How to Claim GST Refund India: Step-by-Step Guide (RFD-01 to RFD-06)

Published on: Wed Sep 03 2025

What Is the GST Refund Process?

The GST refund is the sum of excess tax paid by a taxpayer to the government.

For the GST Refund Process, use the GST portal to file Form RFD-01. You will receive an acknowledgment (RFD-02) within 15 days. If you are eligible, you will receive a provisional refund (RFD-04) up to 90% within 7 days. You will receive your final order (RFD-06) within 60 days. You will then pay using RFD-05.

Step-by-Step Refund Process

- To File Form GST RFD-01: Submit your refund application online on the GST Portal under Services → Refunds → Application for Refund. It needs to be submitted within 2 years from the respective date (date of export invoice, date of payment of tax, etc.)

- Acknowledgment – RFD-02: Computer-printed auto on successful submission, it initiates the cycle of refund

- Deficiency Memo – RFD-03: Within 15 days when the application being lacking. You must cure and refile a new RFD-01

- Provisional Refund – RFD-04: In respect of cases where it is qualified, such as exports or zero-rated supplies, up to 90% of the requested amount may be released within 7 days from RFD-02

- Final Order – RFD-06: Final order of tax officer or refusal of refund, typically issued within 60 days from RFD-02

- Payment Advice – RFD-05: When a refund is authorized, it directs the bank to credit the refund into your account

RFD Form Mistakes & Solutions

- Failure to attach documents or wrong documents or details results in issuance of RFD-03, and you will be required to correct and resubmit

- Wrong selection of the type of refund (e.g., ITC vs. cash) may cause rejection-make the correct selection.

- Errors in bank or IFSC information may cause a delay or rejection of the refund check's correctness.

- Time limit not present: Refund must be filed within 2 years from the respective date, depending upon the nature (e.g., date of exportation or invoice).

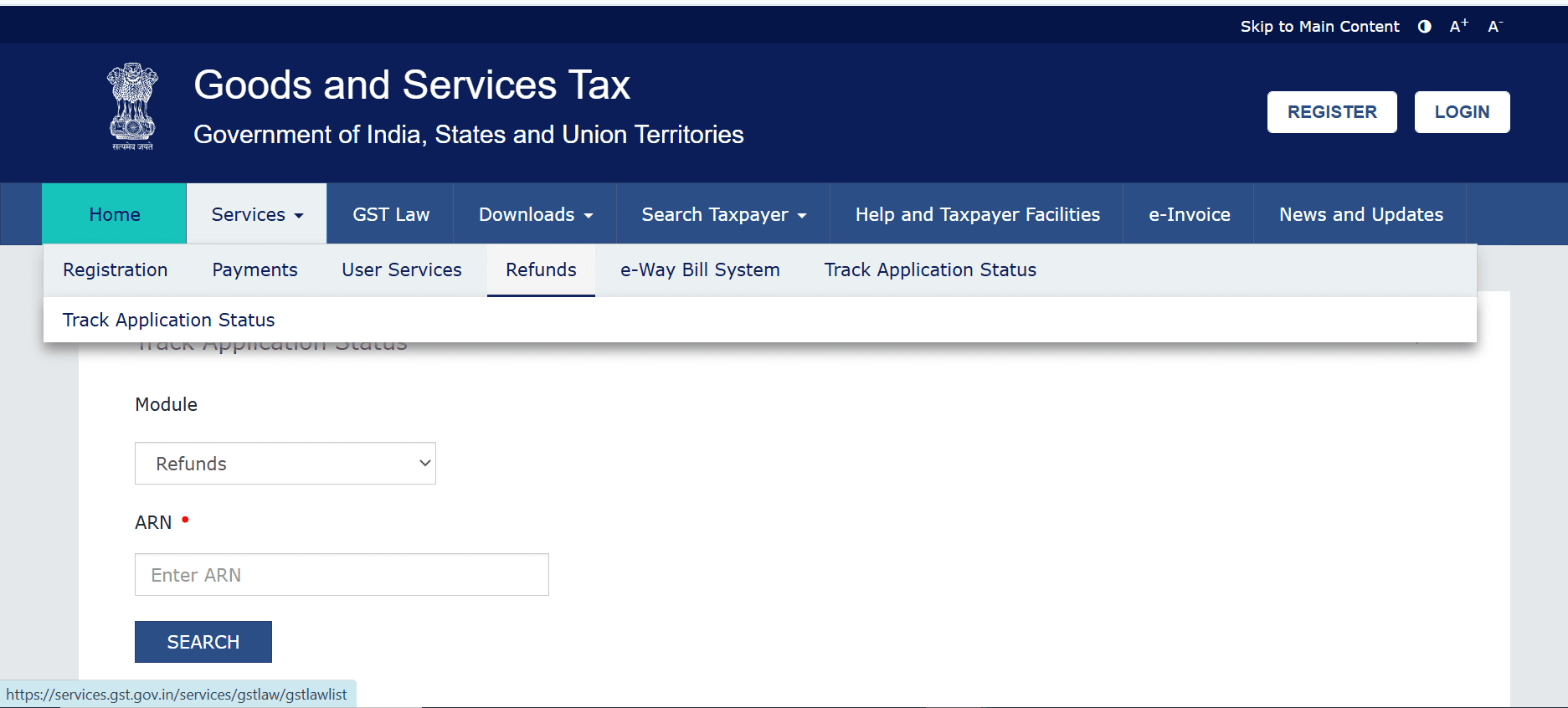

Online Refund Status Tracking

Online status track using your Application Reference Number (ARN) at Services → Refunds → Track Application Status on the GST Portal.

Status reflections are such as follows: Acknowledged (RFD-02), Deficiency (RFD-03), Provisional Order (RFD-04), Withheld (RFD-07), Show Cause Notice (RFD-08), Reply Received (RFD-09), Final Sanction or Rejection (RFD-06).

Refund Timelines and Delays

- Acknowledgment (RFD-02): within ~15 days of filing date.

- Provisional Refund (RFD-04): within ~7 days for zero-rated supplies.

- Final Refund (RFD-06): typically within 60 days of RFD-02.

- Delays are most often due to shortcomings, notices, incorrect bank details, or technical errors on the GST portal.

Errors & Correcting Them

- Incomplete returns: RFD-03 is causing delays. Rectify and resubmit with urgency

- Missing 2-year deadline: Refund claims received late will be rejected

- Data mismatch or bank details error causes delays. Then check again.

Tracking Refund Status

Use ARN in RFD-02 to monitor status under GST Portal (Services → Refunds → Track Application Status).

Possible status:

- Acknowledged

- Deficiency Memo Issued

- Provisional Order Issued

- Reply Pending/Received

- Refund Withheld

- Refund Sanctioned (Full/Partial)

- Refund Rejected

- Show Cause Notice Issued (RFD-08) and replied (RFD-09)

GST Forms and Their Uses

1. GST RFD-01 – Refund Application

For refund against inward supplies, exports, deemed exports, inverted duty structure, or excess balance in the electronic cash ledger.

Should be submitted within two years of the relevant date.

2. GST RFD-01A – Refund Application Manual

Used by such forms as casual taxable persons, non-resident taxable persons, and deductors/collectors of tax.

Same time limit: within a period of two years from the relevant date.

3. GST RFD-02 – Refund Application Acknowledgement

Released electronically by the concerned officer within 15 days from the date of filing of RFD-01, stating that the application is accepted.

4. GST RFD-03 – Deficiency Memo

Released when there are mistakes in the application. The taxpayer rectifies and reposts; a new ARN is issued.

5. GST RFD-04 – Provisional Refund Order

In specified cases (like zero-rated supply), the provisional refund can be issued by way of this form within 7 days from the acknowledgment date.

6. GST RFD-05 – Payment Order

Released on approval of the refund. Precedes actual payment.

7. GST RFD-06 – Refund Sanction or Rejection Order

Shows final status: approved/denied refund. Issued within 60 days of the filing of the application.

8. GST RFD-07 – Adjustment or Withholding Order

Used in the event of complete withholding or modification of the blocked refund. Issued within 15 days.

9. GST RFD-08 – Notice of Cancellation of Refund

Used to inform the taxpayer of the refusal of a refund. To be issued within 15 days.

10. GST RFD-09 – Reply to the Show Cause Notice

Allows the taxpayer to respond to a show-cause notice issued at the time of refund. To be filed within 15 days.

11. GST RFD-10 – UN Organizations, Embassies, etc. – Refund Application

Refund application for special purposes for certain international or multilateral organizations.

12. GST RFD-11 – Providing LUT/Bond for Export Without Tax

Used to provide a Letter of Undertaking (LUT) or bond for zero-tax export. Mandatory prerequisite to obtain a refund without payment of IGST.

Refund Form Mistakes & Their Corrections

1. Refund Type Incorrectly Selected

What fails: Erroneous selection of category-e.g., "excess cash" for refund on zero-rated exports-will lead to outright rejection or resubmission.

Solution: Confirm you've accurately verified the right kind of refund in RFD-01 based on your case (exports, ITC, inverted duty, etc.).

2. Return-Support Document Mismatch

Documents fail or mismatch: GSTR-1, GSTR-2B, GSTR-3B, and the export-related documents like -(shipping bills, invoices, BRC/FIRC) errors lead to rejection or deficiency notices (RFD-03).

Solution: Match your returns, keep proper invoice/HSN codes, and match with shipping/export records.

3. Missing or Incomplete Documents

What goes wrong: Applications with incomplete documents trigger RFD-03 and waste time.

Solution: Upload all required attachments-like invoices, shipping bills, LUT, BRC/FIRC, Statement-2 (Rule 89(2)(c)), and undertakings-depending on your refund type.

4. Bank Account Details Error or Validation Failure

What fails: IFSC or account number mismatch in delay in payment; PFMS validation failure in release of RFD-05.

Remedy: Reverify and, if necessary, correct bank details through GST REG-14 (non-core correction), then use the "Update Bank Account" facility on the portal to re-calculate proper details.

5. Filing After the Two Years

What goes wrong: The GST Act allows for refund claims only within 2 years of the eligibility date. Claims made thereafter are automatically disqualified by default.

Solution: Put reminders in your calendar and submit well in advance of the expiry of the 2-year deadline.

6. ITC Claimed Ineligible

Why it is defective: ITC use on capital goods, exempted supplies, or reverse charge ends up being errors or flat refusals.

Credit only refund of ITC on zero-rated goods (say exports). Ignore domestic supply and blocked credits.

7. Cross-Utilisation of ITC Resulting in Negative Refund Amounts

What happens: Where credit of IGST is utilised in CGST/SGST, causing negative CGST/SGST head values, the portal shows an error such as:

Compute "Maximum Refund Amount" under Rule 89(5) cautiously and check all the tax heads to be positive. Do adjustments or consult a tax consultant otherwise.

8. Finality of "NIL" Refund Filings

What happens: Nil refund filing will automatically disallow you from re-filing for the same period/category.

Re-file under the "Any Other" category in case of re-filing the same period with pertinent support documents.

Best Practices to Avoid Issues

- Reconcile returns before filing (GSTR-1, GSTR-3B, GSTR-2B).

- Maintain records very carefully, i.e., invoices, LUTs, shipping bills, and BRCs/FIRCs.

- Cross-check bank details before filing; update immediately if withdrawn.

- Respond on time in case issued RFD-03 (deficiency memo)-respond within 15 days.

- Use the portal's grievance facility with ARN ready for follow-up.

- Set a deadline milestone on calendar reminders.

- Seek professional assistance in case a problem occurs again or complexity is faced.

Online tracking of refund status: pre-login and post-login process

1. Pre-Login Tracking (Without Login)

Procedure:

Visit the GST Portal.

- Go to Services → Refunds → Track Application Status.

- Select Refund from the dropdown.

- Provide your Application Reference Number (ARN).

Click on Search to display the status.

You will be displayed a color-coded status tracker in addition to the stage of processing, being currently-completed phases in green, the current phase in red, and pending ones in grey.

Restrictions-There is only fundamental information being revealed-you will not find information like tax period and amount claimed unless you log in.

2. Post-Login Tracking of Application (After Logging In)

Steps:

Log in to the GST Portal using your login credentials.

- Go to Services → Refunds → Track Application Status.

- Click Refund, and then either:

- Enter ARN, or

- Select the Filing Year.

Click Search.

You will be able to view the detailed information, such as tax periods, amounts claimed, and the complete case history.

Additional Facility for Exporters:

To monitor the status of IGST refund on export of goods, log in and follow:

Services → Refunds → Track invoice data status to be uploaded on ICEGATE and select the financial year and month. Invoices that have failed can be downloaded, validated for validation errors, and dealt with accordingly.

3. Bank Account Validation & Disbursement (PFMS Portal) monitoring

During the processing of the refund application, bank verification and payment are made via the PFMS (Public Financial Management System).

Why It Matters:

It must be verified twice:

- On filing of refund (Form RFD-01).

- On payment order issuance (Form RFD-05).

How to Trace:

Log on to the PFMS Portal and proceed to the GSTN Tracker.

Options:

"GST Registered" – Validity status after RFD-01.

- "GST Successfully Processed" – After RFD-05, to ensure disbursement.

- "GST Under Process" – If it has not been processed, it shows validity failures.

You can search by GSTIN or bank account number.

Conclusion

For claiming a GST refund in India, the majority of taxpayers will start with Form RFD-01, upload supporting documents as and when required, add (if applicable) LUT via RFD-11, and proceed with the subsequent forms depending upon the step undertaken by the GST officer (e.g., RFD-02, RFD-03, etc.). Keep valid GSTR filing, adhere to time limits, and be prepared for likely Aadhaar verification.

Frequently Asked Questions

Q1. Is it possible to get my amount of GST refund amount through the website?

Yes, you can get the amount by going to the GST department in the proper format with proper documents. The form is RFD-01. It is advisable to go along with a professional.

Q2.It has been two months since I received the RFD-02 receipt, and even my bank account has been verified. What next?

Ans. Raise a grievance on the GST Portal or call the jurisdiction officer in respect of status. Or else, you may contact the MyGST Refund team.

Q3. Refund has been finalized, and the bank UTR has been generated, but has not been credited to my account yet. What should I do next?

Ans. Disbursement has been done, but crediting to the account may still be awaited

Related Posts