD-07 is issued for complete rejection.

What to do after filing a Refund

After the successful filing of the refund, the taxpayer may follow up with the concerned authority/officer. In case, any document or any clarification is required by the officer, he shall provide the same in order to claim the refund.

If you are facing difficulties in claiming your GST Refund, you may always contact the GST Refund consultant at MyGSTRefund.com. We work with a “No Success, No Fee” policy on GST Refund claims.

Related Posts