What is IMS under GST: Key Features, Benefits & How It Works

Published on: Mon Jul 28 2025

What is an Invoice Management System (IMS)?

Recently, the GSTIN portal issued a new advisory on the Invoice Matching System (IMS). This update offers a preview of GSTR-2B based on invoices, including debit and credit notes, filed by the supplier in GSTR-1, IFF, and 1A.

It enables taxpayers to review and take necessary actions before these entries are reflected in GSTR-2B.

Latest Updates – Handling of Inadvertently Rejected Records on IMS

Jun 19th, 2025

Wrongly Rejected Invoices/DNs: Recipients can reclaim full ITC if the supplier re-reports the same document via GSTR-1A or the amendment table and it's accepted in IMS.

Supplier Liability: No impact if the values remain unchanged, as only differences are considered.

Rejected Credit Notes: ITC can be reversed after the supplier re-furnishes the same CN and it's accepted in IMS.

Final Impact: Supplier liability may increase temporarily on CN rejection, but is neutralised once re-reported.

Read More:How to Handle Inadvertently Rejected Records on IMS

Date of Implementation of the Invoice Management System Under GST

IMS (Invoice Management System) has been live on the GST portal since 1st October 2024.

The first GSTR-2B showing IMS action points is for October 2024, available from 14th November 2024 onwards.

Is it mandatory to act on IMS? What happens if no action is taken?

It is not mandatory to act on records in the IMS dashboard for GSTR-2B generation. The records where no action is taken by the recipient would be treated as accepted by the system, and a GSTR-2B would be generated as it is generated presently.

Key Features of Invoice Management System (IMS) under GST

Helpful Tool for Smarter Invoice Management: IMS is a voluntary feature designed to help taxpayers manage incoming invoices with greater control and accuracy. It assists taxpayers in managing their invoice data and also has cleaner and more compliant ITC claims.

Invoice-Level Actions: Taxpayers will be able to accept, reject, and maintain provisional acceptance to the invoices issued to them by the suppliers and debit and credit notes.

Impact on GSTR-2B

Rejected invoices:ITC will not receive consideration, and this will minimize errors of returns.

Flexibility in Reconciliation: Invoices that are kept in a pending position can be rectified and processed in the later months, enabling ITC claims when the matter is settled.

Better ITC Traceability: With an accurate track record of invoices, businesses can have clean financial records and avoid any errors in tax filling.

How Does IMS Work on the GST Portal?

Step-by-Step Guide for Input Tax Credit (ITC) availing process Using the Invoice Management System (IMS) under GST

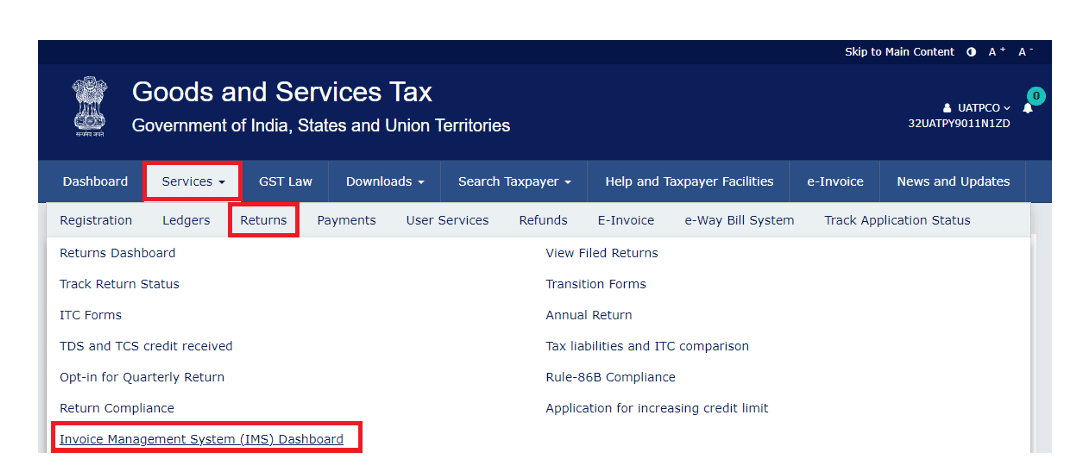

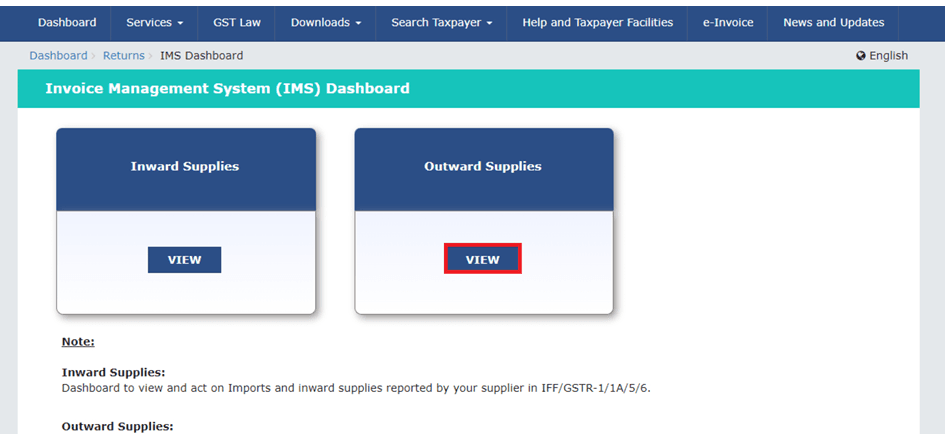

1.Login and Navigation

- Log in to www.gst.gov.in using your GST credentials.

- Navigate to Services > Returns > Invoice Management System (IMS).

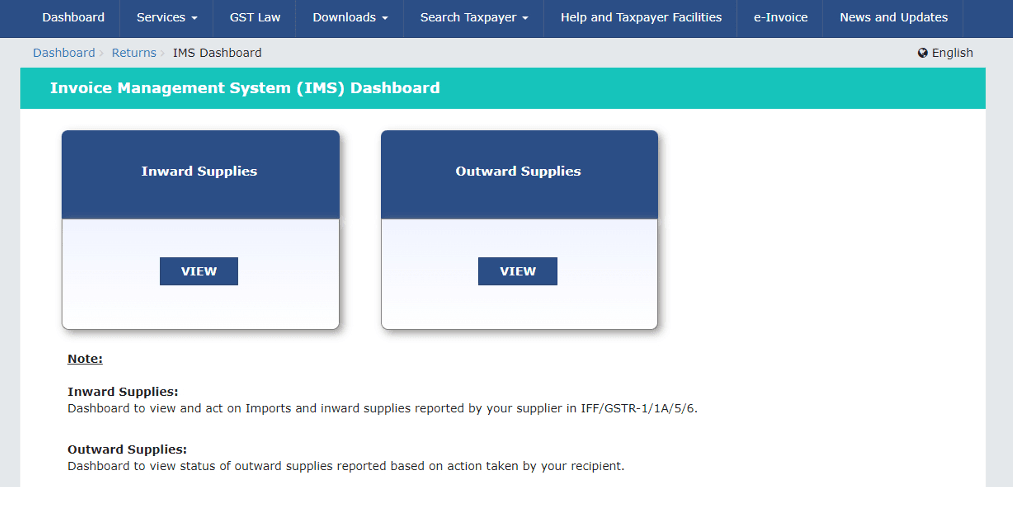

- The IMS Dashboard opens with two sections: Inward Supplies and Outward Supplies.

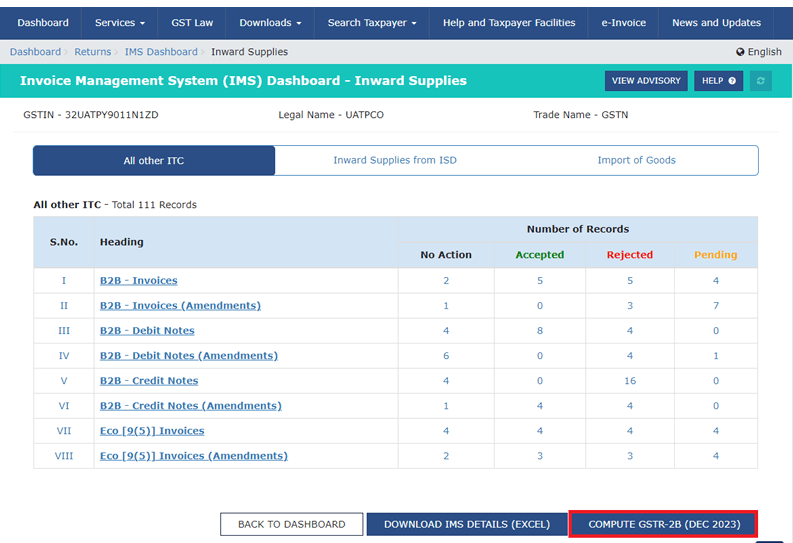

2.Inward Supplies - View and Act

- Click 'View' under Inward Supplies.

- A pop-up informs that invoices with no action will be treated as accepted. Click OK.

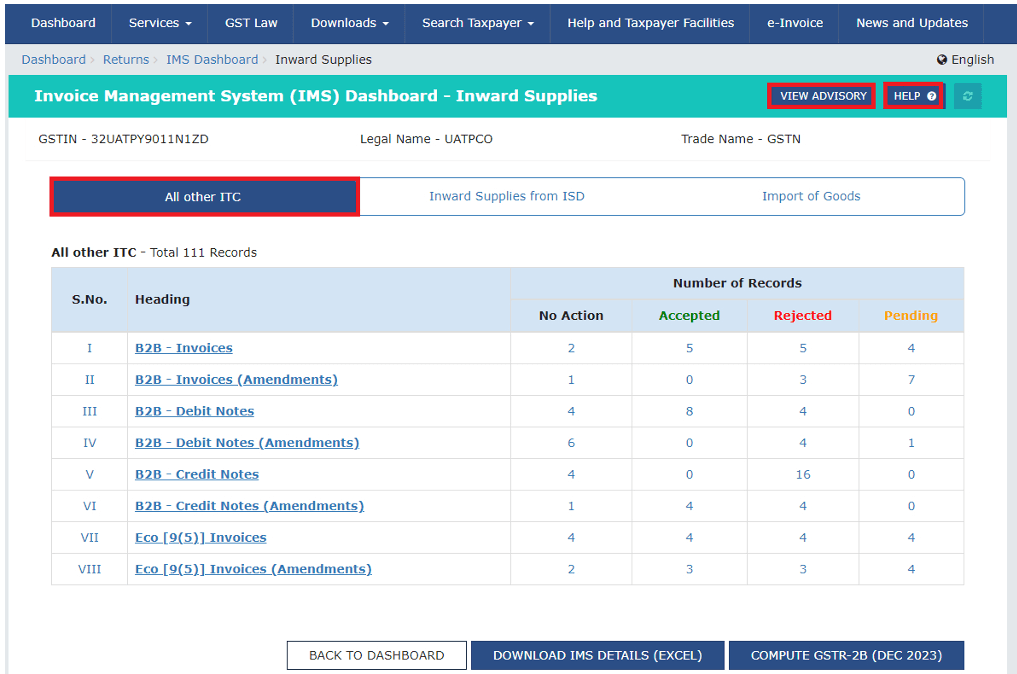

- A summary page displays invoices head-wise with statuses: No Action, Accepted, Rejected, Pending.

- You can click on any status or section to drill down to the details of the invoice.

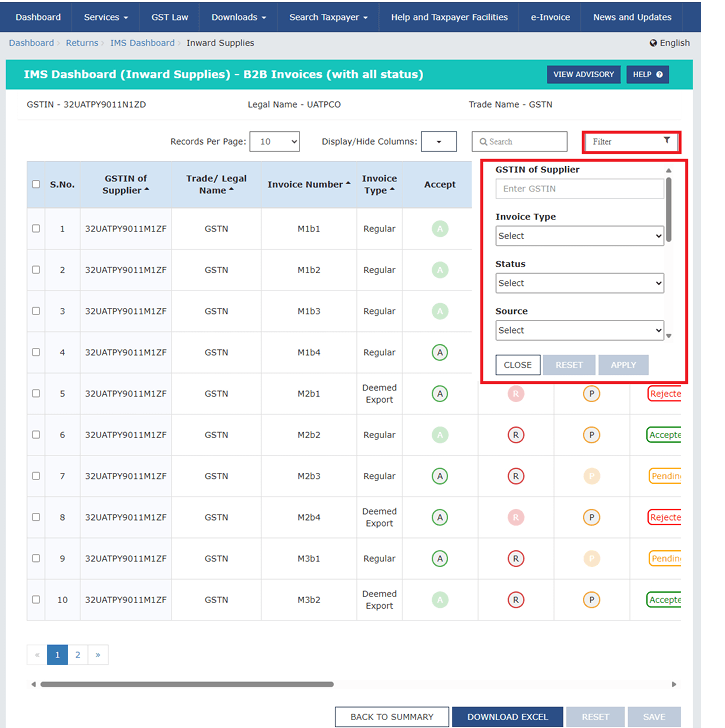

- Filters/search to search by GSTIN, date type etc.

3. Taking Action on Invoices

- Click on either A (Accept), R (Reject), or P (Pending) buttons to take some action on each invoice.

- Or select multiple invoices via checkboxes and apply action in bulk from the header.

- Click 'Save' after the action to update the status.

- Use 'Reset' to undo saved actions on selected invoices.

4. Bulk Selection and Download

- Select invoices on current or all pages using the bulk checkbox in the header.

- Use 'Download Excel' to download section-wise or complete IMS data for offline review.

5. Recompute GSTR-2B

- GSTR-2B is auto-generated on the 14th of the following month based on IMS data.

- If you act on invoices after the 14th, click 'Compute GSTR-2B' to regenerate the latest ITC data.

- Check the status of recomputation using the refresh button next to 'Help'.

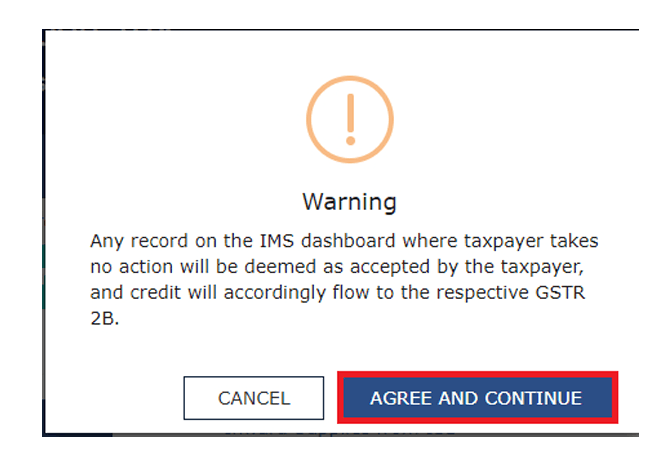

- On clicking the COMPUTE GSTR-2B button, a pop-up will be displayed on the screen. Click on the AGREE AND CONTINUE button to compute

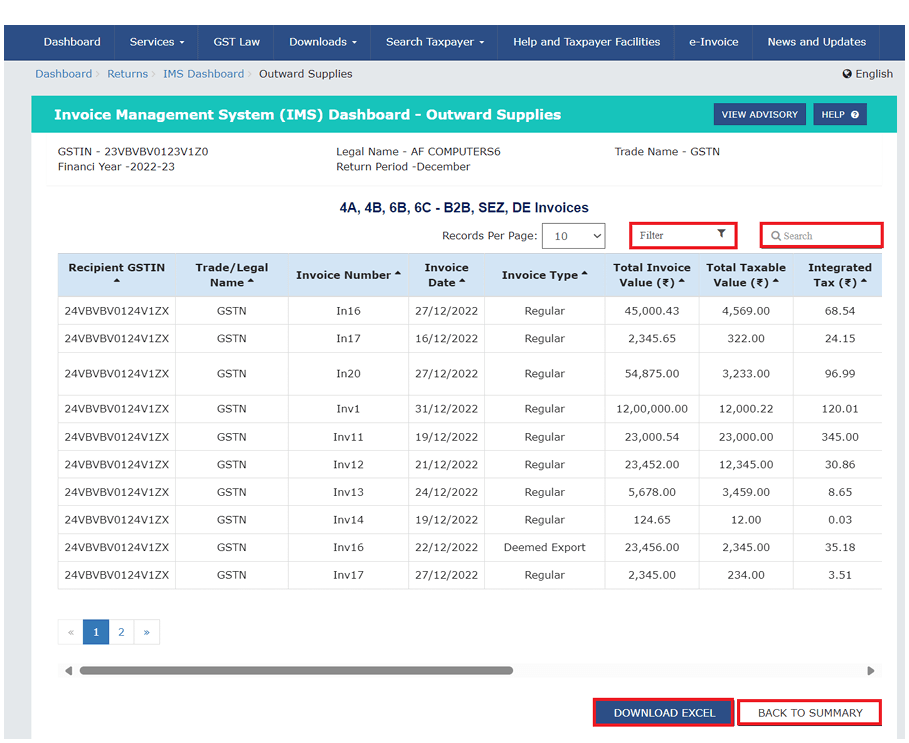

6.Outward Supplies View

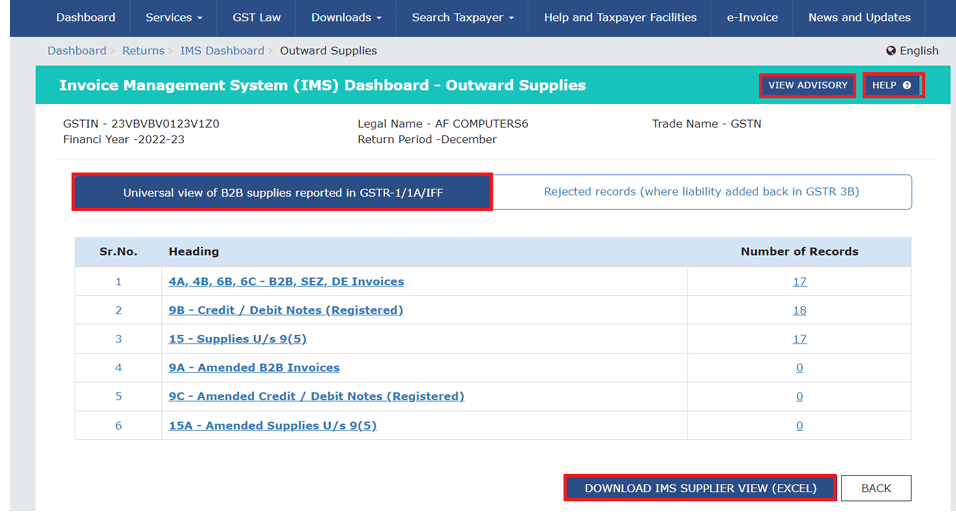

- Click 'View' under Outward Supplies to see how your recipients acted on your issued invoices.

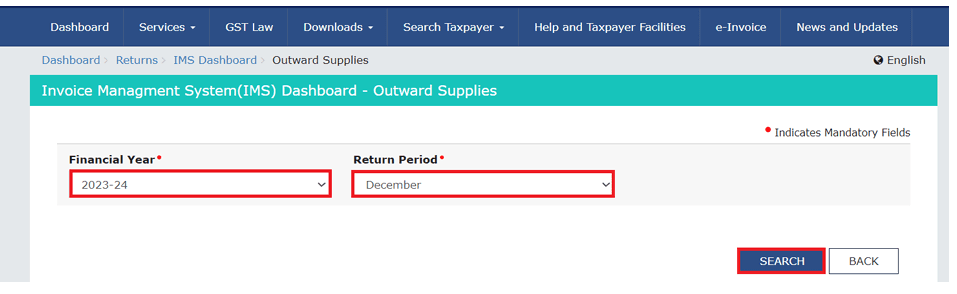

- Select Financial Year and Return Period > Search.

- View and download tables showing the status of B2B supplies reported in GSTR-1/IFF.

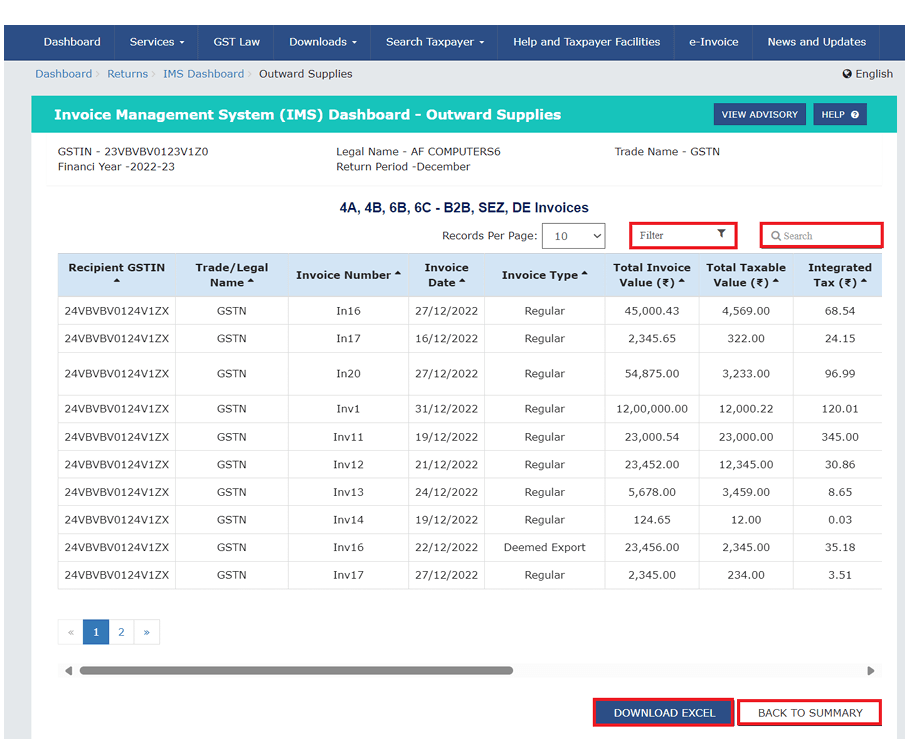

Taxpayers can filter the list by clicking on the Filter field or by entering keywords in the Search field.

Taxpayers can download the details in Excel format by clicking on the DOWNLOAD EXCEL button and can navigate to the summary page by clicking on the BACK TO SUMMARY button.

How Taxpayers Manage Invoices and Claim Input Tax Credit (ITC)

The GST portal has an Invoice Management System (IMS) to manage invoices and optimize Input Tax Credit (ITC) claims by taxpayers who can accept, reject, or keep invoices in a pending status before they appear in GSTR-2B. There is no end-of-period processing.

Thus, the invoice actioning in real time assists in giving a realistic ITC reporting, reducing mismatch between the data, and improving overall compliance by real-time reconciliation with supplier records.

Treatment of Pending Records in the Invoice Management System

Pending records will continue to be in IMS till the time of the cut-off date as per section 16(4) of the CGST Act, 2017. Once records cross the timeline prescribed in section 16(4) of the CGST Act, they will be removed from IMS.

Impact & Resolutions for Wrong Actions on IMS

1. When an accepted incorrect invoice

Resolution: Inform supplier → Supplier amend invoice in GSTR-1 → Accept correct version in IMS → Recompute GSTR-2B → Reverse ineligible ITC in GSTR-3B if already claimed.

2. When a rejected valid invoice

Resolution: Inform supplier → Supplier re-uploads same invoice in GSTR-1/IFF → Accept in IMS → Recompute GSTR-2B → Claim eligible ITC in GSTR-3B.

3. When a valid credit note is rejected

Resolution: Inform supplier → Supplier re-uploads credit notes in GSTR-1/IFF → Accept in IMS → Recompute GSTR-2B → Reflect correct reversal of ITC in GSTR-3B.

4. When the Left invoice is pending indefinitely

Resolution: Periodically review IMS dashboard → Accept/reject based on invoice validity → Recompute GSTR-2B → Adjust ITC accordingly in GSTR-3B.

Benefits of Using an Invoice Management System

Automated invoice generation and tracking: IMS helps companies automatically retrieve, interpret, and monitor invoices that are reported by suppliers and customers. It eradicates manual entry, minimises the chances of human error, and gives a real-time status of accepted, rejected, or pending invoice.

Simplified claims under the Input Tax Credit (ITC): By using IMS, it is possible to simplify the reconciliation of ITC since invoices presented by the suppliers online are matched by those you have. This will make sure that ITC is not claimed on the invalid invoices, that there are fewer mismatches in GSTR-2A/2B Vs GSTR-3B, and chances of ITC reversal are also less.

More efficiency and accuracy: IMS automates the inventory processes, which eliminates the error-prone processes of matching purchase and sales invoices with the supplier data, thereby reducing the manual work of reconciliation. It assists companies to prevent GST notices and helps to do the filing at the right time and they also get time to concentrate on other core functions as the finance staff will not be engaged in the GST notices.

Streamlined GST returns filing: IMS allows simplified and error-free GST returns filing by summarizing and validating the invoices and making them available to the app in real time. It reduces errors, inconsistent mismatching, and GSTR-1, GSTR-3B, and annual returns.

Who Should Use IMS?

Taxpayers who have many purchase invoices and who do not use the Invoice Management System (IMS) actively in order to manage the Input Tax Credit (ITC) more efficiently. IMS enables companies to inspect the invoices assisted by the suppliers and make them available before showing in GSTR-2B by either accepting, rejecting, or leaving them pending.

This aspect comes in handy, especially in preventing unwarranted ITC reversals. Earlier, unverified/disputed invoices were required to be reversed and allowed in Table 4(B) (2) of GSTR-3B temporarily. Such invoices can now just be left as Pending in IMS, not appearing in GSTR-2B and not being claimed until the point that is completely verified, making ITC reporting more exact and relations-free.

How MYGSTRefund (MGR) Helps Taxpayers Ease IMS Compliance

With the introduction of the Invoice Matching System (IMS), GST compliance has become more detailed and complex for businesses. Matching supplier invoices with the recipient’s purchase register, tracking rejected invoices, and ensuring timely reconciliations have added significant pressure on tax professionals and business owners alike.

But with MYGSTRefund’s IMS Reconciliation Tool, this burden becomes a thing of the past.

Smart Reconciliation – No Manual Hassle

MGR provides a robust, web-based reconciliation platform that seamlessly matches your IMS data with your purchase register. The tool intelligently scans your uploaded purchase records, compares them against the invoices appearing in IMS, and highlights any mismatches or rejections. No more spreadsheets or manual cross-checking , let automation handle the heavy lifting.

Auto-Action on Matched Invoices

One of the standout features of MGR is its auto-action functionality. When invoices are successfully matched between IMS and your purchase register, the system can automatically take the appropriate action, such as marking them as accepted or pushing them forward for further processing. This saves countless hours of manual intervention and helps maintain compliance effortlessly.

Say Goodbye to IMS Stress

We understand how overwhelming IMS tracking can be. That’s why our software is built to make IMS compliance feel invisible, like it was never even a challenge. By simplifying invoice-level validations, matching, and status management, MGR helps you stay compliant without breaking a sweat.

Ready to simplify your IMS compliance?

Login Now and experience automation that works for you.

For support: +91 92050-05072 or info@mygstrefund.com

Conclusion

The Invoice Management System (IMS) introduced on 1st October 2024 is a helpful tool that can assist a business in gaining more control of its purchase invoices before being reported in GSTR-2B. Though not compulsory, it offers a more effective method to trace, verify, and manage ITC more precisely.

Related Posts