How to Check ICEGATE Bill of Entry Status: Steps & Process

Importing goods into India involves multiple compliance procedures. One important document in this process is the Bill of Entry (BoE), which is submitted to Indian Customs. For easy logistics, it’s essential to track the Bill of Entry status online, and the ICEGATE (Indian Customs Electronic Gateway) portal provides this functionality. This guide walks you through everything you need to know to check your ICEGATE Bill of Entry status step-by-step, explains its importance, and introduces a smart tool to simplify the process.

What is a Bill of Entry?

When importers or their customs clearing agents bring goods into India, they need to file a Bill of Entry as a legal document. The document gets submitted to the Customs department, triggering the goods clearance process and duty tax determination, including Basic Customs Duty and IGST, and Cess.

What is ICEGATE?

Traders, alongside importers, exporters, and logistics service providers, access the Indian Customs Electronic Data Interchange Gateway, known as ICEGATE, for uploading numerous customs-related documents electronically.

Through ICEGATE, users can:

- File BOEs and Shipping Bills

- Track customs clearance status

- Pay customs duties online

- Both DGFT and GSTN data can be integrated for access.

Read More: What is the Duty Drawback Scheme for export: Eligibility and Types

The application provides users with an online interface to monitor the ICEGATE bill of entry status, which improves both transparency and reduces freight delays during movement.

What Contents Does a Bill of Entry Have?

Each Bill of Entry contains crucial data for customs processing:

- BoE Number (assigned by ICEGATE)

- Date of Entry

- Importer and Exporter Details

- IEC Code (Importer Exporter Code)

- GSTIN

- Port of Import

- Country of Origin

- HSN Code & Description of Goods

- Assessable Value

- Applicable Duties & Taxes

- Customs Assessment Remarks

These details not only assist Customs in determining compliance but also allow importers to track ICEGATE Bill of Entry status effectively by using the BOE number and date.

Pro Tip: Get your GST Refund easily through MYGSTRefund expert assistance!

Steps to Check Bill of Entry Status on ICEGATE from the GST portal

Follow these easy steps to check your BOE status:

Step 1: Go to the GST Website

Start by accessing the official GST website through your internet browser by visiting https://www.gst.gov.in.

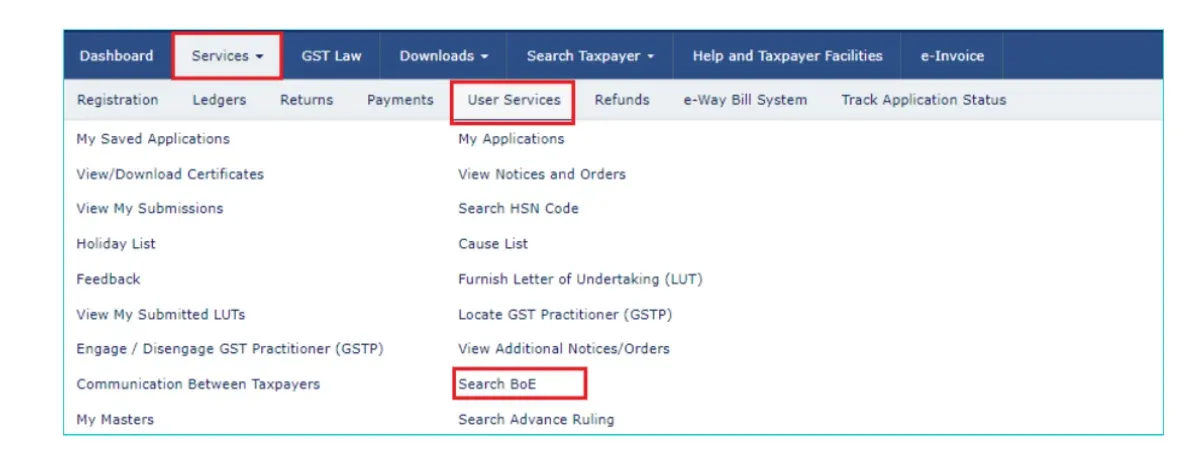

Step 2: Go to ‘User Services’

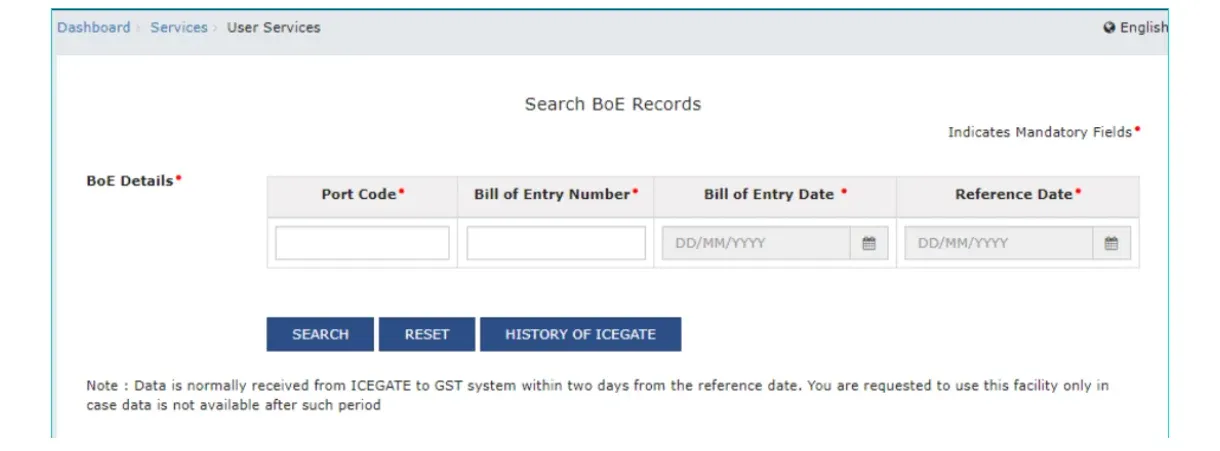

You can locate the ‘Services’ tab on the homepage, so click it to continue. Select ‘User Services’ from the available options of the drop-down menu that appears. Open the ‘Search BOE’ menu following this step.

Step 3: Enter BOE Details

The subsequent page requests you to provide several necessary details. Provide the requisite information, which includes Port Code along with BOE Number and BOE Date, along with Reference Date. Proceed to the search process by pressing the ‘Search’ button after entering all mandatory data.

Step 4: View the BOE Status

Your Bill of Entry status will display after pressing the ‘Search’ button. The Bill of Entry system displays three possible status options currently.

- Open – This is the initial status, and your items might still be under review.

- Ready – At this stage, you can print the BOE documents. Some items might still be processing.

- Assessed – This means your items have been reviewed, and you can still make some changes if needed.

- Closed – This status indicates that all goods have been received, and no more changes are allowed.

Why It’s Important

Examining the BOE status at regular intervals remains essential for achieving prompt customs clearance without any delays. The status check of the Bill of Entry constitutes an essential practice for taxes and import compliance, and thus prevents legal and procedural problems.

Importance of Checking the Bill of Entry Status

Regularly checking the ICEGATE Bill of Entry status is crucial for various reasons:

1. Avoid Demurrage and Storage Costs

The establishment of customs clearance, resulting in delivery delays at ports and ICDs (Inland Container Depots) produces significant financial expenses for importers. Tracking helps preempt such costs.

2. Real-Time Status Visibility

ICEGATE provides an online interface that allows businesses to monitor BoE status without depending on frequent updates from Customs House Agents.

3. Compliance and Audit Trail

The audit process for GST and Customs requires accurate BoE clearance data coupled with details about payments, along with delivery dates of shipments.

4. Integration with GST Filings

The status of the BoE serves as a critical requirement in automated data extraction for GSTR-2A and GSTR-2B thus, accuracy in GST record maintenance depends on its status verification.

How My GST Tool Helps in Tracking Bill of Entry Status

The process of tracking Bills of Entry through ICEGATE and depending only on customs brokers typically causes delays and makes businesses miss important information. MYGST Tool provides an intelligent solution for bill of entry management. The tool accesses BoE data in real time only after a single GSTIN linking process for authorisation with GSTN and customs systems.

Pro Tips: Plan Ahead and Easily Calculate Your GST Refund with Our Online GST Refund Calculator Tool!

Conclusion

The process of monitoring the ICEGATE Bill of Entry status has evolved from being complicated and complex to being simple and user-friendly. Through the online system combined with smart automation tools, importers can perform customs compliance checks and minimize port delays, and maintain GST readiness through an easy click interface.

Tracking Bill of Entry status through an online system remains essential for any business type, including both small businesses and large logistics firms. Importers can follow up with the ICEGATE portal for real-time updates while benefitting from the MYGST Tool for enhanced operational effectiveness and management control.

Frequently Asked Questions

1. How long does it take for the ICEGATE Bill of Entry status?

BoE status typically updates within minutes to hours after key actions like assessment or duty payment. Delays can occur due to network issues or backend delays at Customs.

2. Why is my Bill of Entry status not showing on ICEGATE?

Possible reasons include incorrect BoE number, date, or IEC entered, BoE not filed electronically, or delays in data synchronization from ports or customs stations.

3. Can I check the Bill of Entry status without registering on ICEGATE?

Yes, you can check the BoE status without registration. ICEGATE allows public access to track the status by entering details like the IEC code, BoE number, and filing date.

4. How can I check the status of my Bill of Entry on ICEGATE?

Visit ICEGATE at https://icegate.gov.in, go to “Services” → “Document Status,” select BoE, and enter the IEC code, BoE number, and filing date to track the status.

5. What details are required to check the BoE status online?

You’ll need to provide your Importer IEC code, BoE number, and BoE filing date. Ensure these details match exactly as recorded during the BoE submission for accurate tracking.

Related Posts