How Exporters Can Avoid GST on Purchases from Indian Suppliers Before Export

Published on: Tue Sep 30 2025

How exporters avoid GST during Purchase from Indian Suppliers before Export

Exporters legally reduce the initial payment of GST on their inputs by making use of the Zero-Rated Supply provisions under the law of GST.

The two main techniques :

Export under Letter of Undertaking (LUT): The exporter posts an LUT (or Bond) with the GST authorities so that they can make the ultimate export without depositing Integrated GST (IGST). This way, their working capital is not frozen by the amount of tax. The GST previously paid on inputs (Input Tax Credit or ITC) is subsequently recovered as a refund.

Concessional Purchase Rate: Exporting merchants can ask their Indian suppliers to levy a substantially lower GST rate of 0.1% on goods acquired for the explicit purpose of export. This offsets the tax on the original purchase itself directly.

Indian exporters are presented with the perfect option to evade the payment of GST when they buy from local vendors. This is because, as per the current GST framework, the zero-rated supply provisions are available. They can decide to go either by way of a Letter of Undertaking (LUT) or a bond, which are documented exports, or by an export with an IGST refund.

Why Avoiding GST Matters for Exporters

Exporters can face big problems with their working capital when a GST amount is paid upfront on procurement before exports. By organizing the transactions through the use of India's zero-rated supply provisions, the exporters would be able to recover the taxes on inputs, or to totally void the upfront tax, thus, they will raise their liquidity and competitiveness.

Improved cash flow: GST 2.0 reforms make refunds more accessible and timelines shorter, thus reducing the waiting period for the return of working capital.

Reduced compliance burden: The LUT route helps in reducing the number of papers compared to IGST refund claims, thereby making the operational efficiency better.

Understanding Zero-Rated Supply under GST

Section 16 of the IGST Act, 2017, defines exports as zero-rated supplies. This section prescribes Zero-Rated Supply as supply to Special Economic Zones (SEZs) and exports.

The basic logic is to exempt Indian exports from the levy of domestic taxes ("tax-free exports"). This is done through two alternatives extended to the supplier:

- Supply without charging IGST (under a Letter of Undertaking or Bond) and obtaining a refund of the vested Input Tax Credit (ITC).

- Supply by paying IGST in advance and claiming a refund of such paid IGST.

Importantly, ITC can be claimed even if the last supply is zero-rated.

In layman's terms, exporters can do either of two legal things:

Option 1: Export under LUT/Bond (No IGST Payment)

The company should submit annually a Letter of Undertaking declaring compliance with GST export regulations. The company can buy products from Indian suppliers and pay no IGST.

Working capital can be retained, and fewer refund documents will be required.

The company can file a claim for Input Tax Credit (ITC) on the purchases that are made to support exports of goods/services, which are actually zero-rated.

Option 2: Pay IGST and Claim a Refund

- On export pay IGST (at the moment, the rate is mostly 5% or 18% under GST 2.0 changes).

- Perform the customs shipping bill and file the necessary GST returns (GSTR-1, GSTR-3B).

Usually, refunds are given out very fast; 90% provisional refunds can be issued shortly after the export acknowledgment.

Procedures to Prevent/Withdraw GST on Pre-Export Purchases

First things first, get yourself registered with GST as an exporter.

- One way is to provide an LUT/Bond for every financial year for the sole purpose of not paying IGST. The other way is to pay IGST and come up with a refund.

- Make sure that all the export documents (invoice, shipping bill, bill of lading/airway bill, customs declarations) you have are correct and have been submitted on time.

- For the ITC refund claim, do it through the GST portal within 2 years, and the provisional refund status can be checked (usually it is released within 7-15 days).

What Businesses Must Do After GST 2.0 Rollout

The latest update in September 2025 GST rationalizes the Tax system, which overcomes the basic price, and streamlines the compliance of the exporters.

The rate cuts on manufacturing inputs and essential items are directly decreasing the exporter's expenses.

The government's efforts to introduce the refund process are turning working capital into a source of India's export competitiveness worldwide.

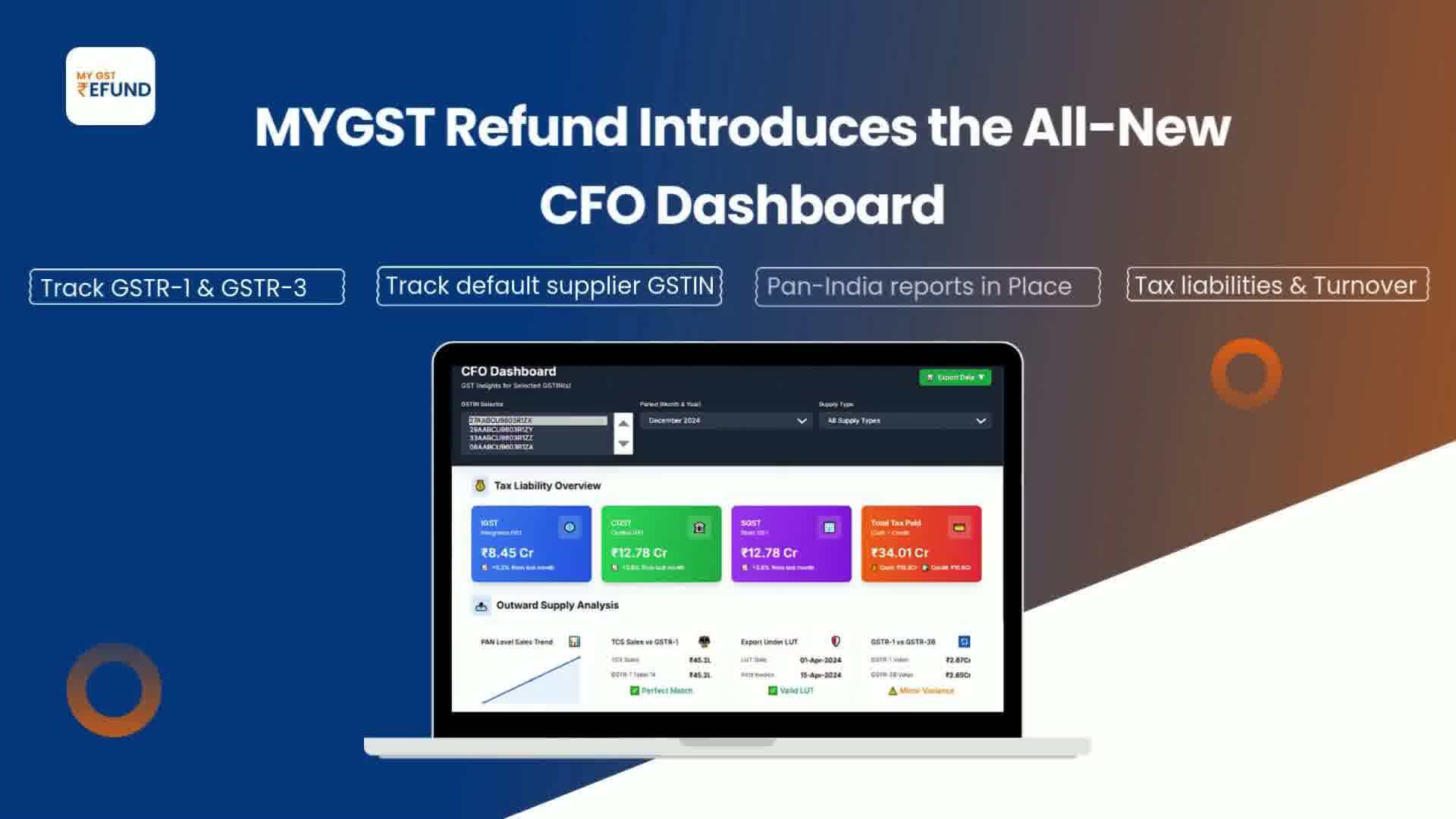

How MyGSTRefund CFO Dashboard Prevents GST on Export Purchases

The fundamental concept of exporting under GST is zero-rating, where the final exported products or services are exempt from tax, and taxes incurred on inputs (Input Tax Credit or ITC) are returned. The most optimal method for an exporter to prevent GST on initial purchases is to supply without the payment of IGST by providing a Letter of Undertaking (LUT).

The MyGSTRefund CFO Dashboard supports the process of GST evasion with two major functions:

- Enabling the LUT Route Compliance:

The dashboard offers a centralized view to confirm that all the procurements are compliant with the LUT route. Through monitoring the compliance status, it enables the exporter to make purchases eligible for tax exemption or for ITC refund at once, directly adding to evading upfront payment of tax and guarding liquidity. - Mitigation of ITC Mismatch and Reversal Risk:

One of the principal reasons for cash being held back is the reversal of ITC caused by non-compliance from suppliers. The dashboard serves as an effective compliance watchdog by furnishing: - Real-time Tracking of Suppliers: It monitors vendor returns (GSTR-1, GSTR-3B) against exporter records (GSTR-2A/2B).

- Risky Taxpayer Identification: It identifies the non-compliant or "risky" suppliers who are identified as such by the tax agency, enabling the CFO to change vendors or hold back payments until compliance is achieved.

How Indian Economy support exporters

India’s post-2025 GST changes aim at supplying new energy to export-oriented industries and, consequently, to the economy by:

- Directly lowering the cost of exporters, which not only lowers the export prices but also increases the global competitiveness of Indian products.

- Minimizing compliance bottlenecks in this way saves time and money for the SMEs and startups in the exporting sector.

- Improving the predictability and the transparency of the tax outcomes, thus supporting business planning and increasing India’s share in global trade.

Tips for Optimal GST Strategy as an Exporter

- If it is permissible, try using the LUT method so that you do not block your cash flow.

- Always maintain all the legal papers and receipts up to date, and make sure the GST return filing is updated.

- This smoothens the ITC return process.

- Maintain coordination with the GST council for updates for any with the GST Council for updates on any rates, refund rules, or compliance deadlines.

- The latest changes are supposed to be implemented by September.

Take the expert advice while exporting from SEZS, EOUs, and under merchant export directions, maybe it has different procedures and advantages too.

How Exporters Can Achieve Zero-Rated Supply Under GST

Exporters in India can either avoid the payment of GST on inputs followed by export by depositing a bond/obtaining LUT or swiftly recover the GST paid by utilizing the enhanced IGST refund routes. The utilization of working capital in the affairs of the company is hence made possible, and the export process is accelerated.

By leveraging the Letter of Undertaking (LUT) under the zero-rated supply provisions, exporters are legally entitled to receive goods from Indian suppliers without paying IGST, thus eliminating the blockage of working capital and minimizing the paperwork related to tax refunds.

The Key Takeaways

In short, businesses have gained from recent GST 2.0 reforms, such as quicker refunds, the use of provisional credit, and the availability of simplified compliance. The exporters of India can utilize the liquidity to offer competitive prices, which will elevate their stature in the global markets. The letter of undertaking (LUT) route is, therefore, the most financially and operationally advantageous way by far for the majority of the authorized exporting agents in India, providing them with a hassle-free process, coverage throughout the year, and reduced administrative costs

Frequently Asked Questions

Q1. What is "Zero-Rated Supply" under GST for Indian Exporters?

Zero-Rated Supply refers to the fact that while exporting goods or services from India, the GST rate charged is zero. This is not an exemption, but a legal requirement that all input taxes (GST paid on local procurements or services availed for export) are completely offset. This is done either by not paying IGST in advance (through LUT/Bond) or by claiming a full refund of the IGST paid.

Q2. How is Export under LUT different from claiming an IGST Refund?

They are the two lawful methods of dealing with Zero-Rated Supply:

LUT/Bond: You export without remitting IGST on the final exported product. You get to keep your working capital right away. You then claim a refund of the Input Tax Credit (ITC) paid on raw materials/services. This is usually the most cash-flow conducive method.

IGST Refund: You are charged IGST on the final export item. Your Shipping Bill serves as your application for a refund, and the refund is normally credited promptly (often 90% provisional refund) against the IGST charged on the export.

Q3. Which is a better route for a new exporter: LUT or IGST Refund?

The Letter of Undertaking (LUT) mode is usually preferred for optimal cash flow and the least amount of compliance. By not availing of IGST in advance, you retain funds and the related administrative work of seeking a refund of IGST of the final product. You need to claim ITC only on your inputs.

Q4. How long is the LUT/Bond valid?

The Letter of Undertaking (LUT) will normally be valid for a financial year. It should be filed and sanctioned electronically on the GST portal before the commencement of the financial year (or before the first export in the year) to maintain continuity of the zero-rated status.

Q5. Can I claim the Input Tax Credit (ITC) if I export under a Letter of Undertaking (LUT)?

Yes, certainly. This is an important advantage. Under LUT export, you pay no IGST on the final product but are still able to claim the refund of the ITC you incurred on all the goods and services that have been used to manufacture or supply the exported product.

Q6. What are the documents necessary for an immediate IGST refund?

The two most important documents are:

- Shipping Bill: Filed electronically with Customs, with proper IGST information.

- GSTR-1 and GSTR-3B: Your GST returns need to be filed accurately, so that the data in the GSTR-1 (Table 6A) is consistent with the information on the Shipping Bill. Early and accurate filing of these returns is very important for a quick, automated refund.

Q7. Need the supplier to do anything differently when selling to an exporter under LUT?

Yes. The Indian supplier, when they receive a copy of the exporter's valid LUT, will have to issue a "Supply for Export Under LUT" invoice, which charges zero (0%) IGST. They will have to report this transaction properly in their GSTR-1.

Related Posts