GST 180-Day E-Way Bill Rule (2025): Impact, Penalties & Compliance

Published on: Thu Oct 02 2025

What is an E-Way Bill?

An E-Way Bill is a bill that is mandatorily used for the movement of goods for more than ₹50,000 in the GST regime. It is generated on the GST portal and contains details of goods, consignor, consignee, and transport partner.

It is easier for them and less expensive, so they can process more shipments efficiently.

For Transporters: It takes less driving time and fuel expense, leading to quicker turnaround and more trips.

For Exporters: It decreases their shipping expenses and provides quicker, safer delivery, hence making their products competitive internationally.

New E-Way Bill Rules (2025): 180-Day Invoice

From January 1, 2025, businesses can hold e-way bills only for bills received in the last 180 days.

For transporters, logistics providers, and exporters, the shift is inevitable-ships backed by transactional invoices will not be permitted to create e-way bills, creating stakes on delay, penalty, and disruption.

Relation with E-invoicing and Transport

Along with the e-way bill facility, there is also the facility of e-invoicing; Part A of the e-way bill is auto-filled from e-invoice data. It is simple to carry out and reduces the risk of errors. E-way bill is needed for the intra-state transportation of goods worth over ₹50,000. For intra-state transport, inter-state rules can be state-specific.

The New Rule: 180-Day Invoice Validity

| Aspect | Detail |

|---|---|

| Exact Update | E-Way Bills (EWB) cannot be generated for invoices, Bills of Supply, or Delivery Challans older than 180 days from the EWB generation date. |

| Rule Reference | Introduced via an Advisory by GSTN, typically issued in December and effective from January of the following year (e.g., Advisory dated 17th December 2024, effective 1st January 2025). This is a portal-level restriction on the E-Way Bill portal. |

Difference from the Previous Regime

| Feature | Previous Regime (Prior to the Limitation) | New Regime (With 180-Day Limitation) |

|---|---|---|

| Invoice Age Limit | No system-level cut-off for invoice age to generate an E-Way Bill. | Invoice/document date must be within 180 days from the date of E-Way Bill generation. |

| Implication | Companies could generate E-Way Bills on invoices months or even years old, leading to misuse (e.g., reusing stale documents, stockpiling goods in transit). | Ensures export of goods requiring EWB happens within a reasonable time, promoting compliance and preventing misuse of stale documents. |

Impact on Exporters: Synchronization of Invoicing & Shipping

For importers in the GST regime, the commercial invoice and shipping bill are not two separate documents; they are two sides of a single, electronically linked transaction. Misalignment creates very serious business and financial problems.

Why Timely Invoicing and Shipment Alignment are Important

- The Data Link is Automated: The GST portal (where you provide your invoice information in GSTR-1) is computerized and linked to the Customs portal (ICEGATE). The refund system tries to reconcile your invoice information from your GSTR−1 with your shipping bill information automatically.

- Evidence of Export: The shipping bill, after it has been cleared by customs (as certified by an "Export General Manifest" filing), is the primary legal document to prove that goods have left India. The data in this document must be duplicated word for word from the sale recorded in your GST invoice.

How Government Portals Are Connected

Modern export compliance runs on automation. Understand the flow of your data:

- Invoice Data Goes to GSTN: You declare your export sales by filing the GSTR-1 on the GST Network.

- Shipment Data Goes to Customs: Your shipping bill details are submitted to the Customs portal, ICEGATE.

Compliance Score: Repeated mismatches can warn a business of more scrutiny by both GST as well as Customs authorities, leading to greater audits and inspections.

Automated Refund Rejection

The most common cause for a GST refund to be held up is an "SB005 Error." It is an auto-error message released when the invoice particulars (e.g., invoice number, date, or tax value) submitted in GSTR−1 do not match the particulars reflected in the shipping bill.

- Blocked Working Capital: If the refund is blocked, the payment of IGST by the exporter is blocked in the government's hands. This impacts the cash flow to pay the suppliers, employees, and fund the next round of production immediately.

- Complex Rectification: It is not easy to rectify a mismatch. A tedious process either in correcting the shipping bill at the customs port or in modifying GST returns, necessitating heavy follow-up.

- Loss of Interest: The longer the capital blocking period, the more larger the notional loss of interest that can be earned or the actual interest to be paid on borrowed working capital.

Transporters & Logistics Companies: Problems with Older Bills

For transporters and logistics companies, the date on a bill is not just a date; it's the silver bullet that sets the gun off for a race with a strict timeline for action by the GST regime.

Issues in Clearing Consignments with Old-Money Bills

The most important concern is with the e-way bill, a computerized bill which should be utilized in order to move merchandise greater than a specified amount (for instance, ₹50,000 in India).

- E-Way Bill Validity: e-way bill validity starts from the date on which it has been generated, and it depends directly on the date of the invoice. A past-dated invoice is an issue at once: the period of transportation for which the e-way bill was permitted may be too brief for travel to actually happen. A one-day bill can be generated for what otherwise would be a two-day journey just because the invoice was one day previous.

- Expired E-Way Bill Mid-Transit: The biggest running nightmare is that an e-way bill is nearing expiry with the goods still in transit. This makes the entire consignment non-compliant and liable to be seized by the tax authorities.

- Document Discrepancy: Perhaps the greatest red flag for the tax authorities is a mass discrepancy between the date dispatched and the invoice date. It could indicate suspected fraud like delayed accounting, a ploy to evade sales reporting, or illicit movement of goods.

Risk of Penalties for Non-Compliance

Non-compliance is the failure to follow a rule, law, regulation, or mandatory standard.

It means not meeting a required obligation, leading to risks like fines, penalties, and legal action.

Carrying goods with a wrong document, like an expired or cancelled e-way bill due to an outdated invoice, puts the transporter directly at risk.

- Severe Financial Fines: Carrying goods without a valid e-way bill can attract a penalty of 200% of payable tax or a default value (i.e., ₹20,000), whichever is higher. The fine often directly goes to the transporter.

- Seizure and Detention: The government departments can seize or detain the vehicle itself along with the load that it is transporting. This not only causes financial losses but also triggers huge operational holds, affecting delivery timings and soiling the company's reputation with its customers.

- Transporter's Liability: Most importantly, under GST legislation, the transporter is also responsible for seeing that the consignment is accompanied by a valid e-way bill. They cannot hold the client (consignor) who had produced the old invoice responsible. Logistical businesses should therefore verify documents before accepting delivery of goods.

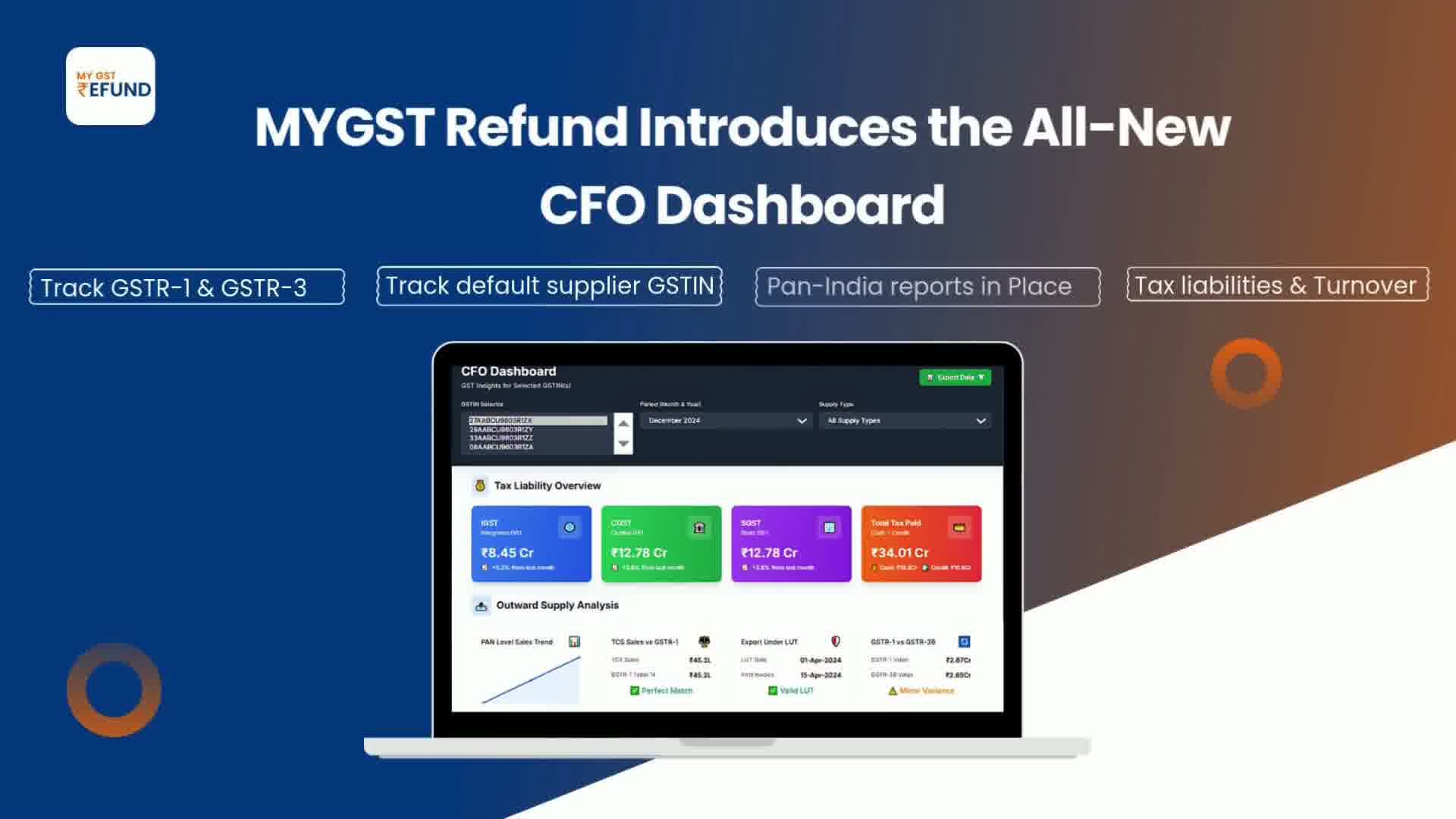

How CFO Dashboard Impacts Compliance for Distributors & Suppliers

The CFO dashboard provides real-time visibility that connects logistics and tax data to financial performance (e.g., cash flow),

| Dashboard KPI/Report | Function | Impact on E-Way Bill & Refund |

|---|---|---|

| EWB Generation Lag | Tracks time interval (in days) between Invoice Date and E-Way Bill Generation Date. | Ensures compliance with 180-day invoice validity. Excessive lag triggers reminders to Logistics/Tax teams, preventing penalties and goods detention. |

| GSTR-1 vs. EWB | Reconciles sales amounts reported in GSTR-1 with all issued EWBs (Invoice No., Value, GSTIN). | Detects mismatches. Errors can block buyer’s ITC, create disputes, and indirectly delay supplier’s GST refunds. |

| Blocked GSTIN Alert | Flags company/vendor GSTINs marked as "blocked" for EWB generation. | Supplier side: Blocks revenue flow by halting goods movement. Distributor side: Stops purchases by freezing EWB generation. Both disrupt cash flow and tax compliance. |

| ITC Mismatch % | Tracks ITC mismatches (GSTR-2B vs. ERP) and Vendor Compliance Score. | High mismatch indicates vendors’ weak compliance (delayed GSTR-1 filings), a major cause of refund delays or rejections. |

Firm Up Invoice Management Cycle

The recent 180-day deadline for generation of E-Way Bill (i.e., EWB generation is not possible if the invoice is more than 180 days old) requires a tighter invoice management cycle.

- Financial Risk: An invoice that is more than 180 days old and has to be rearranged goods now also becomes a stale asset until a new document, like a Delivery Challan or an altered invoice, is generated, creating audit complexity.

- CFO Focus: The dashboard ensures the management in order to bring this 180-day lag to zero with a direct interface between the Sales/Billing function and Logistics/Compliance.

ERP/SAP Reconciliation with E-Way Bill Module

Single integration alone will be enough to meet today's compliance requirements and provide the CFO dashboard with precise, real-time information.

All attempts at successful/unsuccessful generation of EWB, cancellations, and extensions are monitored against the original sales document in the ERP for an explicit audit trail for efficient processing of refunds of GST.

| Error Category | Example Error Message/Code | CFO Relevance: Risk/Compliance |

|---|---|---|

| Data Inconsistency | Invalid GSTIN or Pincode is not part of the State Code. | Risk: Ensures correct tax jurisdiction (IGST vs. CGST/SGST). Mismatch can lead to penalties and e-way bill cancellation. |

| Document Mismatch | Invalid Invoice Date/Number or Duplicate e-way bill for given document number. | Compliance: Confirms that the e-way bill matches a valid, unique transaction document, reducing unauthorized movement risk. |

| Logistics/Time-bound | Validity period has passed, you can't modify vehicle details. | Operational: Critical for logistics planning. Warns when e-way bill validity expires, requiring renewal or extension. |

| E-Invoice Linkage | E-Way Bill Generation not allowed since IRN is cancelled/inactive. | Compliance: Ensures taxpayers generate a valid E-Invoice (IRN) before auto-populating Part A of the e-way bill. |

| Tax/Goods Details | Blank/Invalid HSN Code or incorrect tax rates for intrastate transaction. | Audit Readiness: Validates commodity classification and taxation accuracy, crucial for correct GSTR-1 and GSTR-3B filing. |

How My GST Refund CFO Dashboard Benefits to Exporters

MyGSTrefund (CFO) dashboard is intended to provide exporters with real-time visibility and management over GST compliance, refund tracking, and invoice-level financial information. Unlike traditional filing instruments, CFO promises to operate in harmony with the GSTN ecosystem and SAP/ERP systems to help exporters avoid errors and delays in their refund process.

Important Upgrade Advantage Exporters

1. Portal Upgrade & Ease of Use-Upcoming GSTN enhancements, including E-Way Bill 2.0 and interoperability enhancements, are being rolled out to the CFO to streamline compliance. Exporters will enjoy quicker navigation, greater reliability, and more user-friendly dashboards to track their GST responsibilities.

2. Improved Interoperability does not subject exporters to a single system. With double-portal continuity (E-Way Bill 1.0 & 2.0), when a GSTN portal goes down, the CFO provides immediate switch-over to another system. It reduces supply chain disruption and enables seamless export operations.

3. Criss-Cross Operations-Exporters can carry out sophisticated operations such as:

- Updating Part B (vehicle/invoice details) for Part A slips irrespective of the portal.

- Extension of the e-way bill validity period from any portal.

- Auto-sync of the transporter details across portals without manual input.

- Mitigation of compliance friction through this agility allows exporters to concentrate on business development.

4. Multi-Factor Authentication (MFA)

To protect exporters' sensitive information, the CFO has introduced MFA-based login. This added security layer avoids unauthorized access, protecting GST filing and refund processing.

5. Outdated E-Way Bill Restriction

As a result of stricter GSTN validation norms, older than 180-day e-way bills cannot be created. CFO conducts these checks automatically, keeping the exporters in compliance and not falling behind in old documents.

6. Error Messages & System Validations

CFO breaks down intricate GSTN error messages into precise, actionable notifications for the exporters. Thus, their ERP/SAP systems send correct data, lessening the rejections and making the refund process smoother.

Why Exporter Invoice and Shipping Bill Must Synchronize

For Indian exporters doing business on the GST platform, your shipping bill and commercial invoice are not two different documents. They are two sides of the same coin. When they don't sync properly, it can cause major disruptions and hold your money back. This is how implementing this synchronization is crucial for your business.

- The Automated Link: GST and Customs Portals Talk to Each Other

Your business data is processed through an automated process. Here's how it works: - You file GSTR-1: You feed your sales invoice data to the GST portal.

You file a Shipping Bill: Your shipping bill is filed by your customs broker on the Customs portal (ICEGATE).

These two portals are computer-linked. The system tries its best to automatically match your GST invoice data with your shipping bill to approve your refund. Any minor discrepancy can halt this automatic procedure.

Why Perfect Alignment is Non-Negotiable

The proper information isn't about pretty documents; it has a direct bearing on your money and your compliance score.

1. It's Your Proof of Export

Your. The shipping bill, once cleared by customs, is your proof of documentation that the products have actually shipped out of India. For the bill to be valid, the details on this bill-like product descriptions, quantity, and value-must be a carbon copy of the details on your GST invoice. Without the carbon copy, you cannot document your export, which is the very basis for your tax refund.

2. Your Working Capital is at Stake

You, as an exporter, rely on getting your IGST refund on time. Your refund is an important part of your working capital, that which you employ to cover your day-to-day expenses. If a discrepancy delays your refund, your funds are stuck with the government. This burdens your finances, dampens payments made to your suppliers, and hurts your business growth.

3. It Affects Your Compliance Score

Think of it like a tax credit score. Repeated mismatches between your invoice and shipping bill act as an alert flag to both Customs and GST departments. This could lead to:

- Increased surveillance of all your shipments.

- Heightened auditing and checks are more frequent.

- Delays in future clearances and refunds.

- A clean record assures a quicker, smoother export process.

Key Takeaway for Exporters

Every exporter should ensure that the data you place on your GST invoice is exactly duplicated on your shipping bill. Pre-checking the data before filing can save you from being blocked for refunds, cash flows, and unnecessary examination by taxation officials. Treat your invoice and shipping bill as a single, inseparable document to make your export business easy-going.

Frequently Asked Questions

Q1.What is the new 180-day rule of e-way bills in GST?

Release of e-way bills is allowed only on the bills issued within the previous 180 days.

Q2.From which date is the 180-day validity applicable?

The rule is effective from January 1, 2025.

Q3.Is an e-way bill feasible for invoices older than 180 days?

No, an e-way bill cannot be generated on bills that are more than 180 days from the date of generation.

Q4.Will exporters be affected by this rule?

Exporters will have to synchronize shipments with bills in order to avoid delays in clearance and refund.

Q5.What will be the action if a transporter carries goods against a null e-way bill?

They are fined, held back, and delayed shipment. According to Sections 122 and 129 of the CGST Act, 2017, Goods and vehicle detention or seizure and fine of the higher amount of ₹10,000 or duty evaded is possible in the transportation of goods through an illegal e-way bill.

Related Posts