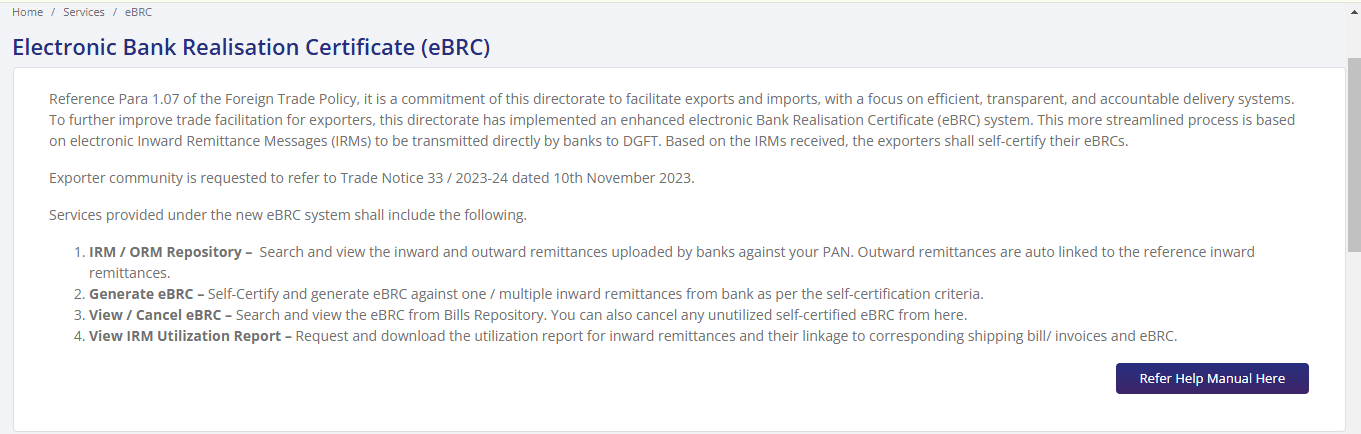

Electronic Bank Realisation Certificate (e-BRC)

An e-BRC, or Electronic Bank Realisation Certificate, is an important digital certificate for export businesses. It's issued by a bank to confirm that the buyer has paid the exporter for goods or services. The details in an e-BRC are vital economic indicators and financial information sources. Businesses that benefit from exports under the Foreign Trade Policy (FTP) must have a valid BRC as proof that payment has been received for exports.

BRC and eBRC full form

BRC stands for Bank Realisation Certificate, while e-BRC stands for Electronic Bank Realisation Certificate.

What is BRC certification?

A Bank Realisation Certificate (BRC) is a document issued by a bank to confirm that an exporter has received payment from an importer for goods they exported. Exporters need to inform the bank about the value of goods they plan to export, and the bank records these transactions using the Export Data Processing and Monitoring System (EDPMS). Once payments are received, exporters must submit shipping bills to the bank, which cancels the corresponding entries in the EDPMS and issues an electronic BRC (eBRC) against these payments. Having a BRC is crucial for exporters to access various government export incentives like subsidies, low-cost loans, and duty exemptions under the Foreign Trade Policy (FTP).

Before the introduction of e-BRC, exporters had to physically visit their banks to obtain BRCs, which were then submitted to the Directorate General of Foreign Trade (DGFT) regional authority for manual entry of export transaction details. This process was time-consuming and complicated, making it difficult to claim export incentives. However, with the introduction of e-BRC by the DGFT in 2012, exporters no longer need to visit banks to obtain BRCs. This streamlined the process of claiming export benefits and incentives from the DGFT and other export agencies, making it more accessible and efficient for exporters.

An e-BRC stands for Electronic Bank Realisation Certificate, and it's a digital document created by the DGFT to make trade paperwork easier and more digital. Starting from August 17, 2012, banks are required to send BRC data electronically to the DGFT server with a digital signature. These digitally transmitted BRCs are called e-BRCs.

So, what are New e-BRCs?

They're basically electronic records proving that exporters have received payments for their trade deals. These documents keep track of foreign trade transactions systematically. The old eBRC portal was shut down in July 2022, and now there's a new DGFT BRC portal running. Authorized Dealer (AD) banks need to shift to this new portal and upload e-BRCs on the DGFT website.

Here's how it works:

The DGFT gets shipping bill info electronically via EDI ports. When banks join in, the DGFT also gets details about foreign currency received, which can be linked to all shipping bills. This way, the information from shipping bills (showing the value of items exported) and e-BRCs (confirming the final payment received) are matched to verify the amount the exporter should get as an incentive.

For Electronic Data Interchange (EDI) shipping bills, exporters need to link the relevant shipping bill and eBRC online when applying for an incentive. They don't need to send paper copies to the DGFT for this process.

How Does eBRC Work ?

Once an exporter gets paid the full amount mentioned in the shipping bill within nine months from the shipping bill date, they need to provide the Electronic Foreign Inward Remittance Certificate (eFIRCs) and export documents to their bank. The bank will then create the Bank Realisation Certificate (BRC) once they receive the export payments. Their staff will put together an XML file containing details about the e-BRC and digitally sign it. The bank will upload these e-BRC files to the DGFT’s server once or twice daily, as per a set schedule. They will convert the foreign exchange payments into rupees based on the exchange rate set by the Central Board of Excise and Customs (CBEC). Once the XML files are uploaded, the server will send an acknowledgment to the bank. Exporters can then check the status and print or download the e-BRCs from the DGFT website to claim export incentives.

How to Check e-BRC on the DGFT Website?

If exporters want to check the e-BRC uploaded by banks on the DGFT website, they can follow these steps

Log in to the DGFT website. Click on 'My Dashboard' and then choose 'Repositories.'On the next page, click the 'Explore' button under the 'Bills Repositories' section. From the drop-down list labeled 'Select Bill,' choose 'Bank Realisations (eBRC).'Enter the start date ('From Date') and end date ('To Date') and then hit the 'Search' button. All e-BRCs uploaded by banks during that period will be displayed on the screen.

How to Download a Bank Realisation Certificate?

Here's how you can download the e-BRC:

Log in to the DGFT website. Click on 'My Dashboard' and then choose 'Repositories.'On the next page, click the 'Explore' button under the 'Bills Repositories' section. From the drop-down list labeled 'Select Bill,' choose 'Bank Realisations (eBRC).'Enter the start date ('From Date') and end date ('To Date') and then click the 'Search' button. All e-BRCs uploaded by banks will appear on the screen. Click on the Bank Realisation Number to view the e-BRCs uploaded by that bank. The e-BRC details will show up on the screen.To download the e-BRC, simply click on the 'Print eBRC' option.

making sure the information is correct and easy to access. This helps exporters claim rewards quickly by connecting their shipping documents with the e-BRCs. Also, the e-BRC works with GST refunds, which makes things even simpler. Overall, the eBRC makes exporting things smoother and helps everyone involved know what's going on.

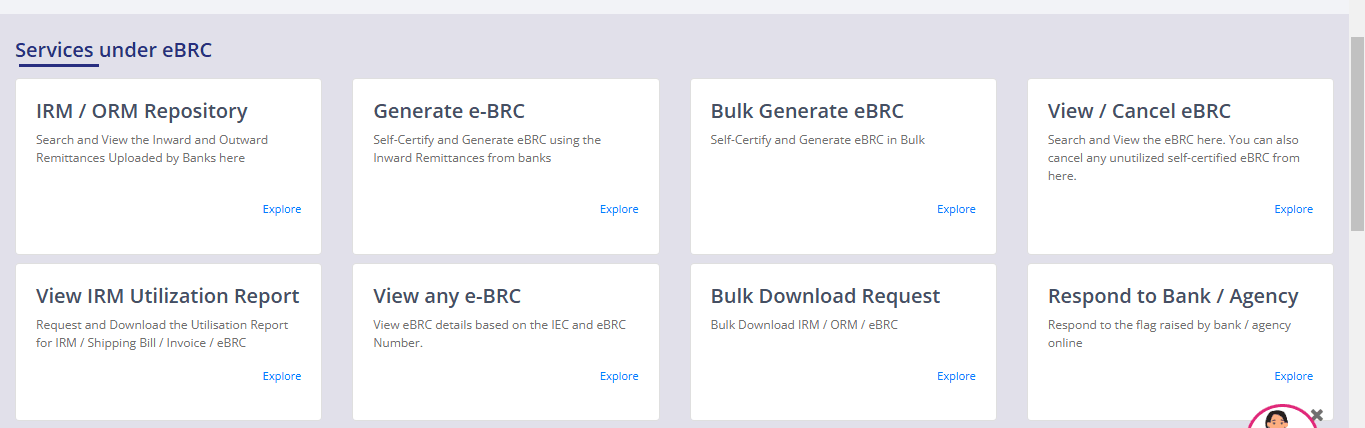

Services under e-BRC

The Electronic Bank Realisation Certificate, or e-BRC, is an important document for exporters in India, as it certifies the realization of export proceeds. It plays a critical role in various compliance processes, such as claiming incentives under Foreign Trade Policy (FTP) and Goods and Services Tax (GST) refunds. Here are the key services under e-BRC:

1. Generation and Submission of e-BRC

- Banks issue e-BRCs for export transactions once the export proceeds are realized.

- These certificates are directly uploaded to the DGFT system by the designated banks.

2. Integration with DGFT

- e-BRC data is also integrated into the DGFT portal for online application of incentives such as:

Merchandise Exports from India Scheme (MEIS). - Service Exports from India Scheme (SEIS).

It enables automatic verification of export data.

3. Export Incentive Claims

- The e-BRC helps in the processing of claims of export incentive under FTP.

- Guarantees the exporter gets the duty credit scrips and other advantages.

4. GST Refunds

- e-BRC will act as a supplementary document for claiming GST refunds by the exporter under Zero-rated supplies.

- Integrated Goods and Services Tax (IGST) paid on exports.

Processing of the refund claims would be subject to verification of the e-BRC.

5. Compliance for Exporters

- Facilitates compliance by computerizing the process of realizing certificates.

- The process reduces the necessity of physically submitting the bank realization certificates.

6. Audit and Monitoring

- e-BRC data helps the authorities track the export proceeds.

Government uses this for compliance check and audit.

7. Simplified Documentation

- This reduces the amount of paper used by replacing physical certificates with an electronic system.

- Reduces errors and delays in processing export benefits.

FAQs

Q.1 How is eBRC generated ?

Ans. The bank will make the BRC when they get the export payments. Then, the bank's workers will make a file with info about the e-BRC. They'll sign it digitally.

Q.2 What is the full form of e-BRC?

Ans.eBRC refers to Electronic Bank Realisation.

Q.3 Is BRC mandatory for a GST refund ?

Ans. For getting a refund for exporting goods, you don't need to provide a BRC document. But if you're refunding for exporting services, you do need to give details of the BRC with your refund application.

Q.4 What are the uses of e BRC ?

Ans.As we talked about before, if you're exporting things and you want to get benefits like duty exemptions, subsidies, or cheap loans from the government, you need an e BRC. This is part of the Foreign Trade Policy (FTP).

Q.5 What is the timeline for BRC ?

Ans. The guidance for BRC says that after your audit, you should get your certificate and full audit report in about 42 days (or 104 days). This gives you 28 days (or 90 days) to provide evidence to fix any problems found during the audit. Then, the Certification Body has 14 days to do their part.

You are missing the GST Refund opportunity! Don't miss out on unclaimed GST Refund. Check your eligibility today for free. Click on the link : https://www.mygstrefund.com/know-your-gst-refund/

Related Posts