HSN Code List & GST Rate Finder

Find the Latest HSN / SAC Codes & GST Rates for your goods & services. Hero section sub content

Check ITC eligibility instantly using your GSTIN or HSN Code.

Want to check ITC Eligibility for your entire Purchase Register?

Let us help you detect blocked credits across all your invoices.

What Is HSN Code?

HSN (Harmonized System of Nomenclature) is a standardized international system used to classify goods in a structured manner using codes, primarily for taxation, trade, and customs purposes.

Why is the HSN Code Important?

HSN codes are crucial for determining the applicable GST rate on goods, maintaining consistent classification across India and globally, and simplifying tax compliance and return filing.

Why is the HSN Code Used/Required?

HSN codes are required under GST law to identify goods accurately, apply the correct tax rate, and support efficient tax administration and auditing.

Who Provides the HSN Code?

HSN codes are developed by the World Customs Organization (WCO) and adopted by national authorities like the CBIC (Central Board of Indirect Taxes and Customs) in India for local use under the GST system.

How To Find HSN Code Using MYGST Refund HSN Code Finder?

This is an online tool provided by MYGST Refund that helps users search and identify the correct HSN code for a product based on its name or description, along with GST rates.

How To Find HSN Code Using MYGST Refund HSN Code Finder?

This is an online tool provided by MYGST Refund that helps users search and identify the correct HSN code for a product based on its name or description, along with GST rates.

Other Useful Tools by MYGST Refund

In addition to the HSN Code Finder, MYGST Refund offers a suite of smart GST tools to make compliance easy and error-free.

GSTIN Validator

Quickly verify the validity and details of any GSTIN (GST Identification Number). Ensure you’re dealing with legitimate vendors or clients.

Verify GSTINKnow Your GST Refund

Check the status of your GST refund using your ARN or GSTIN. Stay informed about your refund cycle with real-time updates.

Check EligibilityGST Refund Calculator

Estimate your eligible GST refund amount based on your input tax credit and export data. A must-use tool for exporters and refund claimants.

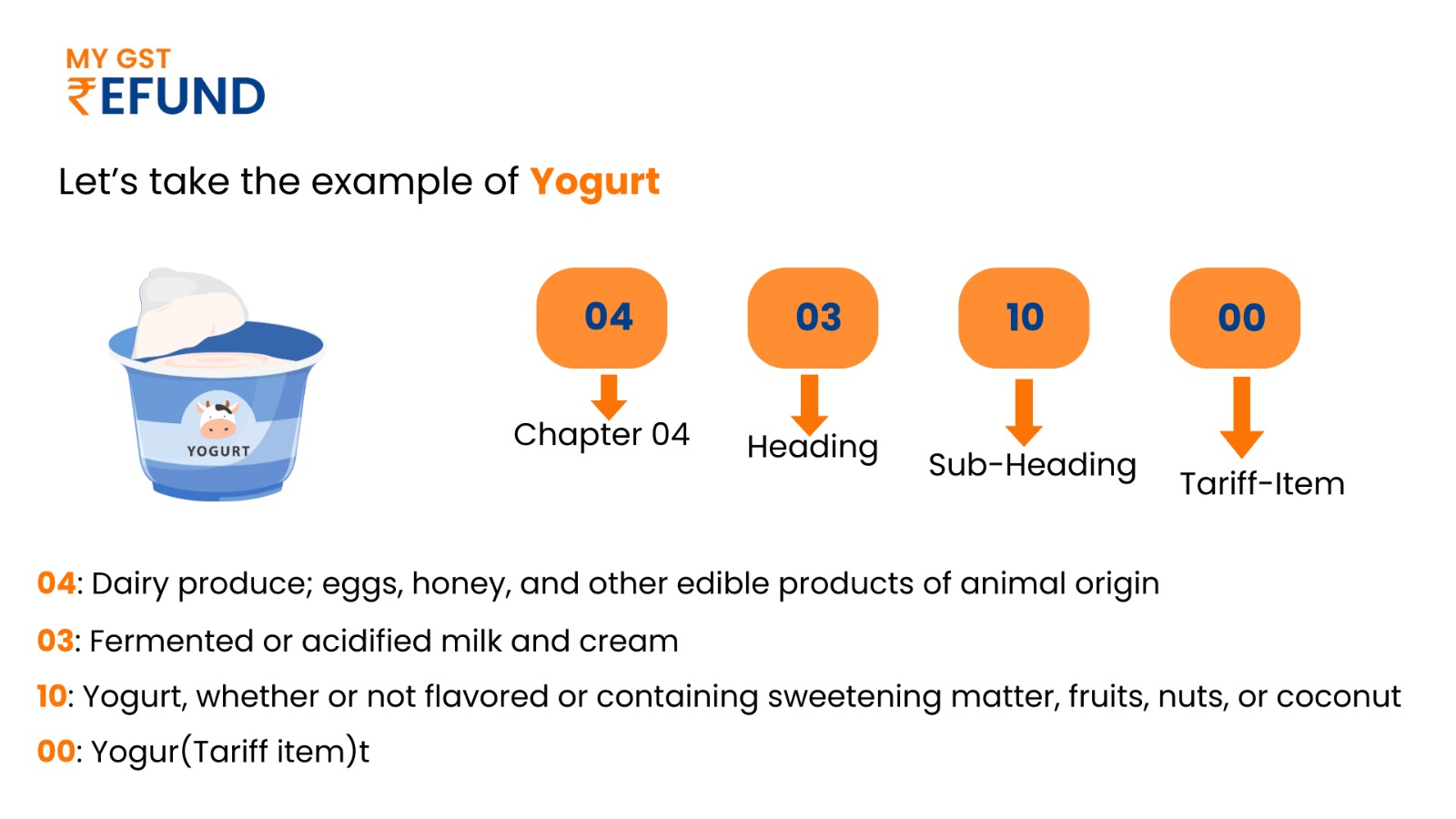

Calculate RefundHSN Code Structure in India

India uses a hierarchical HSN structure based on digits: 2-digit (Chapter), 4-digit (Heading), 6-digit (Sub-heading), and 8-digit (Indian-specific) for detailed classification under GST.

First 2 digits – Chapter

Broad category of goods (“04” covers dairy products).

Next 2 digits – Heading

Sub-category within the chapter (“04 03” = fermented milk products).

Next 2 digits – Subheading

More specific classification (“04 03 10” = yogurt).

Last 2 digits – Tariff Item (India-specific)

HSN Codes for Different Categories of Goods, Chapter Wise?

Goods are categorized chapter-wise under the HSN system, from Chapter 01 to 98, each representing a specific category such as food, textiles, machinery, etc.

HSN Section & Chapter-wise Code List

All goods and services are divided into 21 sections and 99 chapters.We have mention all the sections and chapters listed below:

| Chapter-01 | Harmonized System Code for Live Animals |

| Chapter-02 | Harmonized System Code for Meat and Edible Meat Offal |

| Chapter-03 | Harmonized System Code for Fish and Crustaceans, Molluscs and other Aquatic Invertebrates |

| Chapter-04 | Harmonized System Code for Birds’ Eggs; Natural Honey; Edible Products of Animal Origin, not elsewhere specified or included |

| Chapter-05 | Harmonized System Code for Products of Animal Origin, Not Elsewhere Specified or Included |

Services Accounting Code (SAC) in GST

SAC is the classification system used under GST to categorize and identify services (not goods), similar to HSN codes for products, ensuring proper GST rate application.

Frequently Asked Questions

A code used to systematically classify goods under the GST system.