Inverted Duty Structure in GST: Meaning, Refunds & GST 2.0 Updates

Published on: Wed Sep 10 2025

What Is Inverted Duty Structure (IDS)?

Inverted duty structure in GST is a definition of a higher rate of input GST (e.g., raw material or services) compared to the product. It results in idle Input Tax Credit (ITC) accumulation, distorting working capital and generating refund claims-generating the industry's cash flow issue and the state's expenditure of revenue.

Why Was GST Introduced?

India had an ineffective and disjointed indirect tax system before the introduction of the Goods and Services Tax (GST) on July 1, 2017. Both consumers and businesses encountered numerous obstacles. In order to streamline and harmonize the tax system, the GST was implemented as a "One Nation, One Tax" reform. To eradicate these issues, like -

1. Simplify India's Complex Tax Regime

Before GST, the trader had to deal with a complicated web of indirect taxes-including excise duty, VAT, service tax, CST, entry tax, etc.

2. Put an end to the "Tax-on-Tax" issue

There was no corresponding Input Tax Credit (ITC) during the previous administration; taxes were paid on inputs that had already been subject to taxes. This was fixed by the GST, which mandated that businesses be able to deduct input tax from output tax obligations, with value addition being the only area subject to balanced taxes.

3. Create a Single National Market

Since the states' multi-level structures of taxation differ from one another, interstate trade was plagued with hassles. Application of GST's "One Nation, One Tax" ended differences so that there was easier trade throughout the nation.

4. Increase Compliance & Transparency

GST adopted the digital-first approach in the shape of the Goods and Services Tax Network (GSTN). The portal introduced the facility of online registration, return, invoice matching, and tax payment-increasing responsibility and stopping fraud.

How ITC Provided the Solution

To streamline and improve the tax system, the government implemented the Input Tax Credit (ITC) by:

1. Reduces the Tax Burden

ITC allows companies to pay the difference between GST collected on sales and GST paid on purchases separately, and not be taxed twice.

2 Improvement in Business Efficiency & Cash Flow

Reducing tax burden, easing procedures, and promoting formal transactions, ITC renders the business competitive and more prosperous.

3. Real Value-Added Tax by ITC

Input tax may be credited while calculating output tax liability in GST. Net tax paid was the value addition at one stage, the untaxed value in total.

For Instance, the manufacturer purchases raw material for ₹1,000, pays 18% GST (₹180). The manufacturer sells products, charges ₹212 tax, but refunds earlier ₹180, and pays only ₹32. Net value addition alone is subject to taxation.

What changed: Pre-GST vs Post-GST in relation to ITC: Case Studies

1. XYZ Chemicals – Pre- and Post-GST Scenario

Summary: Pre-GST era, the chemical sector was affected by a discretionary taxation regime-excise, VAT, CST-resulting in cascading taxes and limited ITC benefit, cost inflation, and contributing towards intricacies of inter-state sales.

Post GST: With a single-tax regime and ITC with simplicity, XYZ Chemicals could offset tax paid on inputs against output tax liability, cost benefit, and convenience in compliance, especially in warehousing and logistics.

2. Blocked Buyer ITC Where Seller Fails to Deposit Tax

History: In the pre-VAT era, cases like Digital India Ltd. v. Commissioner of Tax (Delhi HC), bona fide buyers who possess bills lost ITC because of the failure of the seller to deposit tax.

Impact: Courts believed that defaulting cannot punish the buyer; recovery must be carried out by the defaulting vendor.

3. ITC Mismatch: The GSTR-3B and GSTR-2A Conflict

Problem: ITC claims were rejected due to a form discrepancy between taxpayers' auto-drafted GSTR-2A and GSTR-3B.

Solution: They opined that bona fide ITC claims cannot be disallowed on the basis of form mismatch and instructed authorities to reconsider claims.

4. Backdated Cancellation of Supplier's Registration

Problem: Businesses would be deprived of ITC in case the supplier's GST registration is retrospectively cancelled.

Judgment: Delhi HC ruled that bona fide pre-cancellation purchases must continue to be ITC-eligible to protect good faith taxpayers.

5. Vested Interest of Citizens in ITC

Case: Calcutta High Court ruled that if the current ITC is given in good faith, it's a vested right and cannot be withdrawn, unusual - protecting taxpayers from backdated disallowance of credit.

6. Increase in ITC Utilization Ratios

Case: Runwal Forests project analysis under Post-GST ITC as a percentage of turnover from 1.23% to 1.69%-an increase of 0.46%-reflecting actual tax input savings under GST.

7. Fraudulent ITC Claims Under GST

Case: Awadh Enterprises Shell Scam: The supplier's GST registration was canceled as a result of submitting false invoices with the intention of making fictitious ITC claims, making further ITC claims disputed.

Epack Durable Ltd.: forgery of documents led to a ₹5 crore appropriation of the ITC case of fraud.

8. Supreme Court Allows Businesses to Use ITC in GST Appeals

Expansion: The Supreme Court allowed businesses to use ITC credits to offset the 10% compulsion pre-deposit in GST appeals-improving cash flow and ease of compliance.

Pre-Rate Rationalization: Inverted Duty Structure challenge

Sectoral problems: EV, mobile, clothing, and footwear industries were directly affected. For example, GST on finished goods was lowered, and inputs on mobiles were taxed at a higher rate-more crores of refund.

Blocked working capital: The Edible oil manufacturing industry and EV lost precious cash flows due to non-claimable ITC. For example:

Edible oil-5% during manufacturing, but 12–18% during inputs: working capital issue.

EV batteries- charged 18% when cars were 5%: manufacturers' cost volatility.

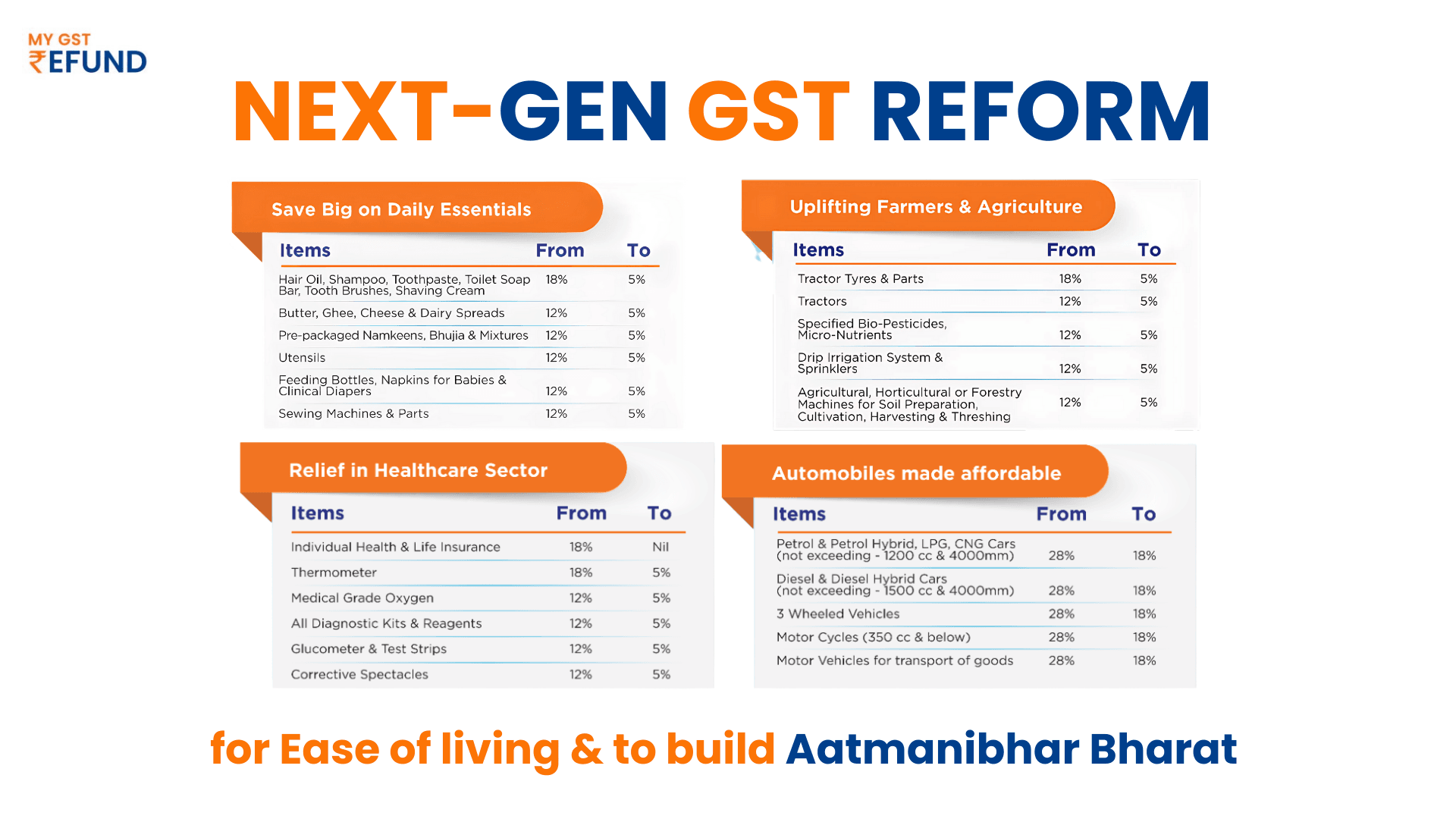

Post Rate Rationalization: How the Inverted Duty Structure Is Reduced

1. GST Rate Rationalization – Simplified Slabs

56th GST Council meeting brought in simplified tax slabs-5%, 18%, and 40% (sin/luxury goods), without the fear of inversion.

The government highlighted that the majority of the reforms were focused on addressing input-output mismatches of tax and preventing ITC pileup.

2. Advance (90%) Refund for IDS Cases

From 1 November 2025, the enterprises that are required to pay IDS can get a 90% refund of their claim in advance on an auto-risk assessment basis. This is consistent with the large exporter refund facility and improves cash flow considerably.

Though the government presently allows refunds of up to 90 per cent of input-linked GST under inverted arrangements.

This measure does not eliminate IDS but minimizes it to a great extent by eliminating the liquidity squeeze.

3. Sector-Specific Relief & Reclassification

Historical corrections-Mobiles (March 2020) and footwear (September 2021): Slabs of GST lowered to the minimum to minimize inversion.

The GoM (Group of Ministers) was requested to particularly suggest rate modifications sector-wise so that refunds on account of IDS are minimized or abolished.

Steps to check if IDS applies to an item or a commodity:

1. Search and identify the GST Rate on certain Inputs:

Inputs include raw materials, intermediate goods, and services used in the manufacture of final goods.

Identify and determine the GST rate applicable to all inputs utilized in the production process of the product or item.

For instance, if you produce a product from raw material textile cloth, identify the GST charge for the textile cloth (input).

2. Identify and Determine the Rate of GST on the Output (End Product):

Outputs are the final product for sale to customers.

Take an example of clothes, ensure the GST is charged on the dress (final good).

3. Product Rates of GST vs Inverted Duty Structure: when the output tax rate (on final good) is less than the input tax rate (on raw material or service).

Example 1

Fabric attracts 12% GST (input tax), while the finished garments attract a meager 5% GST (output tax), thus creating an Inverted Duty Structure.

Example 2

Where input solar panels attract 18% GST but output solar energy-produced electricity is zero-rated under GST, there is an inverted duty structure.

4. Ensure an Inquiry Special Provisions or Exemptions:

Some industries may be down. suffering from an inverted duty structure precisely because a special provision or exemption under GST is being extended to them.

Take the case of the textile and footwear industry. They have suffered from inverted duty structures earlier.

Second, export is a zero-rated supply under GST, and so if your product is being exported, then output tax will be nil, but input tax rate can be higher, and that is an IDS.

5. Unutilized Input Tax Credit (ITC):

Where unused ITC (input tax paid on raw material is greater than output tax received on finished goods), IDS exists.

Unused ITC will be refunded in the GST regime in case of an Inverted Duty Structure.

Sector-Specific Examples of IDS

1. Textile Sector: Input (yarn/spun thread) of the textile or apparel industry can be charged with a higher rate of GST than the final product (cloth/apparel) and thus cause an inverted duty structure.

- Remedy to Correct Inverted Duty Structure

Cancellation of the existing inverted duty structure- in the manmade textile sector by lowering the GST on manmade fibre from 18% to 5% and manmade yarn from 12% to 5%.

2. Footwear Industry: Similar to the apparel industry, the input duty of the sole or leather may be higher than the final footwear and lead to IDS.

3. Renewable Energy Industry: input tax on solar panels is 18%, whereas output (solar energy) is zero-rated and thus leaves a reverse duty structure.

- Correction Of New Inverted Duty Refund

Cut down GST to 5% from 12% on renewable devices and spares being used in the manufacturing of the same

4. Agri Produce: Where agri-machinery tax or agri-fertilizer tax exceeds output product (farm produce or farm products), the Inverted Duty Structure will be effective.

- Amendment of New Inverted Duty Structure

Remedy of inverted duty structure in fertilizers by cutting GST from 18% to 5% on Sulphuric acid, Nitric acid, and Ammonia

How to Check GST Rates of Specific Goods?

To know the new GST rate on any product or commodity, you can follow below:

How MyGST Refund Helps with Inverted Duty Refund

MyGst Refund, as a GST refund service consultant, helps businesses claim a refund under the Inverted Duty Structure by:

- Verifying if their product qualifies means checking if the product is on the list of items for which an Inverted Duty Structure refund is permitted, as some goods/services are specifically excluded by the government.

- Calculating the correct refund amount means what the highest amount of a refund that would be eligible for.

- Handling all documentation and applying to the GST authorities.

Related Posts