How a CFO Dashboard Simplifies ASMT-10 Compliance

Published on: Sat Sep 27 2025

What is Form GST ASMT-10?

Form GST ASMT-10 is a scrutiny notice issued by a GST officer if they find any discrepancies in your GST returns (like GSTR-1 vs. GSTR-3B). It is not a demand for tax but a request for clarification.

Why is this notice issued?

It is a formal notice given by the Proper Officer (Tax Officer) to a registered taxpayer in case discrimination or discrepancies are observed at the time of scrutiny of their:

- Filed GST returns such as GSTR-3B, GSTR-1, etc.

- Incorrect Input Tax Credit (ITC) claims regarding GSTR-2A/2B

- HSN/SAC Code discrepancies

- Unaccounted income or transactions.

How to Respond?

You have two options and must respond within 30 days using Form GST ASMT-11 on the GST portal:

- Agree with the discrepancy: Pay the tax difference, interest, and any penalty using Form DRC-03 and inform the officer.

- Disagree with the discrepancy: Submit a detailed explanation with supporting documents to justify your filings.

Ignoring the notice can lead to a formal demand and recovery proceedings.

What does this form have?

The notice specifies particular discrepancies that have been observed by the officer and asks the taxpayer to either:

- Pay the differential tax, interest, and penalty (if applicable), and notify the officer

- Submit and reason for the differences

What to do after receiving the GST ASMT-10 Notice

Processing and responding to Form GST ASMT-10 is a moderately serious matter. No need to panic because it is not a show-cause notice. It's a formal notice and clarification request.

You have to carefully read the notice and match your records for discrepancies shown.

- Collect all allied documents, invoices, ledgers, and GST returns.

Ready response B in detail. Response options. - Concur with the mismatches shown, pay differential tax, interest, and penalty through Form DRC-03

- In case you are not concurring, you are required to give detailed reasons along with all the allied documents as evidence.

- File the reply within 30 days in Form GST ASMT-11 on the GST portal C. Consequences of Non-Compliance

Time limit to reply to ASMT-10

ASMT-10 refers to a notice issued under the Goods and Services Tax (GST) law in India.

The time limit to reply to a notice in Form GST ASMT-10 is the period mentioned in the notice itself, which is generally 30 days from the date the notice is served.

Consequences of not replying to ASMT-10

If you fail to respond within the stipulated time, a Show Cause Notice in Form GST DRC-01 is issued

All this creates scope for action such as audit, investigation, or recovery proceedings.

How MyGSTRefund CFO Dashboard Helps Exporters

Refund of the Goods and Services Tax (GST) is bound to encourage exports because it "zero-rates" them. However, it imposes tremendous hardships on Indian exporters. It does so by affecting their working capital and liquidity primarily.

Working Capital Deficit is the biggest issue for the exporters. Blockage of payment by failure to refund GST within time is among the major reasons for the shortage of capital. This affects an exporter's ability to meet new orders, purchase of raw materials, and maintain liquidity.

Irregular data entry and reconciliation errors among different GST returns are clerical errors. These are a big problem in GST compliance.

Complex requirements raise the chances of deficiency memos for defective or incomplete filings.

Refund process entails careful documentation such as invoices, bills of forwarding, bank realization certificates, FIRC, etc. Small errors or incomplete filing tend to result in deficiency memos (RFD-03) and make the subsequent claims rejected or delayed. Compliance and Documentation, therefore, become the serious issues with exporters apart.

It is more difficult to monitor refund status and find issues early with a lack of real-time transparency.

GSTR-1, GSTR-3B, GSTR-2A/2B Reconciliation Discrepancies: The Success of the refund claim is subject to the accurate and timely reconciliation of the data for various GST returns, as above, as well as the ITC Data on the GST-2A/2B. Discrepancy is caused when suppliers do not identify and report or submit incorrect data, which is an extremely crucial reason for rejection of a refund or blocking of a refund.

Time Limit: A Strict and stringent two-year time limit is provided to make refunds. Missing the deadline for filing is a top reason for rejection and blocking of GST refund.

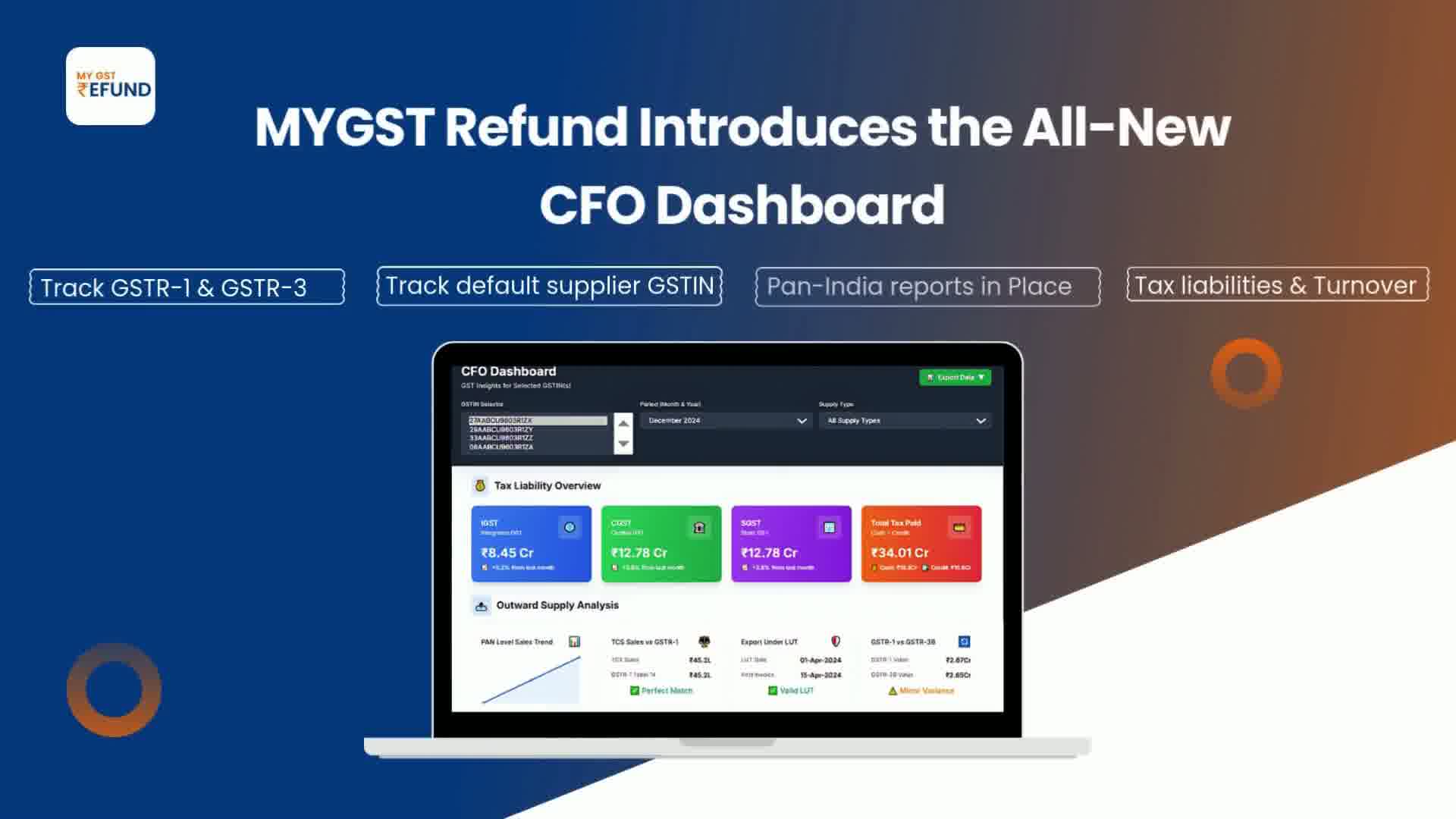

How does the MyGSTRefund CFO Dashboard solve key challenges for exporters?

This tool, meant to simplify and automate Refund Processes and GST compliance, is the MYGST Refund CFO Dashboard.

1. Real-time tracking and automated reminders

It gives a self-contained view of all refund applications and GST filings and their status.

Sends an automatic reminder for any new notice and pending deadline, like Form GST ASMT-10

2. Better Analytics and Data Reconciliation

To find discrepancies before notice is issued, this reconciliation makes sure that the data from GSTR-1, GSTR-3B, and GSTR-2A/2B match.

offers analytics and dynamic reports to track patterns and spot mistakes, preventing mistakes.

3. Proactive Risk Management:

- Identifies risk suppliers who are not returning their returns, avoiding future ITC reversal mismatches.

- Has a comprehensive audit trail and centralized ledgers, thus responding to formal notices such as ASMT-10 becomes simple and quick.

The Key Takeaways

Our dashboard makes GST management a hassle-free, proactive procedure of avoiding such notices. It steers clear of working capital complications by accelerating the refunding process and reducing delays to a greater degree. It reduces compliance and manual error chances through new edge automation and data analysis, rendering GST compliance hassle-free for exporters.

For exporters and entrepreneurs, too, a solution like MYGST REFUND Dashboard is necessary. The requirement is not only for refund management but also for overall GST compliance and litigations.

Frequently Asked Questions (FAQs) for the CFO Dashboard

Q1. What is the MYGST Refund CFO Dashboard

MYGST Refund CFO Dashboard is a product that provides you with an integrated and timely view of your financial data concerning GST. It assists businesses, particularly exporters, in dealing with GST compliance, GST refund processing, and managing possible issues proactively.

Q2. How does the CFO Dashboard assist with Form GST ASMT-10 notices?

The dashboard assists by providing the data required for an immediate and accurate response. It enables you to:

Prevent notices: It allows you to: Avoid notifications. It helps you find and correct any differences before a notification is sent by providing you with the chance to cross-check the data between GSTR-1, GSTR-3B, and GSTR-2A/2B.

Respond efficiently: When serving you a notice, the dashboard provides a detailed analysis and organized authentication. This facilitates easy procurement of the report you need to explain in Form GST ASMT-11.

Q3. How does the dashboard mitigate the working capital problems of exporters?

The exporter normally faces working capital due to late refunds of GST. The CFO Dashboard comes to your rescue by reviewing the actual real-time position of requests for refunds. It gives you instant allowance for any problem or delay. This allows you to respond quickly, which accelerates the refund and results in improved cash flow.

Q4. What reconciliation does the CFO Dashboard do?

The dashboard facilitates a critical three-way matching of:

- Your outward supply information under GSTR-1.

- Your summary returns under GSTR-3B.

- Your auto-populated inward supply information under GSTR-2A/2B.

- It helps you tag mismatches, errors, or differences in tax liability, ITC claims, and other important points.

These mismatches lead to notices of scrutiny.

Q5. Can the dashboard detect risky suppliers?

Yes. The CFO Dashboard also includes analytics that enable you to identify suppliers who are not submitting their GST returns on time. Such risk management avoids future issues related to ITC reversal and only deals with compliant vendors.

Q6. Does the dashboard offer automatic alerts and notifications?

Yes, the dashboard is auto-generated with reminders. It reminds you of compliance due dates, recent GST department notices, including ASMT-10, and the status of refund applications. In this manner, you never miss a deadline and can rectify things in time and in the right way.

Related Posts