NIC e-Invoice Portals to Sync AATO with GST System from 1 September 2025

Published on: Mon Aug 18 2025

GST Advisory: AATO Figures on NIC e-Invoice Portals Aligned with GST Records from Sept 2025

NIC to Align AATO Display with GST System from 1 September 2025

With effect from September 1, 2025, the NIC e-Invoice portals (einvoice1.gst.gov.in & einvoice2.gst.gov.in) will now show Aggregate Annual Turnover (AATO) based on data calculated in the GST system. Any subsequent inconsistencies should be notified via the GST Helpdesk or the GST Grievance Redressal Portal.

Key Change

The GST system's turnover data will now be reflected in the Aggregate Annual Turnover (AATO) on NIC's e-Invoice portals

einvoice1.gst.gov.in

einvoice2.gst.gov.in

Aggregate Annual Turnover (AATO), which is calculated at the PAN level from GSTR-3B return filings, is the total annual business turnover of a taxpayer and establishes the applicability of e-invoicing on NIC's e-Invoice portals.

The National Informatics Centre (NIC) oversees the government-run e-Invoice portals (einvoice1.gst.gov.in and einvoice2.gst.gov.in), which allow companies to electronically record business-to-business invoices. These portals reduce human entry and improve compliance by assigning a unique Invoice Reference Number (IRN), digitally signing the invoice, creating a QR code, and instantly sharing validated data with the GST and e-way bill systems.

Effective Date

- On September 1, 2025, the revised AATO display will go into effect.

- The data calculated in the GST system will be included in the Aggregate Annual Turnover (AATO) shown on NIC's e-Invoice portals as of September 1, 2025.

- After this date, any inconsistencies can be notified through the GST Helpdesk or the GST Grievance Redressal Portal.

Users' Next Steps

After the switchover, if you see any differences in the AATO that is shown, you can:

- Use the GST Grievance Redressal Portal to submit a ticket, or

Get in touch with the GST Helpdesk.

How to Respond to AATO Inconsistencies

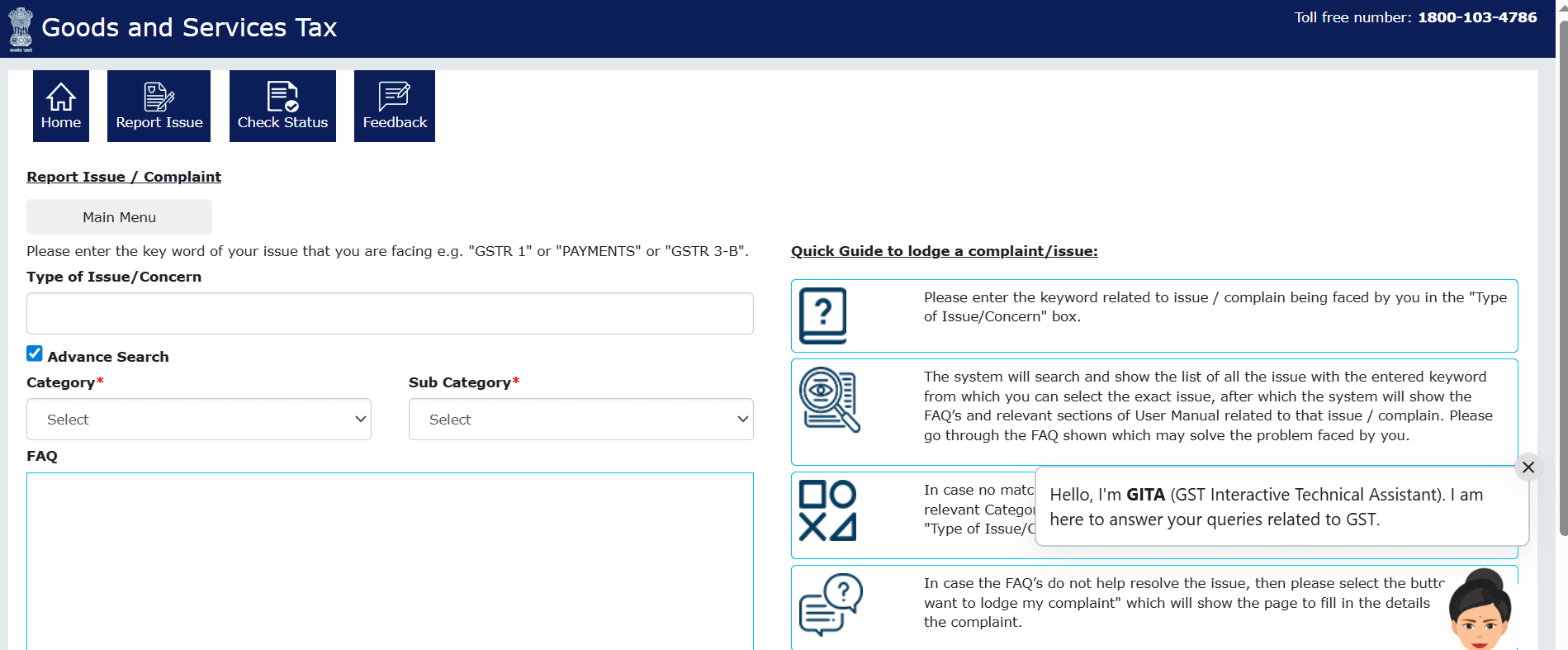

- Using the GST Grievance Redressal Portal to file a complaint

Open the Portal:

- Go to selfservice.gstsystem.in, the GST self-service grievance portal.

Report the Problem:

- Put a relevant keyword in the "Type of Issue/Concern" field, such as "AATO."

- Look over the options; if none address your issue, select "No, I want to file my complaint."

Go to -https://selfservice.gstsystem.in/ReportIssue.aspx

- Provide Information:

- Describe the discrepancy in detail.

If you have documentation or screenshots that show the issue, attach them.

- Purchase a Ticket:

You will receive a reference number (ticket ID) to monitor the status of your submission. GSTSystem.in/selfservice.

2. The Portal was created so that taxpayers and other interested parties may file complaints. Rather than emailing the Helpdesk, they can file a complaint here about any difficulties they encountered using the GST portal. It is set up so that users can upload screenshots of the pages where they encountered problems and explain the issues they encountered.

Other Ways to Get in Touch:

Reaching out to the GST Helpdesk Toll-free Support: To speak with GST support representatives, dial 1800-103-4786.

Resources - einvoice1.gst.gov.in and selfservice.gstsystem.in

Related Posts