Inverted Duty Structure GST Refund 2025: 90% Provisional Refund Faster

Published on: Fri Oct 10 2025

Inverted Duty Structure GST Refund 2025:New 90% Provisional Payout

For many, or we can say a large number of manufacturers and exporters across India have a familiar pain point that persists - money stuck in Input Tax Credit (ITC) because of the Inverted Duty Structure (IDS) under GST. When the tax you pay on inputs is bigger than the tax you collect on your final product, your working capital ends up frozen in your electronic credit ledger, waiting for refunds that often take months.

GST Council’s 2025 reform aims to change and Effective from November 1, 2025, businesses will be eligible for a 90% provisional refund of their IDS claims upfront - a long-awaited liquidity boost for MSMEs and exporters.

What does an Inverted Duty Structure (IDS) mean?

An Inverted Duty Structure happens when the tax (GST) rate on inputs (raw materials) is higher than the GST rate on outputs (ready-to-sale goods). This mismatch results in an accumulation of Input Tax Credit that cannot be fully utilized.

Example: Suppose you are a cloth manufacturer. You buy dyes and yarns taxed at 18% GST, but your finished clothes are sold at 5% GST. That difference creates unutilized ITC, which gets locked in your books.

Impacts:

● Reduces cash flow and liquidity.

● Increases compliance burden.

● Especially affects MSMEs that operate on tight margins.

Major sectors hit by the Inverted Duty Structure

Textiles, footwear, fertilizers, and mobile phone manufacturing - all industries where the input rates are significantly higher than the output rates.

GST Council’s 90% Provisional Refund Rule for 2025

Understanding the strain on businesses, the GST Council has announced a landmark reform. From November 1, 2025, refund claims filed under the Inverted Duty Structure will receive a 90% provisional refund of the total claim amount -credited directly to the claimant’s bank account.

How It Works

File Your Refund Claim – Submit Form GST RFD-01 on the GST portal, as usual.

Receive 90% Upfront – The GST Network (GSTN) will process your application, and 90% of the claimed amount will be credited to your bank account without waiting for a full audit.

Final Verification -The remaining 10% will be paid after detailed verification by a tax officer.

This reform aims to fill the immediate flow of money into the manufacturing sector and industrial sectors, cutting refund timelines from months to a few days.

For manufacturers, this means faster turnarounds, smoother investments, and a clear balance sheet.

Steps to Claim Your Inverted Duty Structure SGST Refund

The refund process remains under Rule 89(5) of the CGST Rules, but has the new 90% provisional payout.

Step 1: Calculate Your Maximum Refund Amount

Use the formula prescribed under Rule 89(5):

Maximum Refund = (Turnover of Inverted Rated Supply × Net ITC ÷ Adjusted Total Turnover) − Tax Payable on Inverted Supplies

Key Definitions of Refund

Net ITC: Total ITC availed on inputs (goods) during the refund period.

Turnover of Inverted Rated Supply: Turnover of goods where the input tax rate > the output tax rate.

Adjusted Total Turnover: Total turnover in the state, excluding leftover supplies.

Step 2: File Form GST RFD-01

This is the official form for claiming refunds on the GST portal.

follow the path: Services → Refunds → Application for Refund

Select “Refund on account of inverted tax structure” as the reason. Enter your tax period and refund details correctly.

Step 3: Get yourself and your documents ready

Ensure all required documents are ready and error-free before submission.

Checklist:

● Declaration under Rule 89(2)

● Statement 1: Details of input and output supply invoices.

● Copies of purchase and sales invoices.

● Proof of payment of tax on output supplies

Step 4: Receive Your 90% Provisional Payout

For claims filed after November 1, 2025, the system will automatically process a 90% provisional refund after preliminary checks. This means a large portion of your working capital will be released within days - giving your business the liquidity and strength it needs to grow.

How Fixing the Inverted Duty Structure Can Power ‘Make in India’

The Inverted Duty Structure has long been a barrier to India’s manufacturing competitiveness. By addressing it through faster refunds, the government is taking a major step toward boosting industrial growth domestically.

1. Enlightenment of ‘Make in India’ -cuts the cost price of domestic production, motivating manufacturers to produce more locally rather than importing from the Global market.

2. Hypes Domestic Value - Frees up working capital, encouraging businesses to invest in advanced manufacturing fields within India without additional thinking about unutilized funds.

3. Increases Export Competitiveness - With faster refunds and better liquidity, exporters can price products more betterly on global markets and boost their profits.

This reform not only relieves financial strain but also supports India’s ambition to become a global manufacturing hub and an independent GDP.

The Key Takeaways

The 2025 GST reform, introducing a 90% provisional refund for Inverted Duty Structure cases, is one of the most impactful policies made in recent years. It solves a long-standing liquidity problem and offers a real, time-bound solution for manufacturers and exporters of our nation.

If your funds are locked in unutilized ITC, now is the time to act.

● Review your accumulated credits.

● Prepare your documentation early.

● Get ready to claim your refund efficiently once the new rule takes effect on November 1, 2025.

By doing so, you can free your trapped capital and reinvest it where it matters the most or in your business again to build it more.

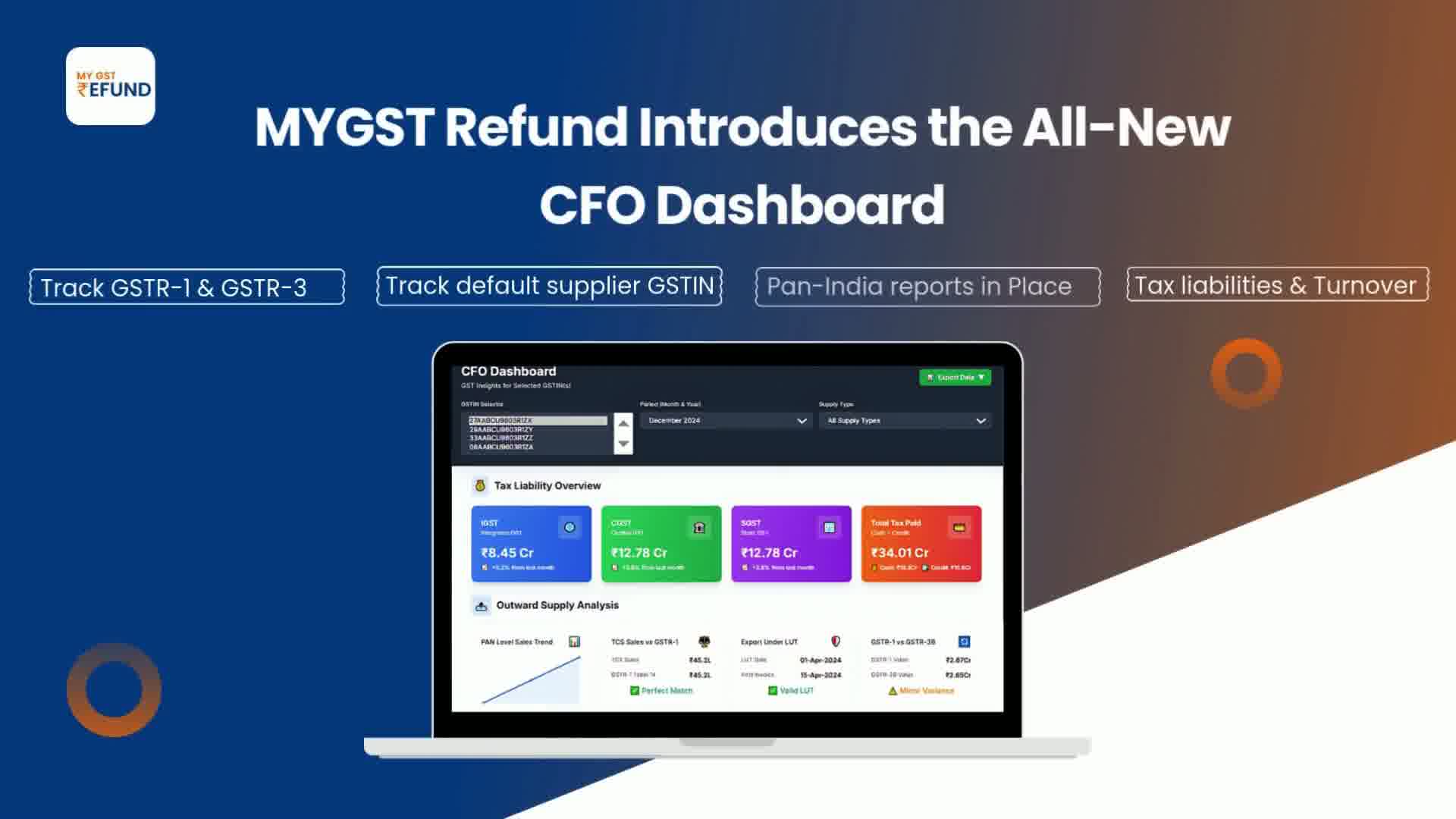

How exporters get GST Refunds Faster with MyGSTRefund?

MyGSTRefund helps exporters automate refund filing, reconcile invoices instantly, and track refund status in real time. Stay alerted to delays and errors-get faster, compliant, and hassle-free GST refunds through our smart CFO dashboard.

Stay alerted to delays and errors-get faster, compliant, and hassle-free GST refunds through our smart CFO dashboard.

Frequently Asked Questions

Q1. What happens if GST rates change after I’ve purchased my inputs?

Don’t worry, Refund eligibility is determined by the rates applicable at the time of the transaction. A rate change later does not disqualify your claim.

Q2. Are services covered under the Inverted Duty Structure refund?

Generally, IDS refunds apply to input goods, not input services, unless and until both the input and output are services.

Q3. Is the 90% provisional refund available for all GST refund types?

No. The 90% provisional refund is specifically introduced for Inverted Duty Structure refunds to address working capital blockages.

Q4. How long will the provisional refund take to reflect in my account?

The exact timeframe will be notified, but early indications suggest the credit could be processed within 7–10 working days after filing the claim.

Related Posts