What Is a GST Refund, and Who Is Eligible?

GST refund is a process of claiming repayment due to overpayments of tax by a registered taxpayer, usually because of exports or an inverted duty structure, or payment of tax made to the taxing authority.

Eligible applicants for claiming a GST refund are exporters and suppliers in the SEZ (Special Economic Zone) who claimed a lower income than presumptive income or have unutilized input tax credit.

What is a GST refund?

A GST refund is the process by which a registered taxpayer claims excess tax paid to the government. It can result from:

- Unutilized Input Tax Credit (ITC)

- IGST paid on exports

- Tax paid on exempt or zero-rated supplies

- Inverted duty structure Refund

- Excess payment or erroneous payment of GST

- Accumulated balance in the electronic cash ledger

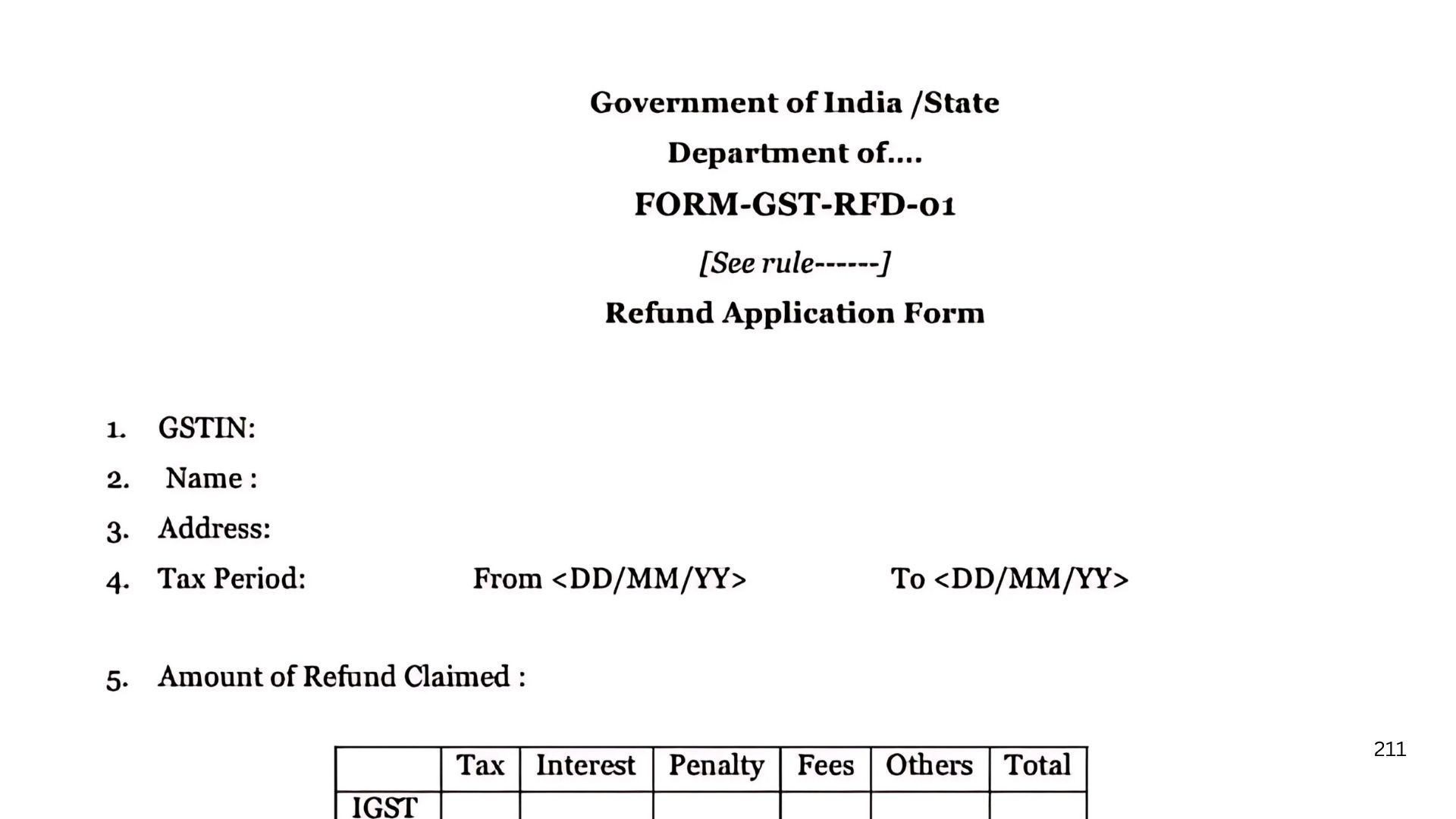

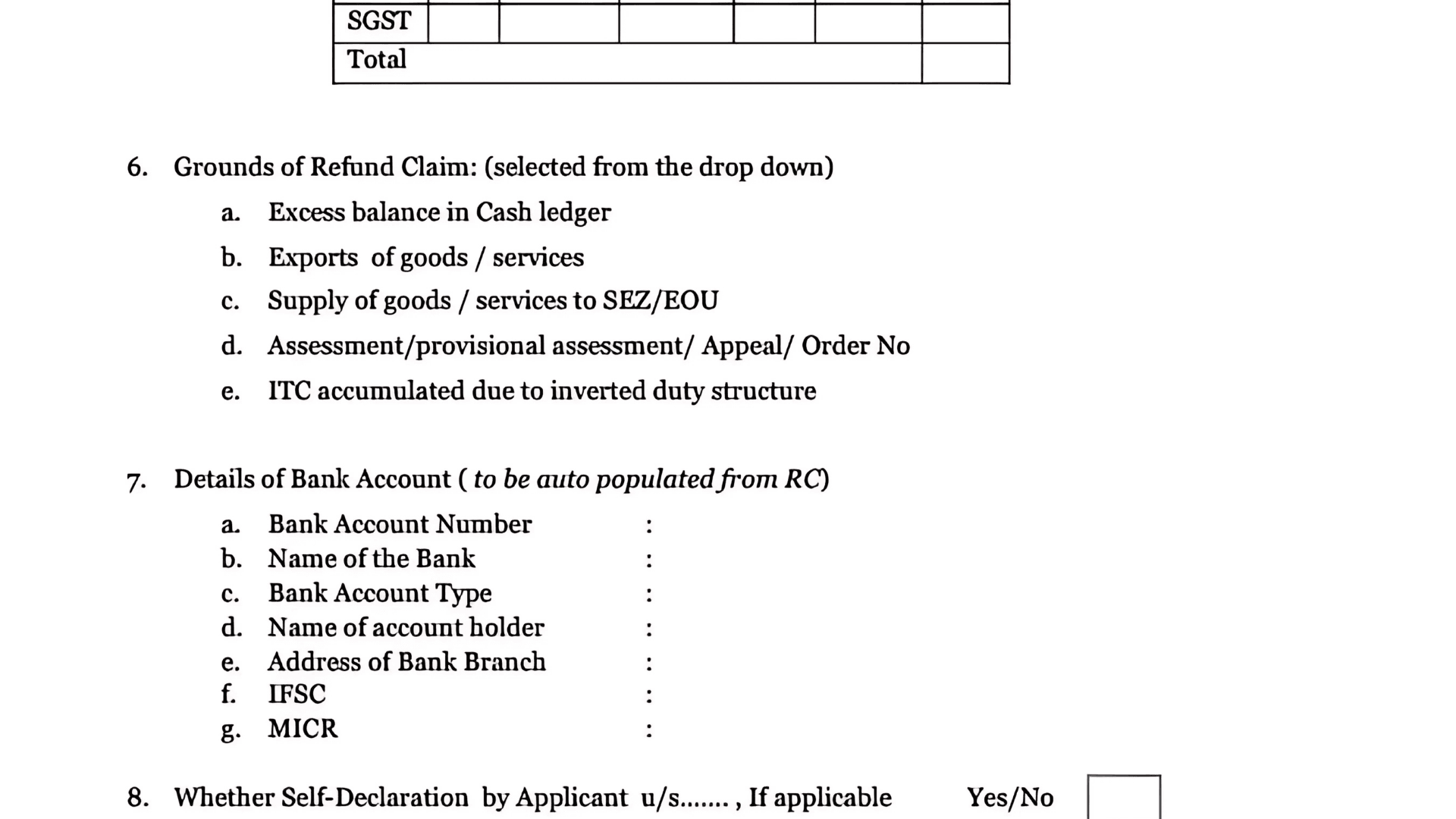

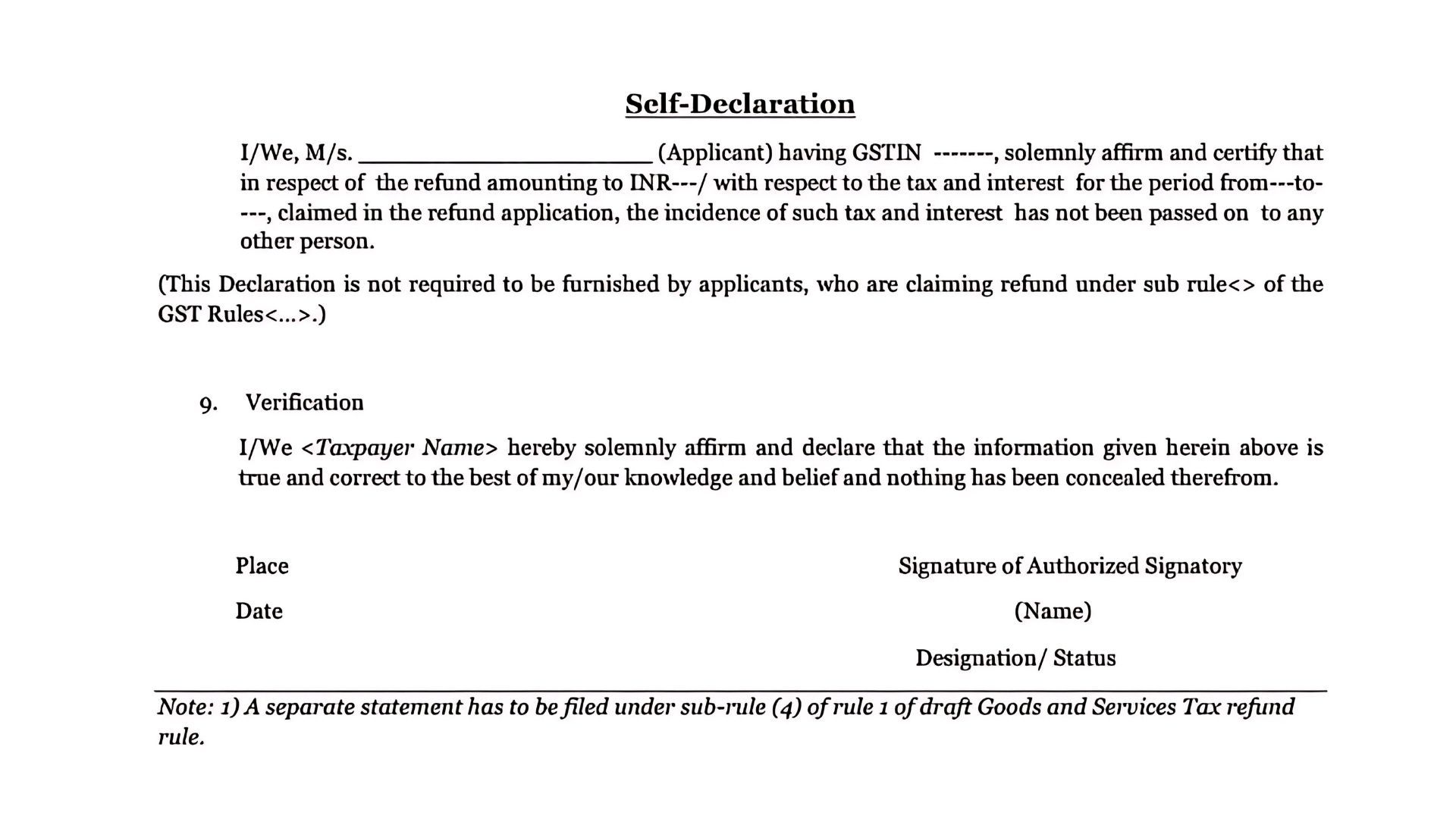

The user can claim a refund through the GST portal using the GST RFD-01 refund form to be refunded. If they are eligible, the taxpayers receive the refund amount directly in their bank account.

Who Is Eligible for the GST Refund in India?

Not every taxpayer is eligible; many of them are under the GST regulations.

A claim for refund may arise due to the following situations:

1. Exporters of goods and services

Exporters can claim a refund of IGST paid or unutilized ITC under LUT (Letter of Undertaking).It also comprises foreign providers and the suppliers of the SEZ.

2. Taxpayers Under Inverted Duty Refund

If a higher GST rate is imposed on inputs than on outputs, it results in an accumulation of ITC. The accumulated ITC difference may be taken as a refund.3. Excess Balance in Electronic Cash Ledger

Any extra amount deposited that remains unutilized after the return filing can be claimed back as a refund by the taxpayer.

4. Deemed Exporters

Deemed exporters are the suppliers of goods defined as, e.g., Export Oriented Unit and Export Promotion Capital Goods.5. Non-resident Taxable Persons

A business or individual registered temporarily and who falls under the category of non-resident taxable persons can equally claim a refund of the excess amount of tax deposited at the point of registration or payment when the liability is known to be lower.

Types of GST Refunds in India

Refunds Under GST Related to Exports & SEZ Supplies

- Refund on the export of goods

- Refund on export of services

- Refund of the accumulated input tax credit (ITC)

- Refund for supplies sent to the SEZ (Special Economic Zone) unit or the developer without tax being paid

- As of the inverted tax structure, the refund of the input tax refund is credited

What is the time limit to claim a GST refund in India?

In 2 years, the application that has been made to obtain a refund should be made in Form RFD-01

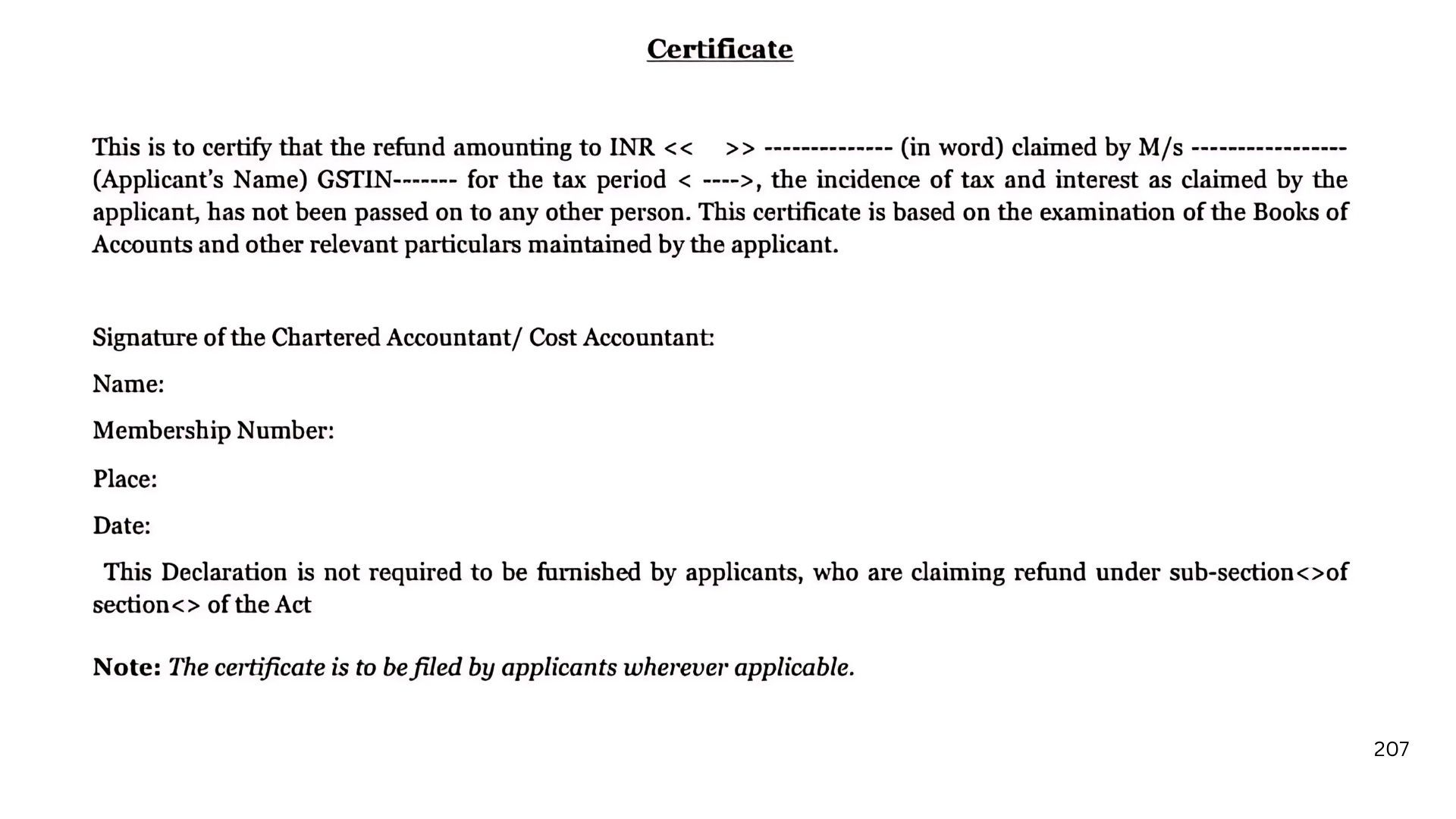

In case the refund claimed exceeds the stipulated remittance, the same should be certified by a chartered accountant.

Common Relevant Dates:

- For export of goods: Date of shipping bill or export invoice

- For export of services: Date of receipt of the amount received in foreign currency

- For excess tax paid: Date of tax payment

- For inverted duty structure: End of the relevant tax period

GST Refund Process:

The following are the steps:

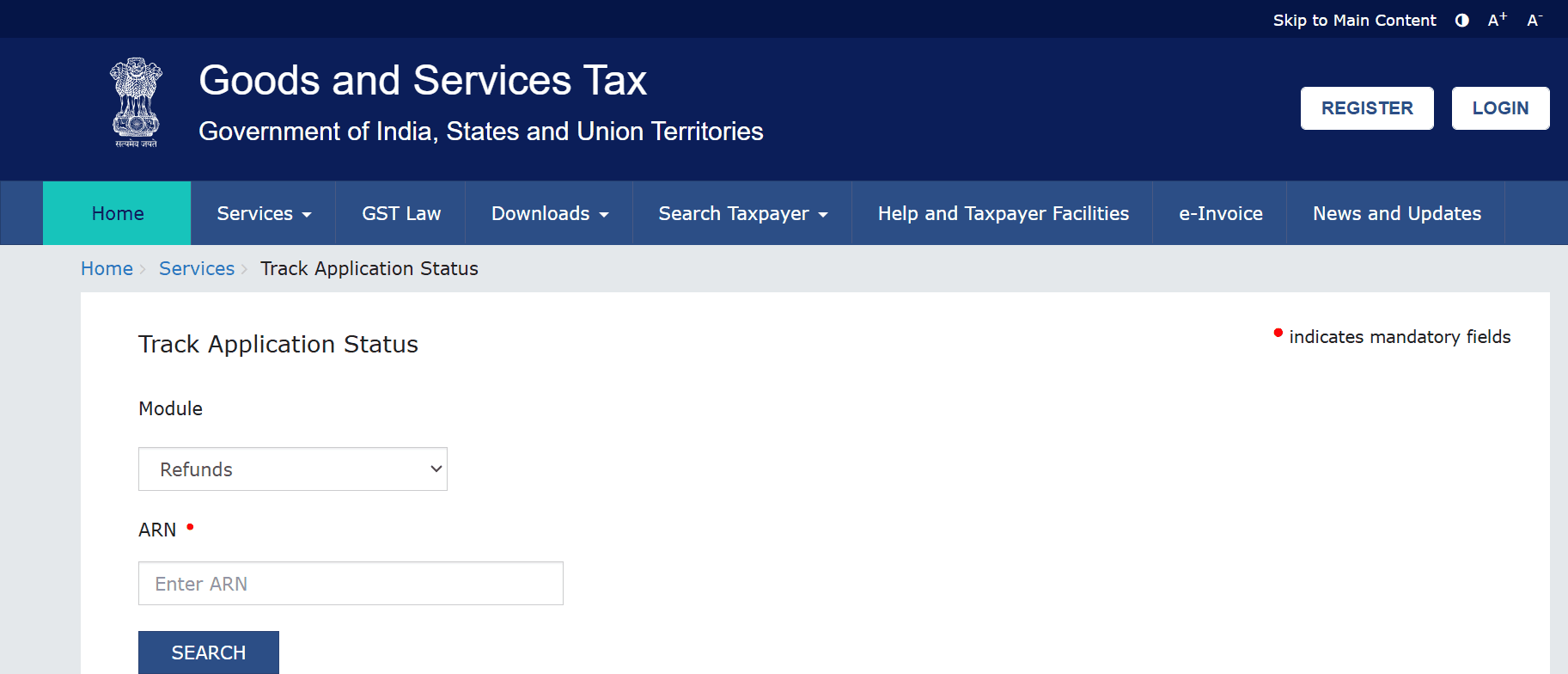

- Log in to the GST Portal

Visit www.gst.gov.in and log in with your credentials.

2. Click on: Services, followed by Refunds, and concluding with Application for Refund (Form RFD-01).

3. Select Refund Type

3. Select Refund Type

- Choose the appropriate category: e.g., refund on exports, inverted duty, etc.

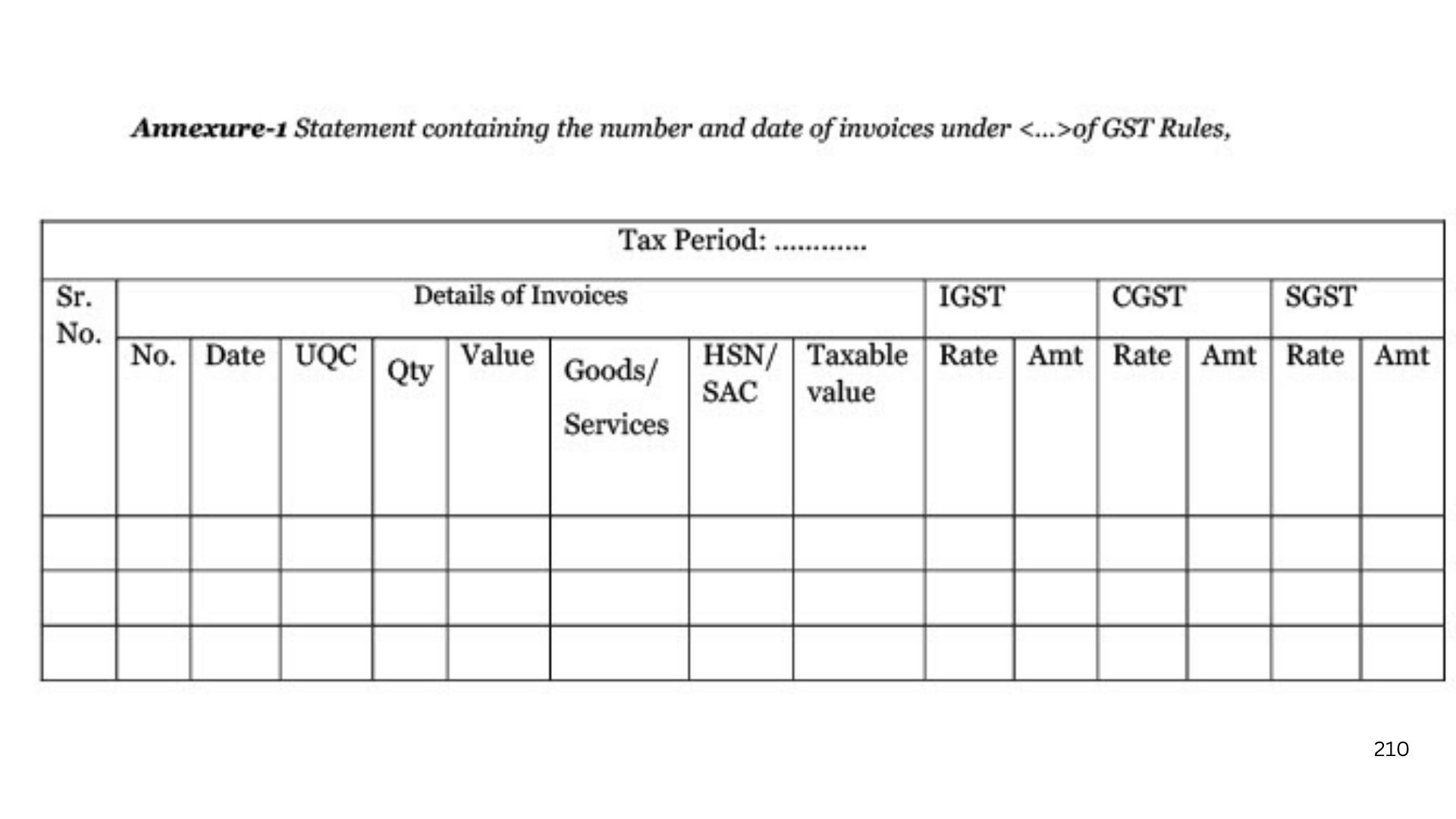

4. Upload Required Documents

- Depending on the refund type, you need to provide invoices, shipping bills, LUT, BRC/FIRC, reconciliation sheets, and other required supporting documents.

5. Submit Application

- File the form using DSC or EVC. ARN (Acknowledgement Reference Number) will be generated.

6. Refund Processing

The refund is reviewed by the jurisdictional officer.

7. Refund Order Issuance

Upon verification, Form RFD-06 (Sanction Order) is issued, and a refund is credited to the taxpayer’s bank account.

The key takeaways

Whether you are an exporter, a supplier to SEZ units, or subject to an inverted duty structure, the first step in getting back excess tax or unused credits is identifying your true eligibility.

The user From timely filing of Form RFD-01 to tracking status via ARN (Application Reference Number), completing all necessary documentation, and acting within the two-year refund window, every step matters. If you want to calculate your unclaimed GST refund, use our refund calculator with the automated GST refund platform in Gurgaon.

What is the New GST Advisory on Changes in the GST Refund Filing Process?

As per the latest GST advisory (2025), taxpayers must file Form GST RFD-01 within two years from the relevant date to claim a refund. Additionally:

- The application has to be certified by a chartered accountant when the amount of refund due to the individual is more than a specified figure.

- The export and SEZ supplies do require a justification by means of reconciled invoices and shipping bills as grounds for refunds.

- GST returns will now be coupled with Acknowledgement Reference Numbers, whereby one will track the status in real time.

The changes are made in a bid to enhance the speed of processing, minimize mistakes, and eliminate any fraudulent claims

How MyGSTRefund helps exporters to claim refunds

The exporters often experience delays in GST refunds due to portal errors, documentation inaccuracies, or a lack of professional advice.

MyGSTRefund is an automated GST refund platform designed to help Indian businesses claim refunds easily and transparently

- End-to-end GST solutions: An all-in-one solution to all your GST needs, and all being done in one place.

- Fastest Turnaround Time: Claim your refund with zero hassle, minimal steps, and no delays.

GST Refund Helpline (MyGSTRefund): +91 92891 92891

Check: www.mygstrefund.com

Frequently Asked Questions

1. What is a refund in GST?

A GST refund can happen when registered taxpayers claim an excess amount if they paid more tax than they owe. They can file a refund with basic information through the GST portal.

2. How to Get a GST Refund?

To receive a GST refund, a taxpayer must:

Log in to the GST portal

- Navigate to Services > Refunds > Application for Refund (RFD-01)

- Choose the appropriate type of refund (exports, inverted duty, excess tax etc.).

- Upload required documents (Invoices, BRC, LUT, Declarations

- Apply online

Track the refund using the ARN provided after submission

Refunds are generally processed within 60 days, and 90% provisional refunds are issued within 7 days for zero-rated supplies (exports).

3. What are the refund options for GST available to exporters?

Refund of IGST: This applies when exports are made and IGST has been paid (as per Rule 96). Refund of accumulated input tax credit (ITC): This is applicable for exports where IGST is not paid, but the export is covered under a bond or LUT (as per Rule 96A).

4. Who Can Claim a GST Refund?

You are eligible for a GST refund if you have paid excess tax, exported goods or services, made zero-rated supplies, claimed a lower income than presumptive income, or have unutilised input tax credit (ITC)

Related Posts