GST Refund in India: Who is Eligible & How to Apply

Published on: Sat Aug 30 2025

What is a GST Refund & Who is Eligible?

The GST refund process involves claiming repayment for overpaid tax by a registered taxpayer, typically due to exports or an inverted duty structure, or for tax payments made to the taxing authority.

When the Goods and Services Tax, or GST, came into effect, it also brought major changes in multiple systems and mechanisms for refunds.

Eligible applicants for claiming a GST refund are exporters and suppliers in the SEZ (Special Economic Zone) who claimed a lower income than presumptive income or have unutilized input tax credit.

What is a GST Refund?

A GST refund is the process by which a registered taxpayer claims excess tax paid to the government. It can result from:

- Unutilized Input Tax Credit (ITC)

- IGST paid on exports

- Tax paid on exempt or zero-rated supplies

- Inverted duty structure

- Excess payment or erroneous payment of GST

- Accumulated balance in the electronic cash ledger

The user can claim a refund through the GST portal using the GST RFD-01 refund form is to be refunded If they are eligible, the taxpayers receive the refund amount directly in their bank account.

Who is eligible for the GST Refund in India?

Not every taxpayer is eligible; many of them are under the GST regulations.

A claim for refund may arise due to the following situations:

1. Exporters of goods and services

Exporters can claim a refund of IGST paid or unutilized ITC under LUT (Letter of Undertaking).

It also comprises foreign providers and the suppliers of the SEZ.

2. Taxpayers Under Inverted Duty Refund

If a higher GST rate is imposed on inputs than on outputs, it results in an accumulation of ITC. The accumulated ITC difference may be taken as a refund.

3. Excess Balance in Electronic Cash Ledger

Any extra amount deposited that remains unutilized after the return filing can be claimed back as a refund by the taxpayer.

4. Deemed Exporters

Deemed exporters are the suppliers of goods defined as, e.g., Export Oriented Unit and Export Promotion Capital Goods.

5. Non-resident Taxable Persons

A business or individual registered temporarily and who falls under the category of non-resident taxable persons can equally claim a refund of the excess amount of tax deposited at the point of registration or payment when the liability is known to be lower.

Types of GST Refunds in India

Refunds Related to Exports & SEZ Supplies

- Refund on the export of goods

- Refund on export of services

- Refund of the accumulated input tax credit

- Refund for supplies sent to the SEZ (Special Economic Zone) unit or the developer without tax being paid

- As of the inverted tax structure, the input tax refund is credited

What is the Time Limit to Claim a GST Refund in India?

- In 2 years, the application that has been made to obtain a refund should be made in Form RFD-01

- In case the refund claimed exceeds the stipulated remittance, the same should be certified by a chartered accountant.

Common Relevant Dates:

For export of goods: Date of shipping bill or export invoice

For export of services: Date of receipt of the amount received in foreign currency

For excess tax paid: Date of tax payment

For inverted duty structure: End of the relevant tax period

GST Refund Process:

The following are the steps for how to claim gst refund:

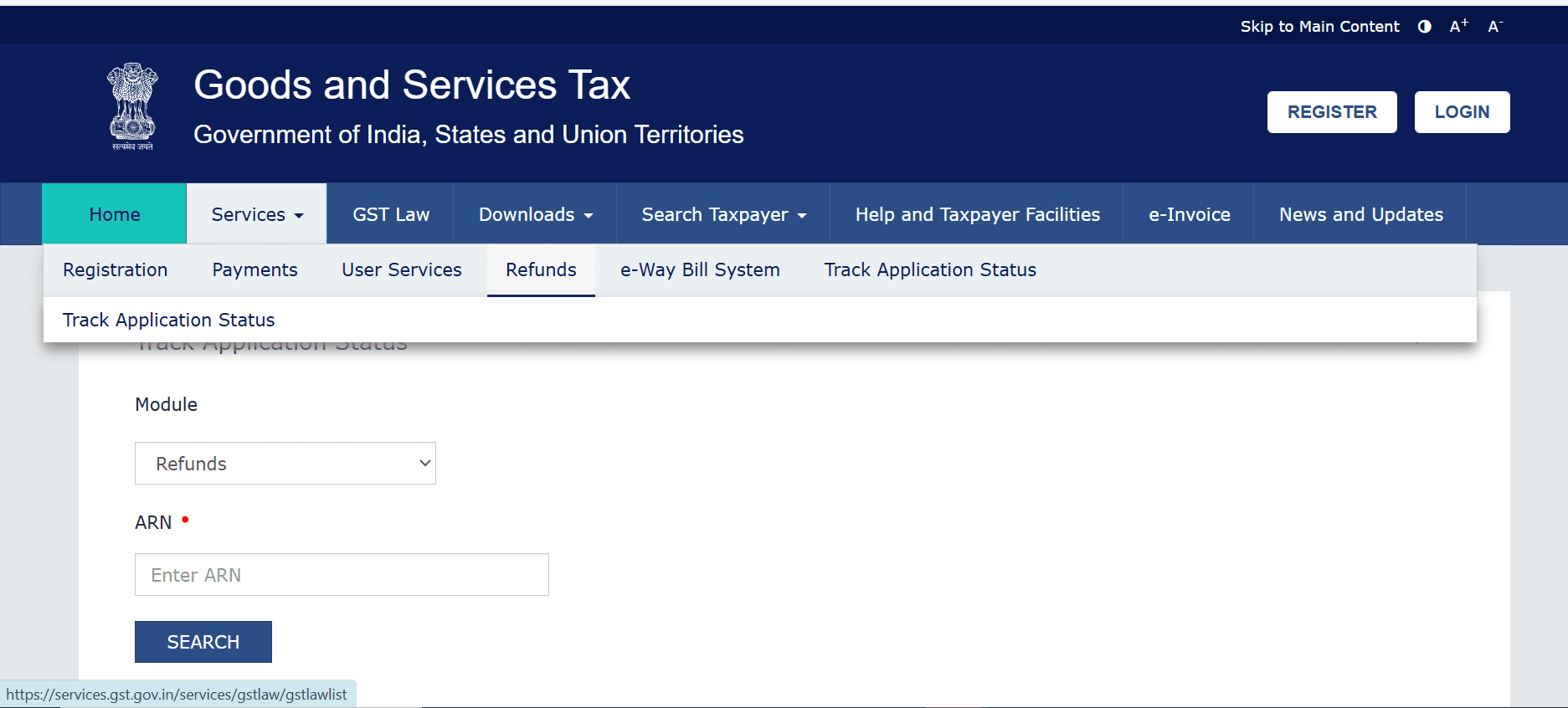

1.Log in to the GST Portal

Visit gst.gov.in and log in with your credentials.

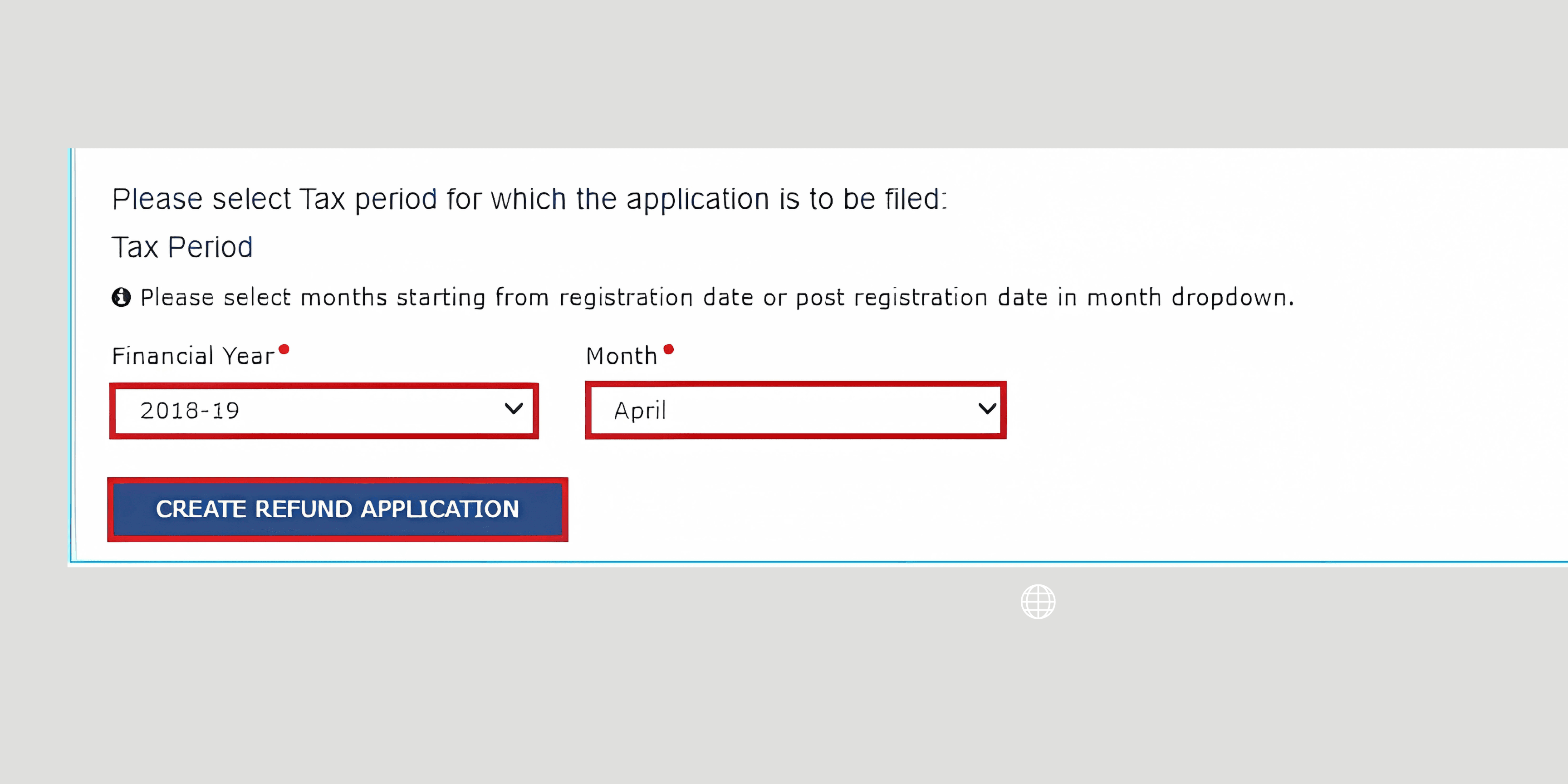

2. Navigate to Refund Application

Click on: Services followed by Refunds, and concluding with Application for Refund (Form RFD-01).

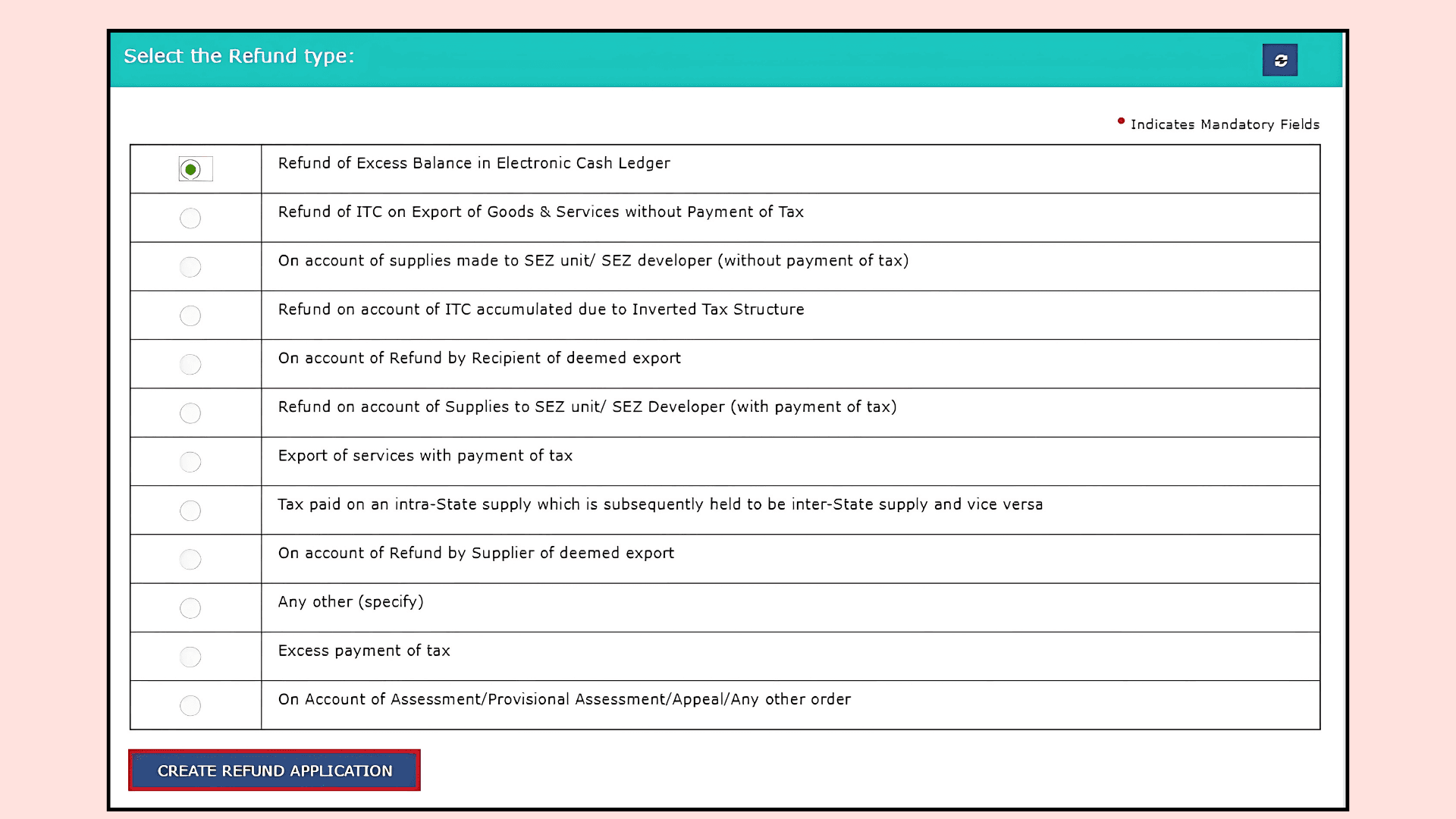

3. Select Refund Type

Choose the appropriate category: e.g., refund on exports, inverted duty, etc.

4. Upload Required Documents

Depending on the refund type, you need to provide invoices, shipping bills, LUT, BRC/FIRC, reconciliation sheets, and other required supporting documents.

5. Submit Application

File the form using DSC or EVC. ARN (Acknowledgement Reference Number) will be generated.

6. Refund Processing

The refund is reviewed by the jurisdictional officer.

7. Refund Order Issuance

Upon verification, Form RFD-06 (Sanction Order) is issued, and a refund is credited to the taxpayer’s bank account.

How to recover GST refund (ITC) for advertisement services?

To recover Input Tax Credit (ITC) on advertisement services, all conditions of GST compliance must be fulfilled:

- The advertisement should be utilized solely for business purposes and not for personal or exempted purposes.

- You should have a GST-registered supplier who provides you with a valid tax invoice.

- You and the supplier should both have correctly filed your GST returns, reflecting the proper characterization of the transaction.

- And if the ad services are imported (i.e., from an Indian supplier located overseas), the GST under the Reverse Charge Mechanism (RCM) needs to be paid, and you can claim ITC accordingly.

How MyGSTRefund helps exporters to claim refunds

The exporters often experience delays in GST refunds due to portal errors, documentation inaccuracies, or a lack of professional advice.

MyGSTRefund is an automated GST refund platform designed to help Indian businesses claim refunds easily and transparently

End-to-end GST solutions: An all-in-one solution to all your GST needs, and all being done in one place.

Fastest Turnaround Time: Claim your refund with zero hassle, minimal steps, and no delays.

Claim Your GST Refund: Login/Register: mygstrefund

Conclusion

Whether you are an exporter, a supplier to SEZ units, or subject to an inverted duty structure, the first step in getting back excess tax or unused credits is identifying your true eligibility.

The user From timely filing of Form RFD-01 to tracking status via ARN (Application Reference Number), completing all necessary documentation, and acting within the two-year refund window, every step matters. If you want to calculate your unclaimed GST refund, use our refund calculator with the automated GST refund platform in Gurgaon.

Frequently Asked Questions

Q1. What is a refund in GST?

A GST refund can happen when registered taxpayers claim an excess amount if they paid more tax than they owe. They can file a refund with basic information through the GST portal.

Q2. What Is the New GST Advisory on Changes in the GST Refund Filing Process?

As per the latest GST advisory (2025), taxpayers must file Form GST RFD-01 within two years from the relevant date to claim a refund. Additionally:

The application has to be certified by a chartered accountant when the amount of refund due to the individual is more than a specified figure.

The export and SEZ supplies do require a justification by means of reconciled invoices and shipping bills as grounds for refunds.

GST returns will now be coupled with Acknowledgement Reference Numbers, whereby one will track the status in real time. The changes are made in a bid to enhance the speed of processing, minimize mistakes, and eliminate any fraudulent claims

Q3. How to Get a GST Refund?

To receive a GST refund, a taxpayer must:

Log in to the GST portal

Navigate to Services > Refunds > Application for Refund (RFD-01)

Choose the appropriate type of refund (exports, inverted duty, excess tax, etc.)

Upload required documents (invoices, BRC, LUT, declarations)

Apply online-

Track the refund using the ARN provided after submission

Refunds are generally processed within 60 days, and 90% provisional refunds are issued within 15-20 days for zero-rated supplies (exports).

Q4. What are the refund options for GST available to exporters?

Refund of IGST: This applies when exports are made and IGST has been paid (as per Rule 96). Refund of accumulated input tax credit (ITC): This is applicable for exports where IGST is not paid, but the export is covered under a Bond or LUT (as per Rule 96A).

Q5. Who Can Claim a GST Refund?

You are eligible for a GST refund if you have paid excess tax, exported goods or services, made zero-rated supplies, claimed a lower income than presumptive income, or have unutilised input tax credit

Q6. Can I recover GST refund (ITC) for advertisement services?

Yes, you can recover Input Tax Credit (ITC) on advertisement services

Related Posts