Everything You Need to Know About RFD 01/01A Form in GST

Published on: Wed Mar 29 2023

What is RFD-01 and RFD-01A?

RFD-01 is an online platform used for processing refunds under the GST system. Users can file this application on the GST portal to claim refunds for taxes, cess, and interest paid in situations where there are no taxes on supplies (except in the case of exporting goods with tax payment), or when there is an excess cash balance in the electronic cash ledger.

On the other hand, RFD-01A is an offline application that was previously used for claiming refunds but is no longer in use. Refunds will only be issued if they exceed Rs. 1,000 in value. In summary, RFD-01 is the current online application used for processing GST refunds, while RFD-01A is an outdated offline application that is no longer in use.

Who should file the application in RFD-01 or RFD-01A?

To claim a refund, the taxpayer must submit an application using Form GST RFD-01 on the GST portal. They should indicate “Refund of excess balance in Electronic Cash Ledger” as the reason for their refund claim. Once submitted, the application will be assigned to a Refund Processing Officer for processing, and the applicant can monitor the status of their refund application.

Under the GST system, any taxpayer can make a claim for a refund by completing the RFD-01 form online through the GST portal. The outdated RFD-01A offline application is no longer used. Refunds will only be issued if the refund amount is greater than Rs. 1,000.

Types of refunds where RFD-01/01A is applicable

The following types of refunds under GST are being processed if filed via form RFD-01: –

- Refund of IGST paid on zero-rated supplies, which includes exports of services with tax payment and supply to SEZ units or developers.

- ITC on exports of goods or services under the letter of undertaking or bond, without tax payment.

- Claims for deemed exports by recipients or suppliers.

- Refund claims on account of inverted duty structure.

- Refund of excess balance in the electronic cash ledger.

- Refund of excess tax paid erroneously.

- Refund due to assessment or provisional assessment, appeal, or any other order.

- Refund of tax paid towards intrastate supply that was later held to be interstate or vice versa.

- Refund in miscellaneous cases, which should be specified while applying.

- Refund by unregistered taxpayers.

Cases where RFD-01 and RFD-01A should not be filed

- Export of goods involving payment of export duty

- Exports of goods where IGST is paid, and shipping bill is by default considered an application for refund.

- Cases where the supplier avails the drawback scheme of the CGST/SGST/IGST paid on the supplies

- UN or embassies and certain persons notified

- Casual taxable persons/non-resident taxable persons

Prerequisites for applying for a refund

When a taxpayer applies for a refund for tax paid or accumulated input tax credit without payment of output tax, for zero-rated supplies and deemed exports, they must ensure they have filed GSTR-1 and GSTR-3B for the relevant month of such supplies. When filling out GSTR-1, the applicable Table 6A should be filled for exports, Table 6B for supplies to SEZ units/SEZ developers, and Table 6C for deemed exports. In addition, GSTR-3B must be filled out in Table 3.1(b) and filed in line with GSTR-1. Any discrepancies found between the returns could result in a delay in refund processing. The applicant must also have a list of invoices against which the refund is being claimed.

Time limit and frequency of filing RFD-01

To claim a refund in RFD-01, the taxpayer must file the application within two years from the relevant date. Multiple tax periods can be included in a single refund application for one financial year. If goods are supplied to SEZ units or developers, the supplier must file the form once the receipt of goods is authenticated by a specified officer of that zone. If services are supplied to SEZ units or developers, the supplier must file the form once the evidence of service receipt is authenticated by a specified officer of that zone. Unregistered taxpayers claiming a refund must calculate the two-year due date to file a refund application from the date of issuance of the contract’s cancellation letter.

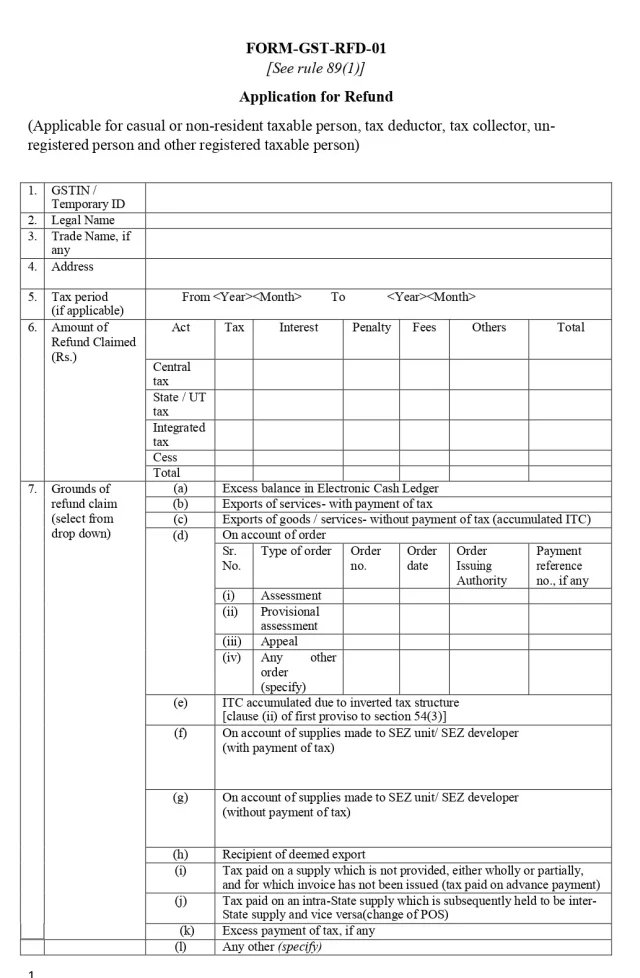

Format of RFD-01 and RFD-01A

The format of RFD-01 can be broken down into the following parts: –

- Basic form (Sl. No. 1-10 of the form)

- Declarations and verification

- Annexure-1

- Annexure-2

Basic form

- The unique GSTIN or temporary ID assigned.

- Legal name of the applicant.

- Trade name, if applicable.

- Address of the main business location.

- In case of a claim for a specific tax period, mention it.

- Indicate the amount of IGST, CGST, SGST, interest, or cess, if relevant.

- Choose the grounds for the refund claim from the provided list.

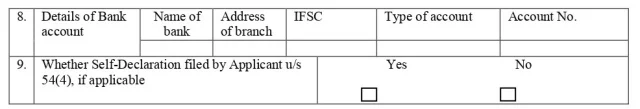

- Bank account details where the refund should be deposited, if applicable. This is automatically filled from the registration data but can be modified if necessary.

- Select ‘Yes’ if Annexure 1 is required for supporting documentation for the reason chosen in (7), else select ‘No’.

- Verification: An authorized person must sign this section to certify the accuracy of the information and statements provided.

Declarations and verification

Certain types of refund claims made by taxpayers require them to make declarations to assert that they are the ones burdened by the tax and that no other person can make a claim for the refund.

Annexure-1

Various types of refund claims require different declarations to be made or submitted as documentary evidence. RFD-01 prescribes a total of 11 statements for different types of refund applications. However, if the amount of refund claimed is less than Rs. 2 lakh, documentary evidence is not necessary. Instead, a self-declaration stating that the recipient of goods or services is not claiming the ITC benefit is sufficient.

Annexure-2

To accompany the refund application in RFD-01/RFD-01A, it is necessary to attach a certificate issued by a Chartered Accountant/Cost Accountant.

Calculation of the refund amount

The refund amount typically corresponds to the tax, interest, or cess paid as per the tax invoice. If there are any amendments to the invoice details, including exports, the refund amount will be calculated based on the amended value. When claiming a refund for the accumulated ITC, there are two formulas prescribed. Only the proportionate amount of accumulated ITC can be claimed that corresponds to the value of the turnover related to zero-rated supplies or inverted rated supply, relative to the total turnover earned by the taxpayer for the given period.

Formula to calculate the refund amount of Input Tax Credit(ITC): –

Net ITC x [(Turnover of zero-rated supply of Goods + Turnover of zero-rated supply of Services)/Adjusted Total Turnover] (for the relevant period).

What is RFD-01B and RFD-01W?

RFD-01B, which is also called ‘Refund Order Details’, is a document that provides a summary of refund orders passed once the entire refund process has been completed.

On the other hand, RFD-01W is a form that applicants use to withdraw a refund application that they had previously submitted.

Follow-up after filing the refund application

After submitting the RFD-01 application, the refund amount requested will be automatically debited from the electronic credit ledger of the claimant, and a debit reference number will be provided for future reference. Within 15 days of receiving the application, the GST officer will review it to ensure that it is complete in all respects. If anything is missing or not declared, the claimant will be informed via RFD-03 and asked to submit a fresh application. However, this scrutiny will not apply in the case of a refund claim of the balance in an electronic cash ledger. If the refund application is successful, an acknowledgment in RFD-02 will be provided on the GST portal, which will include the Application Reference Number (ARN), the refund claim period, and the date of filing RFD-01. The GST officer has 60 days from the date of receiving RFD-02 to pass the order of sanction of the refund claim, provided that the refund application is complete in all respects.

Who will be the GST officer for refund sanction?

The RFD-02 form contains the name of the GST officer who will be responsible for processing the refund. It’s important to note that the processing of all types of taxes, including IGST, CGST, and SGST/UTGST, can be done by either the central or state tax authority. However, the payment of the refund will be made by the appropriate tax authority based on the type of tax paid. To facilitate this process, the GST officer who issued the refund order will coordinate with the relevant tax authorities of the central, state, or UT government within seven working days of issuing the refund order to initiate payment.

Are you Looking for GST Refund Service? Mygstrefund.com offers GST refunds on business, exports, and many more if your GST application is rejected. Get in touch with us today.

Related Posts