GSTR‑3A Notice: What Happens If You Don’t File GST Returns?

GSTR-3A is not a return, but it is a notice declared by GST authorities in the system in case of a non-submission of the taxpayer in the specified GST return on a due date as an obligation under it. It is a form of adaptive reminder, and it is mostly of interest to people who comply in 15 days.

What is GSTR‑3A?

GSTR‑3A meaning: It is an automated reminder notice served to taxpayers who haven’t filed their required GST returns. This is not a return form, as is the case with GSTR-3B, which reports actual tax data.

GSTR-3A just requests the taxpayer to make the pending returns within 15 days of the notice date. Failure to do this can lead to the calculation of tax based on best judgment, which in most cases means that the result can be of a greater financial impact.

Who Receives GSTR‑3A?

The GSTR‑3A notice applies to multiple categories of taxpayers who fail to file their respective returns:

- Regular Taxpayers not filing GSTR‑3B

- Composition Dealers missing GSTR‑4

- Non-resident taxpayers missing GSTR‑5

- Input Service Distributors (ISD) missing GSTR‑6

- TDS Deductors missing GSTR‑7

- TCS Collectors missing GSTR‑8

- Taxpayers missing Annual Returns (GSTR‑9) or Final Returns (GSTR‑10)

So, whether you're a small trader under the composition scheme or a TDS deductor, non-compliance can attract a GSTR‑3A notice.

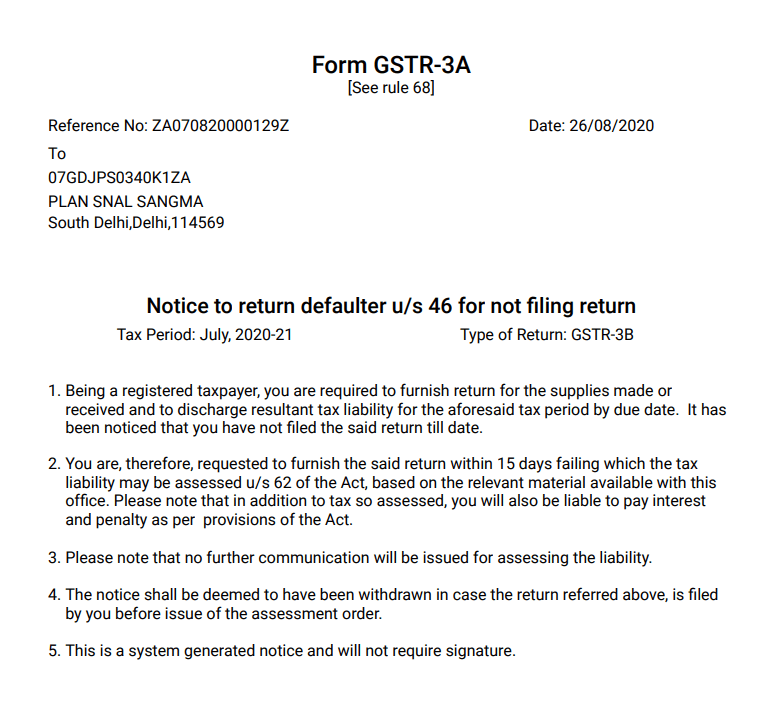

Contents of the GSTR‑3A Notice:

A typical GSTR‑3A GST notice will include:

- Your GSTIN and legal name

- The tax period for which the return is pending

- Details of the non-filed return form (e.g., GSTR‑3B, GSTR‑5)

- Filing due date

- Tax dues (if any) and a reminder of legal provisions

You can view GSTR‑3A on the GST Portal by navigating to:

Services → User Services → View Notices and Orders

You may also download this GSTR‑3A notice in PDF for offline reference or to share with your tax advisor.

Keen Deadlines & Actions Required:

The most important point: You have 15 days from the notice issue date to file the pending return. For example:

If your GSTR-3B for June is due on 20th July but you didn’t file it, a GSTR‑3A notice may be issued by the first week of August. You must then file the return by the middle of August to avoid further action.

Take Action:

- Download and review the GSTR‑3A notice promptly.

- File your pending return (like GSTR‑3B, GSTR‑5, GSTR‑7, etc.) within 15 days.

- Pay applicable late fees and interest immediately.

Penalties & Interest: What You May Owe

Non-filing of GST returns doesn’t just stop at a warning. Here's what it can cost you:

Late Fees GSTR‑3A:

- ₹100 per day under CGST + ₹100 under SGST

- Max limit: ₹5,000 per return

- For annual returns, the cap is 0.25% of turnover in the state/UT

Interest on Late Payment:

- 18% per annum on outstanding tax dues

- Calculated from the due date to the date of payment

- If your return remains unfiled even after the GSTR‑3A notice, the consequences can be severe.

If No Response Within 15 Days:

The GST department can even act against you under Section 62 of the CGST Act if you abscond the notice or fail to comply with the due within 15 days.

Then what happens?

- Best Judgment Assessment is launched to your liability towards tax paid is accounted without consultation with you

- A judicial order of assessment is implemented.

- You may now face a penalty of ₹10,000 or 10% of tax due, whichever is higher

This is mandatory and a legal one as well; so far, your record of compliance suffers.

Can You Still File After 15 Days?

Yes, if you file your pending return before the assessment order is passed, the GSTR‑3A notice is treated as withdrawn.

This means:

- No penalty under Section 62

- You still pay interest and late fees, but avoid escalation

How to File the Pending Return?

Step-by-step guide to resolve GSTR‑3A notice:

Login to GST Portal → https://www.gst.gov.in

- Go to Services → User Services → View Notices and Orders

- Download GSTR‑3A notice and review the return type pending

- File the appropriate return (GSTR‑3B, GSTR‑5, etc.)

- Make tax payment and pay interest + late fee

- If the notice was issued in error, you may respond online through the same dashboard

Tips to Avoid GSTR‑3A Notices:

The preemptive measure will help you avoid these warnings.

GSTR‑3A Compliance Tips

- Turn on calendar reminders or GST Portal SMS alerts (sent on 18th and 25th)

- Keep the right bookkeeping to prepare returns on time

- Take into account automation tools or professional filing services to prevent errors introduced by hand

- Check on the portal to track returns regularly

GSTR‑3A vs GSTR‑3B: Don’t Get Confused

| Feature | GSTR‑3A | GSTR‑3B |

| Type | Notice (Litigation) | Return Form (compliance) |

| Purpose | Reminder for non-filing | Monthly/quarterly summary return |

| Issuer | GST Department | Taxpayer files it |

| Filing Timeline | 15 days after notice | By 20th of next month |

| Action Needed | File overdue return | File regularly to avoid notice |

GSTR‑3A and Special Cases:

For Composition Dealers:

- If you miss GSTR‑4, you’ll receive a GSTR‑3A. Penalties are the same.

For Non-Resident Taxpayers:

- Missed filing GSTR‑5? GSTR‑3A applies with equal force.

For TDS Deductors:

- Failing to file GSTR‑7 for deducted TDS? You may get GSTR‑3A.

Whichever the case, the same process is used to clear or sort the situation: act within 15 days, file, pay, and be in compliance.

How Can MyGSTRefund Help?

If you use MyGSTRefund’s tools consistently. like GST refund estimates, HSN finder, and HSN validator, you will not get a GST notice. It happens because most of the time it entails a compliance issue, such as non-filing, mismatching of returns, incorrect ITC claims, or even tax evasion.

To avoid these issues, you can significantly reduce the risk of receiving GSTR‑3A notices or other GST notices arising from:

- ❌ Filing errors (e.g., incorrect HSN codes)

- ❌ Mismatches between GSTR‑1 and GSTR‑3B

- ❌ Incorrect or ineligible ITC claims

Why These Tools Help

HSN finder & validator: These tools are available to ensure the input of claimed refunds matches an auto‑populated amount in the GSTR‑2B and eliminate audit triggers.

Reconciliation and the timely reminders will facilitate the correct filing of GSTR-1 and GSTR-3B and the timely payment of taxes to avoid late fees, interest, and AI-initiated notices

Key takeaways:

In conclusion, GSTR-3A is not a tax return; it is rather a headache of being out of commission. It does not require money but is simply an order to get your return within 15 days or pay a best judgment assessment and pay heavy penalties.

- View and download the GSTR-3A notice from the GST portal.

- Submit appropriate forms of return, such as GSTR-3B or GSTR-7.

- On interest/late payment: 18 percent late fee.

- Prevent the escalation of Section 62

Related Posts