GST Appellate Tribunal Appeals Time-Limits

Published on: Thu Sep 18 2025

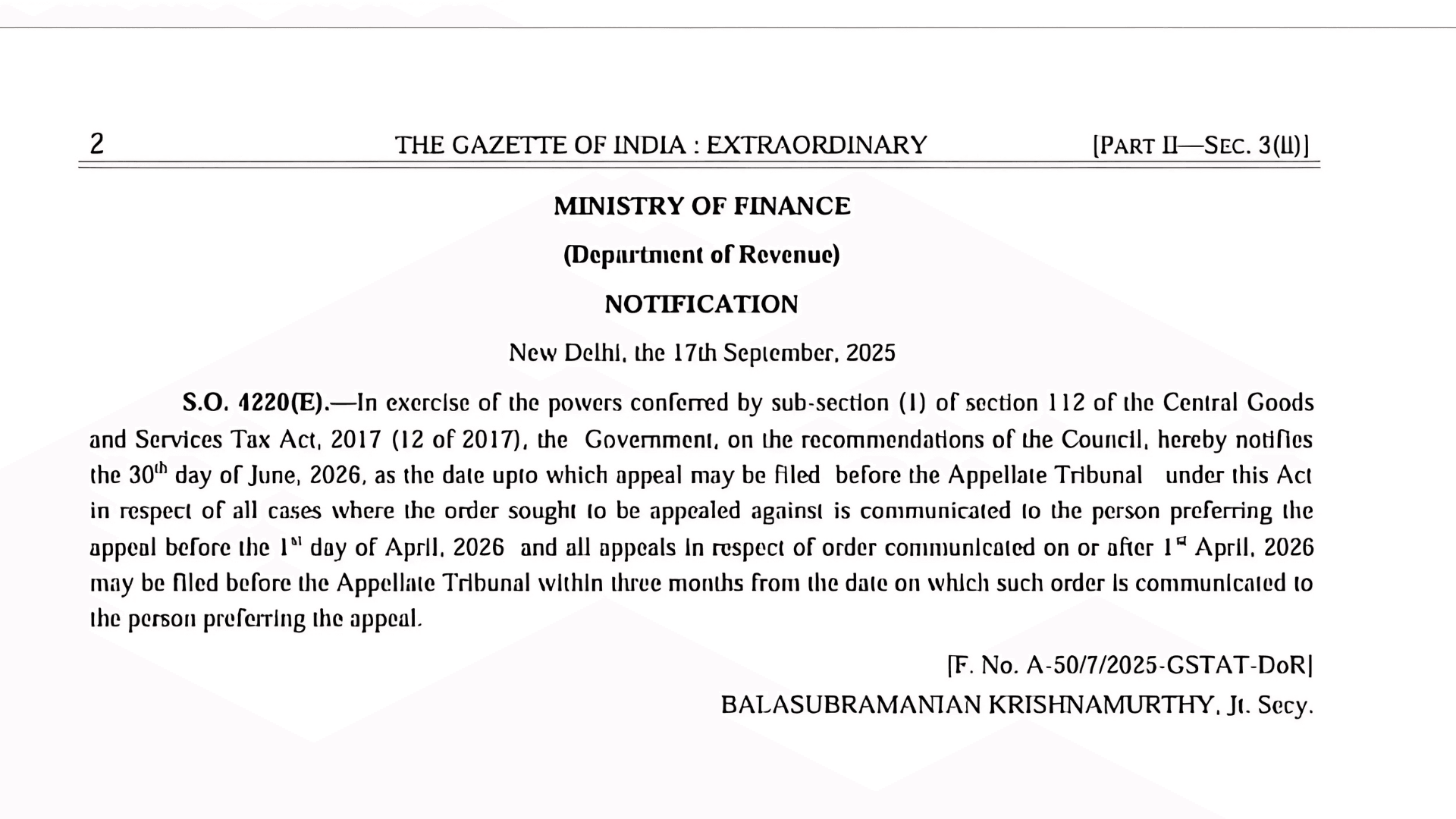

New Delhi, 17th September, 2025 | Ministry / Department: Ministry of Finance.The Ministry of Finance has extended the deadline for filing appeals with the GST Appellate Tribunal (GSTAT)

Notification Number: S.O. 4220(E)

GST Appellate Tribunal Appeals Time-Limits

This notification is issued under the powers granted by sub-section (1) of section 112 of the Central Goods and Services Tax Act, 2017 (12 of 2017).

Official Notification and Legal Basis

Appeals before the GST Appellate Tribunal must normally be filed within three months of the date a ruling is notified, according to Section 112(1) of the Central Goods and Services Tax Act, 2017.

The Government, acting on the GST Council's recommendations, has extended the filing deadline to help taxpayers with outstanding orders and in light of the Tribunal's formation delays. In particular, appeals on orders issued before April 1, 2026, may now be submitted until June 30, 2026. Orders communicated on or after April 1, 2026, are subject to the usual three-month term.

Purpose

The primary purpose of Notification S.O. 4220(E) is to establish a fixed deadline for filing appeals before the GST Appellate Tribunal under the Central Goods and Services Tax (CGST) Act in respect of orders already communicated. This “cut-off date” ensures clarity for taxpayers about how long disputes from past orders can be challenged under the new Tribunal structure.

Further, the notification distinguishes between orders based on when they were communicated:

For orders communicated before 1 April 2026, taxpayers are given a temporary extended window to appeal, up to 30 June 2026.

▸For orders communicated on or after 1 April 2026, the usual time limit (three months from communication) resumes.

Key Provisions: Appeal Filing Deadlines

- Orders entered before April 1, 2026. ▸Taxpayers have to appeal orders given before 1 April 2026 to the GST

- Appellate Tribunal on or before June 30, 2026. ▸For orders placed on or after 1 April 2026

In certain cases, appeals have to be brought within the normal three-month period from the date the order was served.

Implementation

The notification includes a transitional window so that past orders (those issued before 1 April 2026) can still be appealed even though the new GST Appellate Tribunal has just become operational. From 1 April 2026 onwards, however, the usual rule applies.

- appeals must be filed within three months of the order communication.

The notification is formally identified as File No. A-50/7/2025-GSTAT-DoR, signed by Joint Secretary Balasubramanian Krishnamurthy.

It places importance on ensuring that all appeals under the CGST Act are filed before the newly constituted GST Appellate Tribunal, aligning the process with its operational status.

Key Provisions and Dates

Extended Deadline for Past Cases: The new deadline for filing an appeal is June 30, 2026.

Applicability: This extension applies to all cases where the order being appealed was communicated before April 1, 2026.

Deadline for Future Cases: Appeals for orders communicated on or after April 1, 2026, must be filed within three months of the order's communication date.

Related Posts