How to Check IGST Refund Status Online: Everything You Need to Know

In the complex world of taxes and online business, it is essential to stay updated with the IGST Refund Status. The Government of India has launched its official GST portal, wherein a business may log in online through the GST portal credentials to file an IGST Refund and track the IGST refund status.

In this blog, we will guide you in order to track IGST refund status online, ensuring that you are always one step ahead of others in terms of checking your tax compliance and receivables.

What is IGST Refund?

The provisions of Integrated Goods and Services Tax (IGST) are provided under Section 16 of the IGST Act, 2017, in India. It is imposed on the interstate supply of both goods and services.

In case of exports, the exporters will get a refund of the Input Tax Credit (ITC) paid on IGST on supplies for these exports.

This system makes the exporter pay the tax only on the input goods or services and is able to demand a refund on the same once he has exported the goods out of India, or in case he is paid in foreign exchange in case of services.

Is your IGST Refund stuck for any reason? Want to get it processed quickly? With MYGST Refund, we’ll ensure your Export GST Refund is processed in as little as 15 days!

Latest Update About IGST Refund

Invoice-based Filing: Refund claims are now filed per invoice, not by tax period.

Mandatory Returns: All returns of GST (GSTR-1, GSTR-3B) have to be filed before making an application for a refund.

Enhanced Refund Table: The New form includes a detailed refund calculation for accuracy.

Use of ITC: ITC can be utilised under IGST, CGST, and SGST.

Customs Refunds: Electronic processing via ICEGATE for faster refunds.

Legal Updates: Save yourself the trouble of having to read case law by reading legal updates of cases that affect refunds.

How to Check IGST Refund Status Online?

You can check the IGST Refund status online through two portals:

1. IGST Refund status on ICEGATE.

2. IGST Refund Status on GST Portal.

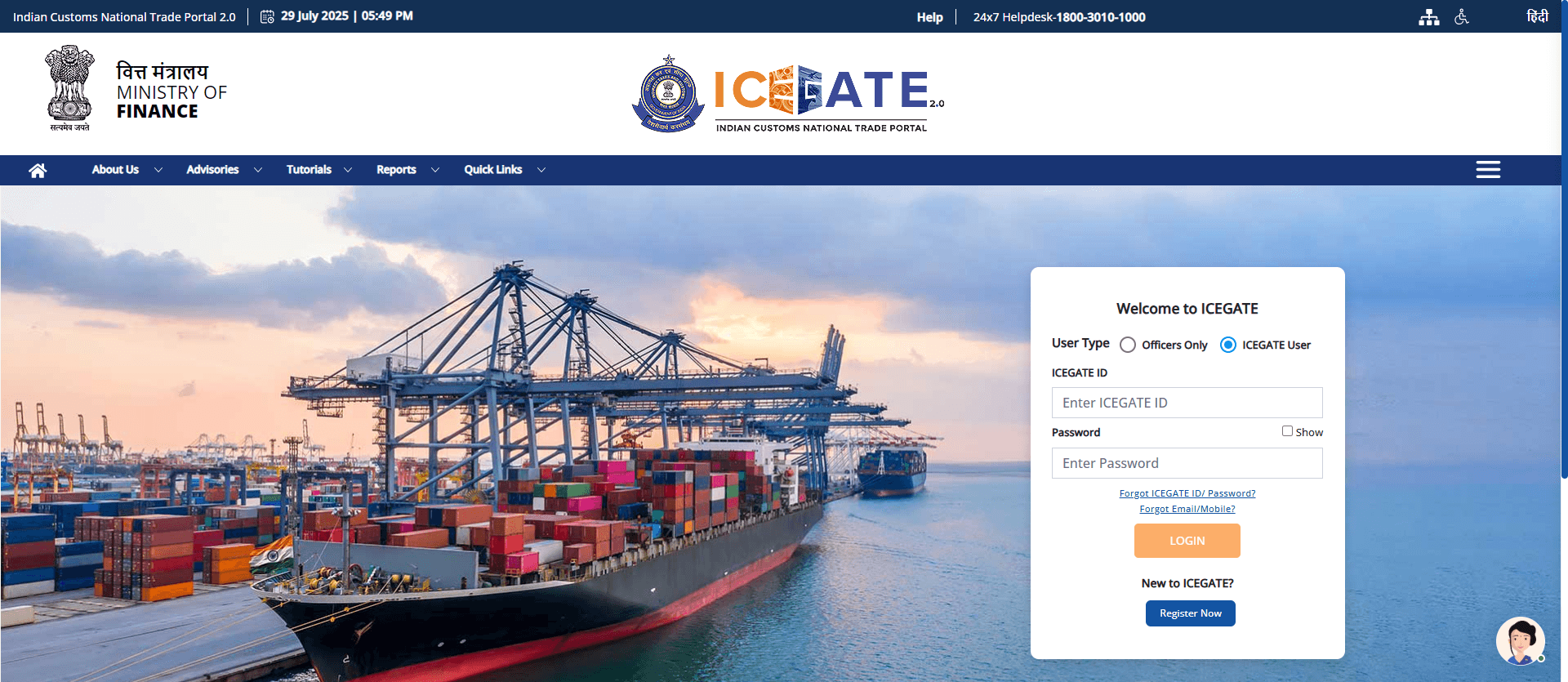

How to Check IGST Refund Status on ICEGATE?

The following process helps in checking the IGST Refund Status on ICEGATE:

Step 1

Go to the official ICEGATE Portal:

Step 2

After logging in, go to:

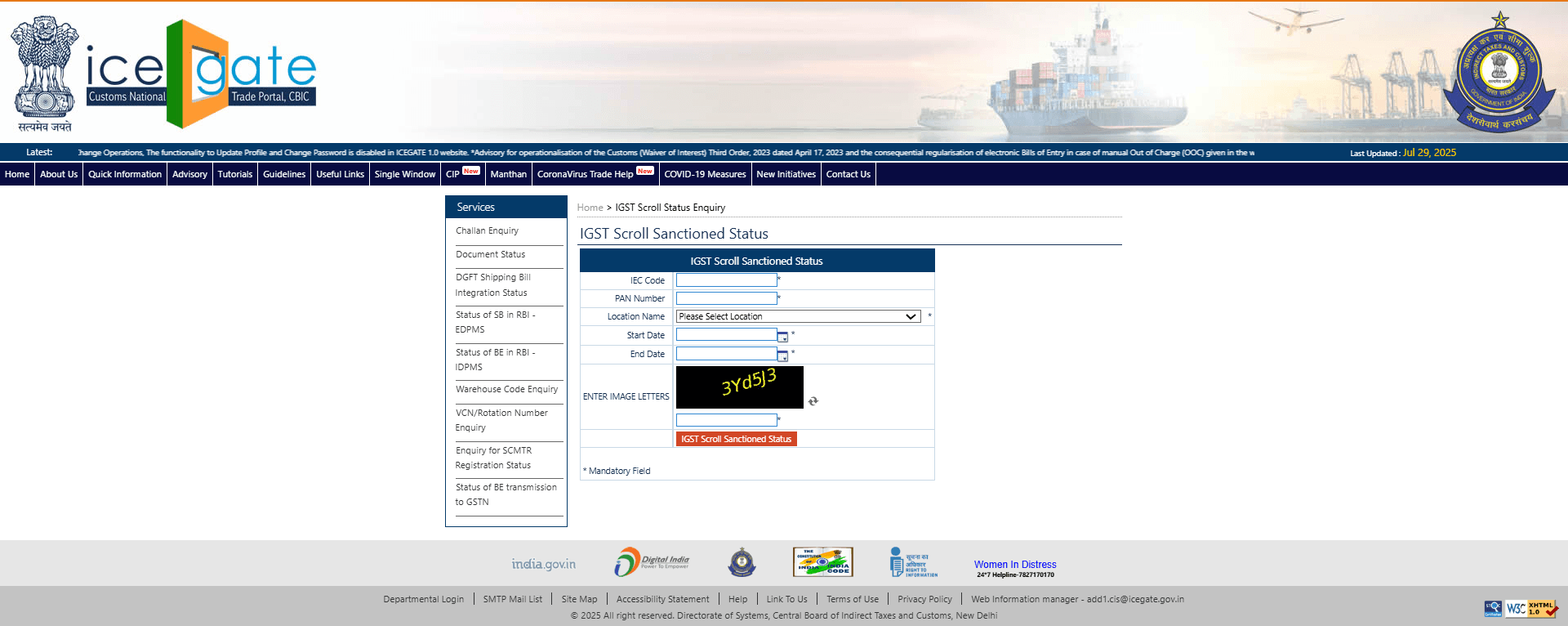

Services → Enquiries → IEGCATE Enquiry Service → IGST Scroll Sanctioned Status

Step 3

Enter the required details:

Step 4

Click the "Search" button.

You will be able to view the IGST Refund scroll status for your exports.

You can now find the IGST Refund status on ICEGATE. The online tool will indicate to you if it is valid or awaiting approval, or if it has been rejected.

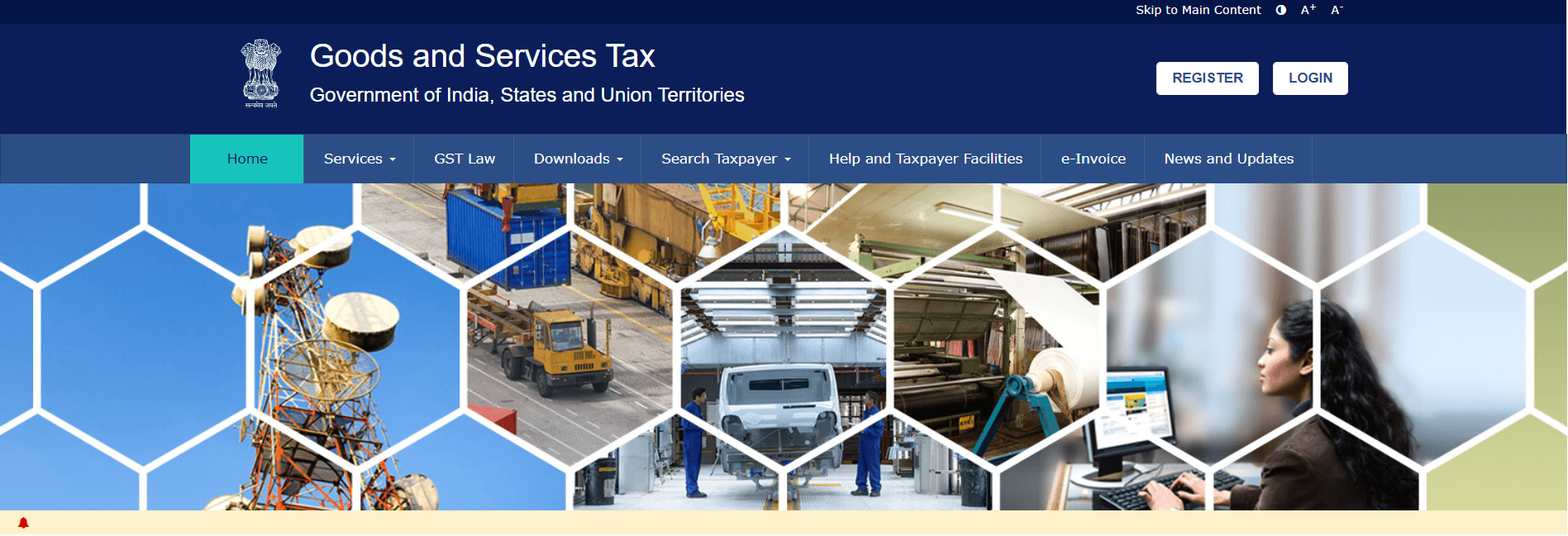

How to Check IGST Refund Status on the GST Portal?

The following are the ways to check the IGST Refund Status on the GST Portal:

How to Track IGST Invoice Sharing Status on the GST Portal

Step 1

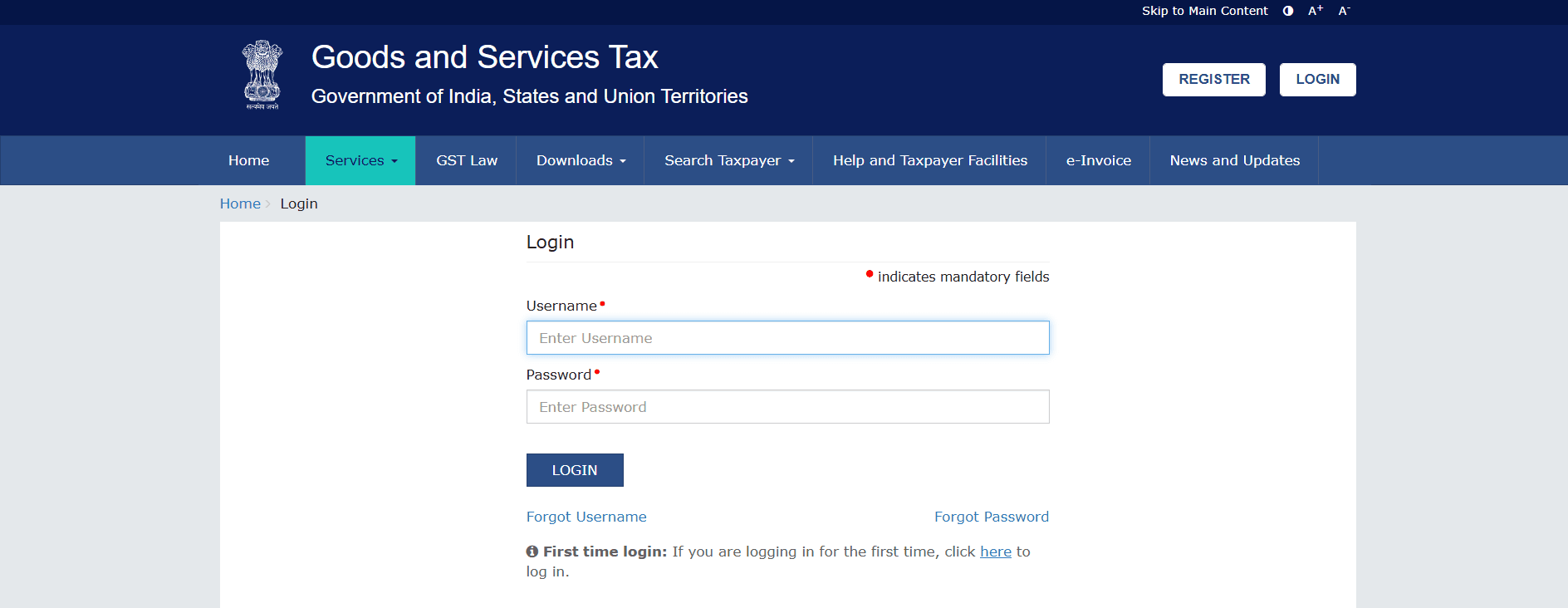

Visit the official GST Portal:

Step 2

You have to use your GSTIN and password.

Step 3

Navigate to:

Services → Refunds → Track Status of Invoice Data Shared with ICEGATE

Step 4

Select the→ Financial Year→Month

This helps you check whether your export invoice data has been shared with ICEGATE.

Step 5

Click on "Search".

You can track the IGST status using:

- ARN (Acknowledgment Reference Number)

- Filing Period

- If some invoices are not transmitted, you can:

- Download the list of rejected invoices.

- Check the errors

- Correct and re-upload the invoice data in GSTR-1

You can find out the status of your refund and how far along the application process is on the GST portal. The page shows account details for a GST refund request from the GST Portal.

Common Reasons for IGST Refund Status Delays or Rejections

A mistake in the application can result in delays or no refund.

Issues that arise commonly are: When the information from GSTR-1 and the shipping bill is different.

- Errors in the invoice’s numbers or port codes

- The given bank account details have not been validated.

- Late submission of GSTR-3B

- Mistakes from typing out the data in export invoices

- Another concern is when the same shipment is entered unfairly two or more times.

The more careful you are while filing, the less likely you are to create delays.

How MYGSTRefund Helps You File IGST Refund?

MYGSTRefund is India's No.1 automated GST Refund platform that makes filing your IGST refund less challenging by automating data validation, ensuring that it is GST compliant, and accelerating the entire filing process with an easy and intuitive interface through which the status of the pending refund can be tracked in real-time, along with expert assistance.

File now to have your IGST Refund done without complications.

For support, call: +91 92050-05072 or Email: info@mygstrefund.com.

Conclusion

In conclusion, by monitoring the IGST Refund status, the exporters can manage their cash flow, but not in cases where mistakes in invoices, erroneous data on which the banking will be based on and downtimes in submission delay them.

Frequently Asked Questions

Q1. How long does an IGST refund take?

In the majority of cases, you will have to wait up to 15-30 days after GSTR-1, GSTR-3B filing, and receiving the shipping bill confirmation receipt.

Q2. What to do if a refund is stuck?

In case your refund is held up, verify the mismatch of data, make sure that all returns have been filed properly, update the details at the bank, and reach the GST helpdesk or Customs.

Q3. How do I track my IGST Refund Status?

To know the current specified IGST refund status, the ICEGATE requires inputting the shipping bill number, port code, and the date.

Q4. What is the procedure for claiming an IGST refund?

Submit GSTR-1 and GSTR-3B; the data is to be linked with the shipping bill; IGST refund is auto-processed by customs, and this amount is deposited in your bank.

Related Posts