GST Refund Calculator Demo- How It Works

Claiming GST refunds is very vital and time-consuming for Indian businesses in general and exporters, in particular, and the businesses that experience inverted duty structures. The traditional process envisages complicated forms, compliance nightmares, and long delays. That is why the GST refund calculator tool can be a game-changer.

In this blog, we are going to take you through how the tool works, provide a step-by-step demonstration, and highlight the advantages of why and how you should use it. It's time to stop guessing and start claiming with surety.

What is a GST refund?

A GST Refund Calculator is a useful tool that helps businesses and individuals estimate the refund amount they are eligible to claim under GST (Goods and Services Tax). In such cases, the excess amount becomes eligible for a refund, and a situation arises.

Who Can Claim a GST Refund?

● Exporters of goods and services

● Businesses with an inverted duty structure (higher input tax than output tax)

● Sellers selling on E-commerce platforms.

● SEZ units and developers

● Taxpayers who have paid excess GST inadvertently

Additionally, taxpayers who have inadvertently paid excess GST can apply to get that amount refunded through the appropriate process under GST law.

Sometimes businesses make the top 5 mistakes delay GST refund because of a delay in getting the refund on time

What Is the GST Refund Calculator?

The GST refund calculator is a tool made specifically to facilitate the process of calculating GST refunds on zero-rated outputs, especially for exporters and start-ups. All you need to do is enter your export turnover and valid ITC, and the calculator will automatically give your calculation as an export refund under Rule 89(4) of the CGST Rules. There are no manual formulas, no mistakes, simply correct compliant estimates on your zero-rated supplies.

The MYGST Refund Calculator helps you estimate the total GST refund amount you’re eligible to claim. It streamlines the process by allowing secure data entry and generates a detailed refund report within minutes.

Key Features of the GST Refund Calculator Tool

This GST refund calculator tool has been designed to deal with many different complicated refund scenarios with accuracy and efficiency.

- Automatic Refund Calculation

Automatically processes refund amounts based on your data inputs. - Easy-to-Use Interface

User-friendly design ensures a smooth and hassle-free experience. - 100% Error-Free Calculations

Reliable and precise refund computations with minimal chance of mistakes. - Supports All Types of Refunds

Handles various refund scenarios, including exports, excess payments, advances, and more.

Detailed Reports in Excel Format

Generates comprehensive and downloadable refund reports for your records.

Use Cases of the GST Refund Calculator

The GST refund calculator supports multiple refund scenarios, making it suitable for a wide range of businesses. Here are the main use cases and a case study of a GST refund calculator:

1. Exporters (With or Without LUT)

Use Case:

To calculate the refund of input tax credit (ITC) on goods/services exported without paying IGST (under LUT) or the refund of IGST paid on export.

Example:

An exporter exporting goods worth ₹10,00,000 can calculate how much GST paid on inputs is eligible for a refund.

2. Inverted Duty Structure

Use Case:

When the tax rate on inputs is higher than the output, businesses can use the calculator to estimate how much refund they're eligible for.

Example:

If you buy raw material at 18% GST and sell the finished product at 5%, you can claim the difference.

3. Excess Cash in Electronic Cash Ledger

Use Case:

When you are selling an e-commerce platform or supplying goods to the government, you can claim a refund of TCS/TDS.

5. SEZ Units/Developers

Use Case:

To estimate a refund on tax paid on inputs or services used for authorized operations in a Special Economic Zone (SEZ).

6. Deemed Exports

Use Case:

Suppliers can calculate the refund of GST paid on deemed export transactions (like supplies to EOUs).

Opportunities:

Monthly/Quarterly ITC Refund Planning

Use Case:

Helps accounting teams plan monthly refund claims and cash flow, especially in businesses with large turnovers.

Case Study 1: Export Without Payment of Tax (Under LUT)

Company: DEF Textiles Pvt. Ltd., Gujarat

Scenario:

DEF Textiles exports cotton fabrics to the UK under a Letter of Undertaking (LUT), allowing exports without charging IGST on the invoice.

Export Invoice Value: ₹25,00,000

Input GST Paid (Raw Materials & Services): ₹2,00,000

Adjusted Total Turnover (Monthly): ₹30,00,000

Refund amount= 25,00,000/30,00,000*2,00,000 = 1,66,667/-

Outcome:

By exporting under LUT, DEF Textiles benefits from zero-rated supplies without upfront IGST payment, enabling smoother cash flow and seamless input tax credit utilisation.

Case Study 2: Export With Payment of Tax (IGST Route)

Company: GHI Pharma Ltd., Telangana

Scenario:

GHI Pharma opts to pay IGST on medicinal syrup exports to Australia to accelerate the refund process.

Export Invoice Value: ₹50,00,000

IGST Charged (18%): ₹9,00,000 (Refund will be processed automatically through the (ICE GATE Portal)

Shipping: Sea freight with customs clearance

Outcome:

Although IGST is paid upfront, GHI Pharma expedites the refund procedure under GST, ensuring quicker reimbursement and improved working capital.

Case Study 3: GST TCS Refund for ABC Enterprises

Company: ABC Enterprises

Scenario:

ABC sold goods through Flipkart, which collected 0.5% TCS amounting to ₹200,000 under GST. Post filing returns, ABC realized their GST liability was lower, resulting in an excess TCS balance in their cash ledger.

Action Taken: Filed refund application on the GST portal with TCS certificates and reconciliation statements.

Result: Refund of ₹200,000 approved and credited within 60 days.

Benefit:

ABC successfully recovered excess TCS, enhancing liquidity and cash flow.

Case Study 4: GST TDS Refund for XYZ Ltd.

Company: XYZ Ltd., service provider to government departments

Scenario:

2% GST TDS amounting to ₹1,50,000 was deducted during FY 2023-24. After the return filing, the actual GST liability was lower due to input tax credits, creating an excess balance in the electronic cash ledger.

Action Taken: Filed refund application with TDS certificates and reconciliation documents.

Result: Refund of ₹150,000 approved and credited within 60 days.

Benefit:

XYZ Ltd. reclaimed excess TDS, boosting its cash position.

Case Study 5: GST Refund for SEZ Unit

Company: Sunrise Electronics, SEZ unit

Scenario:

Sunrise Electronics exported goods under zero-rated GST provisions but accumulated significant unutilized input tax credit due to large input purchases.

Action Taken: Filed a refund application with export invoices and ITC reconciliation.

Result: Refund of ₹50 lakhs approved and credited within 60 days.

Benefit:

The SEZ unit recovered substantial ITC, enhancing financial efficiency.

Inverted Duty Refund- Various Cases

Case 1: A supplier filed a refund claim for an incorrect period, resulting in a lower refund. Upon refiling for the correct period, the refund amount increased.

Case 2: A trader concerned about one-to-one ITC correlation was clarified by the authorities that proportional allocation is acceptable, simplifying the refund process.

Case 3: A trader selling multiple SKUs claimed an inverted duty refund due to purchasing goods at a higher GST rate and selling at a lower rate. After filing all documents, the refund was sanctioned on time.

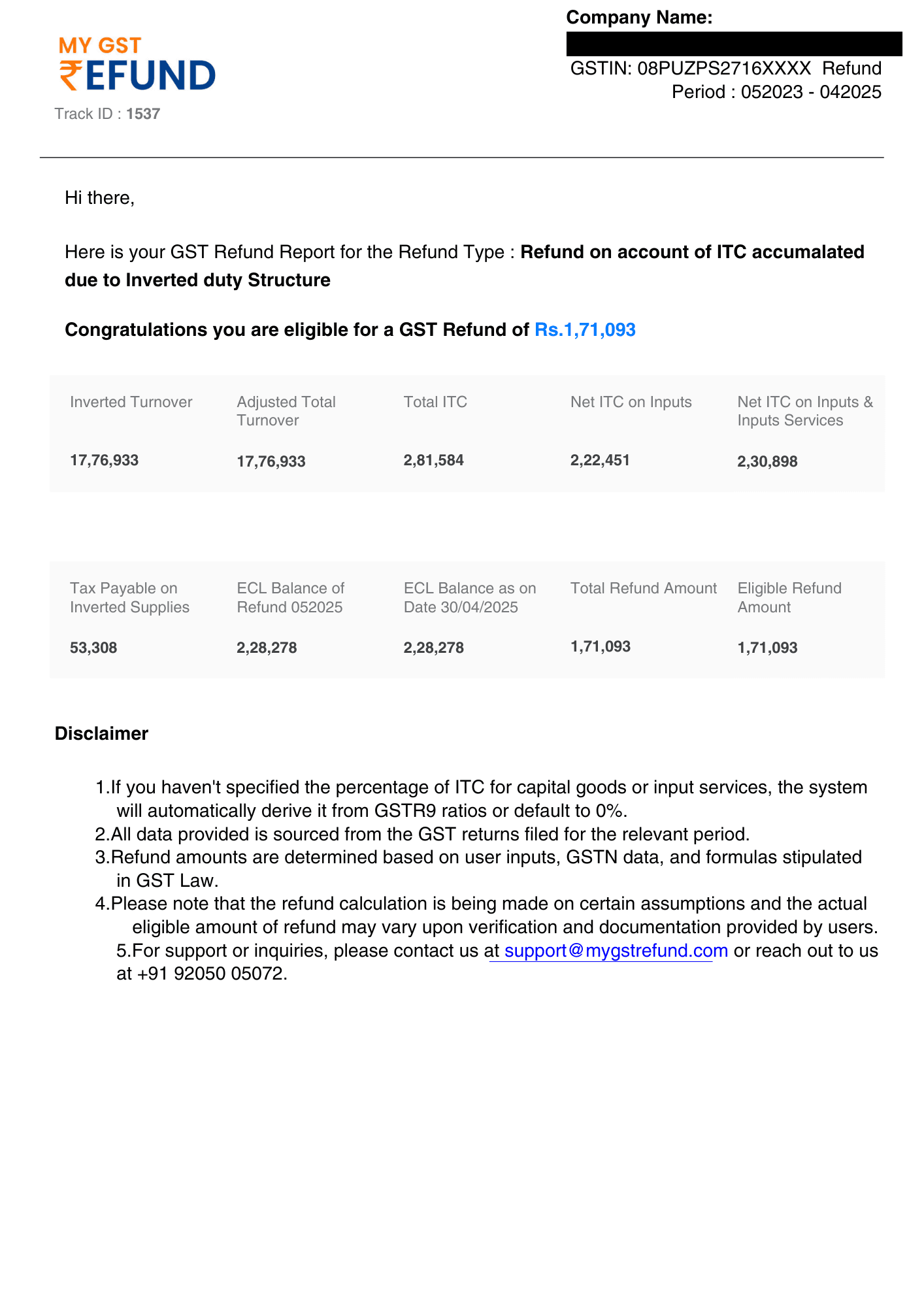

Understanding the GST Refund PDF Report

The calculator also generates a detailed PDF report, typically including:

- Invoice-wise export summary

- GSTR mismatch reconciliation

- Eligible refund amount as per the rule

- Turnover in India vs. export turnover

- ITC claimed and utilized

- Declaration and supporting documents checklist

This report acts as a ready-made annexure to your RFD-01 application, making refund filing straightforward and defensible during scrutiny.

Step-by-Step Demo: How Does It Work?

- Open the tool at app.mygstrefund.com.

- Log in using your credentials.

- Click on Get Started and then Add Your Business.

- Enter the following details:

- GSTIN

- GST Portal Username

- GST Portal Password

Verify your identity using the OTP sent to your registered mobile number.

View and download your report — the tool instantly generates a detailed GST Refund Report, showing the total amount you can claim

The GST refund calculator tool demo below explains how easy the calculator of mygstrefund.com, the first automated GST refund tool in India, can be used.

Frequently asked questions (FAQs)

What’s required to use the GST refund calculator tool?

You only have to have your GSTIN, the information on your zero-rated supplies, and the input tax credit information. In the case of exporters, the shipping bill and invoice details serve to sharpen the estimate.

Is it accurate and GSTN-compliant?

Yes, the GST refund calculator runs off APIs that are GSTN compliant, and the calculation logic of refunds is provided in Rule 89 and other related notifications. It is frequently revised when there are policy changes.

Is the calculator tool free?

Yes, this free GST refund tool is available on the myGSTrefund platform and is completely free to use, especially helpful for small businesses and consultants.

Can I use it for multiple clients?

Absolutely. The tool provides the refund calculation based on several GSTINs, which is perfect when dealing with tax professionals and compliance departments.

The Key Takeaways

Conclusively, GST delay in refunds may seriously affect the working capital of your business and can retard its growth and development. Refunds are best calculated manually, but the process is usually complicated, error-prone, and time-consuming, which is a useless burden and has a compliance risk.

Due to this fact, MyGSTRefund has innovated an exclusive tool that can be described as the first fully automated GST refund calculator tool in India, meant to make the process of refund estimation easier, faster, and more accurate.

Related Posts