Who Can Claim a Refund in GST?

Goods and Services Tax (GST) is a single tax that replaced many different taxes in India. It applies to almost everything sold or provided as a service. Sometimes, businesses or individuals may pay more GST than they owe due to errors, cancellations, or eligibility for certain exemptions. In such cases, the government has made a system where you can get your money back.

In this article, we will explain who can claim a refund in GST, when and how you can claim it, and what you need to Know for. We will also cover common questions people usually ask about GST refunds.

What is the GST Refund?

A GST refund occurs when governmental entities return your surplus tax payments. The government may be returning your excess tax payments due to system errors or mistakes, or special export cases. Understanding the correct process of getting refunds without delay becomes essential for managing the cash flow impacts of taxes.

The system follows established rules that determine how you can request a refund. Following the right steps leads to refund processing within the stated time frames in the GST law.

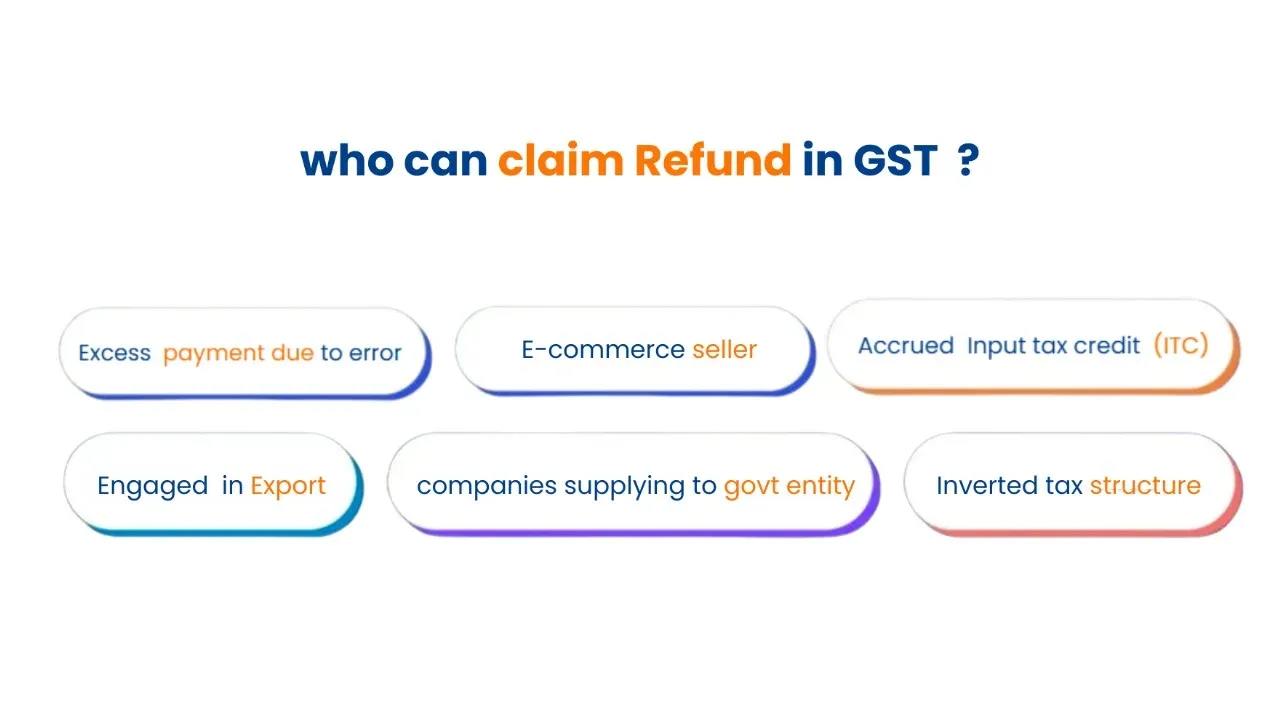

Common Scenarios for GST Refund Claims

Here are some common cases when people and businesses file for a how to claim gst refund -

GST Refund Claim on Exports

If you export goods or services, you can claim a GST refund in two ways:

Export under a Bond or Letter of Undertaking (LUT): In this case, you do not pay GST at all on exports, but you can claim a refund of the tax paid on purchases (input tax credit).

Export on Payment of IGST: You pay Integrated GST (IGST) on exports first and then claim a refund for the same amount later.

Note: Many businesses prefer using a LUT to avoid locking up their money in tax payments. Check out our comprehensive guide on how to claim an export GST refund.

Inverted Duty Structure

Sometimes businesses pay higher GST on raw materials than they collect on their final product. For example, if the GST on cloth is lower than the GST on yarn. In such cases, the business can claim an Inverted Duty Structure Refund under GST.

Excess GST Payment

Mistakes happen. If you accidentally paid tax twice or entered the wrong figures while filing returns, you can file for a refund.

Deemed Exports

Supplies made to Export Oriented Units (EOUs) and some other categories are treated as exports under the law. You can claim refunds in these cases.

Advances Refund

If you paid GST on an advance received for goods or services, but the order was later canceled, you can file a refund claim.

Refund from Court Orders

If you win a case in court, and the judgment says you are eligible for a refund, you can apply under that order.

In government supply:

The supplier claims TDS as cash ledger credit and also gets ITC on purchases used for making the supply.

E-commerce:

The seller claims TCS as credit and avails ITC on inputs used in business activities.

Conditions for Claiming GST Refunds

There are a few important rules you must follow when claiming a GST refund:

- You must file the refund claim within two years of the relevant date.

- The refund amount will not be granted if you have already passed the tax burden to someone else (to prevent unjust gains).

- You must submit the required documents, like invoices, shipping bills, and payment proofs.

- The GST returns (GSTR-1, GSTR-3B) must be filed properly before claiming the refund.

Pro Tip: If your documents are in order, your refund will be quicker and smoother. Need help? Get your GST refunds easily through MYGSTRefund's expert assistance!

How to File a GST Refund Claim

This article will help you claim a GST refund. Start your claim now.

Here’s a simple breakdown of the steps:

1. Log in to the GST Portal: Use your login ID and password.

2. Choose the Refund Option: Go to the refund application (Form RFD-01).

3. Fill the Form: Enter the details of the refund, like the amount and the reason, and attach documents.

4. Submit the Application: Once submitted, you will get an ARN (application reference number) to track your claim.

5. Processing by the Tax Office: The tax office may ask for extra documents or clarification.

6. Refund Approval: Once everything is verified, the refund is approved and transferred to your bank account.

Key Takeaways

Getting your GST refund is not as difficult as it seems if you know the rules and follow the process carefully. Now you know who can claim a refund in GST, when to apply, and how to do it properly. Whether you are exporting goods, overpaying by mistake, or dealing with an inverted duty structure, you have a legal right to get your money back.

If you are unsure or short on time, you can always get expert help to make sure your refund is claimed correctly.

Act today! Get your GST refund easily with MYGSTRefund's expert team at your side.

Frequently Asked Questions

Can individuals claim a GST refund?

Yes, individuals can claim GST refunds, especially if they are foreign tourists reclaiming GST paid on goods purchased in India or if they have mistakenly overpaid GST.

Who can claim a refund of GST in India?

Exporters, businesses with excess ITC, taxpayers who made excess payments, embassies, UN bodies, tourists, and those affected by final assessments or court orders can claim refunds in India.

How to claim a GST refund on purchases?

You can claim a refund by filing Form RFD-01 on the GST portal, providing all relevant purchase invoices, and submitting the required documentation.

Documents required for GST refund in case of export

Export Invoices

Shipping Bills

Bank Realization Certificate (BRC) or Foreign Inward Remittance Certificate (FIRC)

LUT or Bond (if applicable)

Copies of filed GSTR-1 and GSTR-3B returns

Statement of export invoices

Related Posts